9th Jul 2020. 8.58am

Regency View:

Update

Regency View:

Update

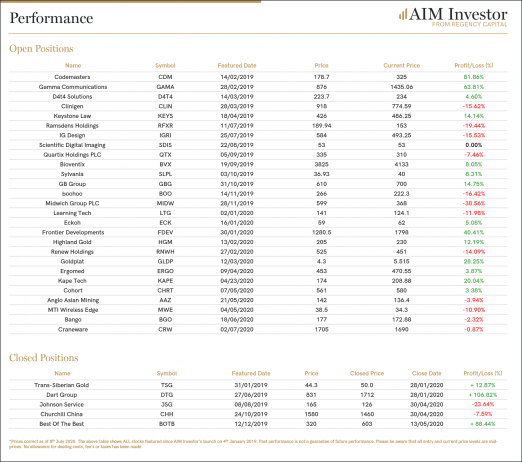

As the market treads water ahead of summer earnings season, it’s no real surprise to see our portfolio undergo a small pullback. Encouraging recent performances from Gamma, Ergomed and D4T4 have been offset by Bohoo’s sharp sell-off (see below). Overall, we believe our portfolio is nicely balanced and of high enough quality to withstand some summer earnings volatility.

Boohoo supply chain allegations spook shareholders

Our position in Boohoo (BOO) has taken a hit this week following reports of illegal working conditions and pay at a Leicester-based factory used to allegedly supply some of the online retailers’ clothes.

Boohoo’s response was swift – stating that the findings are “totally unacceptable” and that they have ceased all business with the associated company and begun an investigation. However, the timing of the allegations couldn’t have been worse given Leicester’s return to lockdown and a number of high-profile distributors, including Amazon, Next and Asos have dropped Boohoo from their websites.

The market’s reaction has been equally as brutal with prices plunging 45% this week. Whilst the severity of the market’s reaction should be respected, we believe it is important not to react too hastily to one off news events, especially when the strength of the underlying company remains intact.

There should be no doubt that Boohoo is in a stronger position than many of its rivals. As previously documented, sales continued to thrive during lockdown and the firm have a £350m cash pile which is likely to drive acquisitive growth.

If this incident is a one-off, we will likely see a swift recovery. However, if the independent investigation, that Boohoo have ordered, reveals a deeper issue throughout its supply chain, this could severely damage Boohoo’s brand and the its flexibility of supply, which is its key competitive advantage.

We expect the shares to bounce during the coming sessions, and the nature of this bounce is likely to reveal a lot about the markets longer-term view. If the bounce starts to become v-shaped in nature, it’s likely that buying appetite will accelerate. However, if we see prices tread water near recent lows, this will signal that another round of selling is imminent.

We will keep you updated…

GB Group exceed expectations with 40% jump in profits

Identity data intelligence specialist GB Group (GBG) released a strong set of full-year numbers last week with revenue almost hitting the £200m marker – up 39% year on year.

Pretax profit came in at £20.6m, up 40% and comfortably ahead of expectations.

The strong performance was largely driven by it’s Identity segment which saw revenues nearly double to £105.5m.

CEO Chris Clark commented:

“I am extremely proud of our performance in the last 12 months, which saw profit and revenues exceed market expectations. This was driven by GBG’s international expansion and innovative product offerings. Although it is hard to predict the full impact of Covid-19, we remain well-positioned to support our customers through the current environment and in the longer term.”

Gamma expands into Germany with key acquisition

Last Thursday, Gamma Communications (GAMA) announced the purchase of an 80% stake in German-based IP telephony services provider HFO Holding AG for EUR20.4m in cash.

Gamma also noted that it has the option to acquire the remaining 20% over the next three years.

Euroepan auqisitions are a key part of Gamma’s aggressive growth strategy and whilst the firm has a presence in the Netherlands and Spain, last week’s aquisitons will be Gamma’s debut in the German market.

Gamma said in its statement: “These countries are following a similar cloud telephony migration path to the UK, providing Gamma with a significant opportunity to leverage its capabilities and know-how to build leadership at a critical time in the development of this large continental growth market.”

The shares are performing well during challenging conditions and we expect Gamma to kick on higher as demand improves.

Craneware trading update in-line with market expectations

Last week’s addition, Craneware (CRW) posted a robust trading update yesterday.

The healthcare-focused financial software provider said it expected revenue growth to be flat following the disruption caused by Covid-19 pandemic.

For the year ended 30 June 2020, revenue was expected to be about $71.4m, unchanged from last year’s $71.4m, while adjusted earnings (EBITDA) was expected at $24.5m, up from $24.0m.

CEO Keith Neilson commented:

“Many areas of the US through the last three months have faced a rising death toll. Our customers have had their business operations repurposed and completely disrupted to maximise capacity to deal with anticipated demand for emergency services. In addition to the clinical challenges, they have had to meet the reality of declining hospital revenues due to the deferral of elective procedures through the period which is only now starting to show signs of recovery towards normal run rates…

“We believe the Trisus platform differentiates us from other healthcare solutions vendors, providing substantial benefits for our customers with the ability to meaningfully impact their healthcare operations. This, as we have demonstrated, can deliver substantial improvements to the financial effectiveness of US hospitals and provides an opportunity for significant future growth for Craneware.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.