25th Jun 2020. 9.00am

Regency View:

Update

Regency View:

Update

Full Year Profits Rise Amid Shift to Digital Channels

It’s been well signposted by the company in recent months, but this week we received confirmation of Codemasters (CDM) impressive Full Year numbers.

Revenues increased by 6.8% to £76m and gross profit jumped 4.5% to £65.2m for the period to 31 March 2020.

The pandemic has supercharged Codemasters transition to digital revenue channels. During lockdown their number of active daily online gamers increased over two-times to around 800,000.

Codemasters now generates 68% of revenues through digital channels compared with 59% in 2019 and they expect the shift to continue – increasing gross margins in the process.

We’ve almost doubled our money on Codemasters and the shares have carved out a powerful uptrend in recent weeks – we remain happy to hold these shares.

CEO Pens Upbeat Letter to Shareholders

Anglo Asian Mining (AAZ) CEO, Reza Vaziri, has written to shareholders of the company ahead of their recent AGM.

“2019 has been another year of consistent delivery for the company,” he said.

“Anglo Asian Mining is now a well-established, dividend paying, low cost producer of gold, copper and silver. The year demonstrated the company’s ability to deliver excellent financial performance and production whilst pursuing growth opportunities. To date, the company has also been able to weather the COVID-19 pandemic without significant disruption to its operations or performance.”

He went on to outline some of Anglo Asian’s financial achievements.

“Our impressive financial performance in 2019 was highlighted by revenues of US$92.1mln, a two per cent year-on-year increase. Profits after tax increased by over 18% to US$19.3 million and we ended the year with US$21.1mln in net cash.”

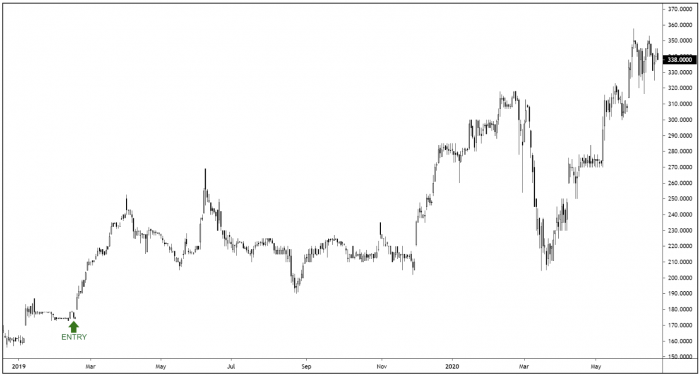

We can see from the chart below that our technical timing into this position was, in hindsight, not the best. However, with the recent rally in gold, we are now seeing the shares climb higher and we remain bullish on this stock.

Eckoh Says ‘Current Trading is Encouraging’

Eckoh (ECK) released a strong set of Full Year numbers to the market last week.

Revenue jumped 16% to £33.2m, gross profit increased 9% to £26.3m with net cash of £11.6m.

In the results statement, CEO Nik Philpot said:

“The strength of Eckoh’s performance, business model, market position and high recurring revenues, combined with our robust balance sheet and liquidity, means we are well placed to manage the impact of COVID-19, and we look forward to further progress in the year ahead.”

“Eckoh had an excellent performance in the year, with double-digit revenue and profit growth as well as record order levels for a second year running. Both UK and US Operations delivered growth and we remain market leader in the US for Secure Payments with revenue growing substantially to over $8mln.

“Eckoh’s product portfolio can help organisations to respond positively to the challenging times ahead, so we can assist both new and existing clients to fulfil their fast-evolving requirements,” Philpot added.

The shares are now trading back near their February highs and the serves to underline the strength of their trading throughout the pandemic.

Learning Technologies in “a Strong and Resilient Position”

At the company’s virtual AGM, held last Friday, Learning Technologies (LTG) chairman Andrew Brode told shareholders that the company is seeing demand “in line with expectations”

In a review of 2019, Brode described it as an excellent year for the company, and that it was “particularly pleasing to see our Content & Services business return to organic constant currency growth, as expected”.

Excluding gross placing proceeds of £81.8m received in June, Learning Technologies’ net debt as at May 31, 2020, was £4.5m.

The shares are yet to regain the momentum we saw at the start of the year but we expect the current sideways consolidation to resolve itself with higher prices.

Cohort’s Chess Dynamics wins €7.5m contract

Cohort said its subsidiary Chess Dynamics had won a €7.5m contract for its anti-drone protection equipment for an international customer.

The majority of the contract was to be delivered during the current and next financial years.

Andy Thomis, Cohort CEO, said:

“I am delighted to confirm that Chess has secured this important contract, which speaks to the benefits of its well-proven defence technologies. Together with other recent wins across the Group, this contract further underpins Group revenues and our short and medium term outlook.”