11th Jun 2020. 9.00am

Regency View:

Update

Regency View:

Update

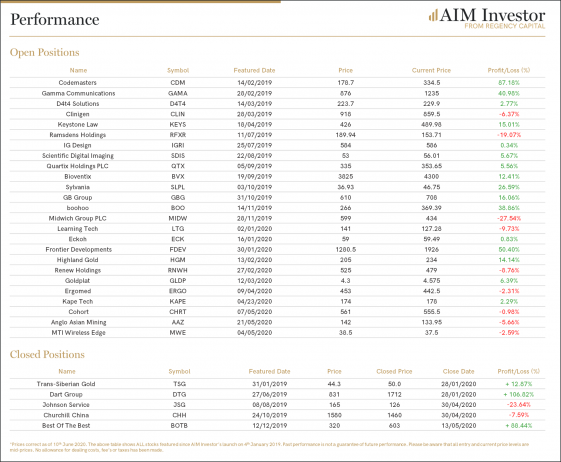

Our portfolio has continued to strengthen in recent weeks, with our exposure to gaming stocks Frontier Developments (FDEV) and Codemasters (CDM) serving us well. There has also been notable bounce back performances from D4T4 Solutions (D4T4), Eckoh (ECK) and Quartix (QTX).

Overall market conditions remain relatively fragile, so we will continue to focus on cash generative stocks that have strong balance sheets and a robust outlook.

Gama’s Resilient Business Model Paying Dividends

Gamma Communications (GAMA) released an impressive trading update last week.

The telecoms technology developer plans to pay an end of year dividend after continuing to trade strongly.

Since the lockdown started, Gamma has reported continued growth from the SIP Trunks and Cloud PBX seats, although at a lower rate compared to their strong first quarter.

As the group has recognised that some of its customers in contract are not currently trading, the group has allowed them to hibernate their voice services until June 30, so that they do not have to pay for it when it is not in use – Gamma expects this to cost in the region of £1.2m in earnings.

The group’s Dutch business has continued to trade positively and in line with expectations, with similar trends to the UK.

The underlying positivity in the trading statement hasn’t really been reflected in the market with the shares continuing to tread water. Should lockdown continue to be eased we would expect Gamma to break higher.

Quartix Says COVID-19 Unlikely to Have Material Impact on H1 Profit

An update from Quartix (QTX) this week indicated that the pandemic was impacting growth rather than profits.

The vehicle tracking systems supplier operates a subscription-based model for it’s little black tracking boxes and this revenue has continued to roll in. However, new fleet installations had tumbled 25% in the four months ended 30 April – with a 60% drop in April alone.

Quartix warned that new installations for insurance remained limited by both installation capacity and demand but also maintained that the pandemic was “unlikely to have a material impact on profit and cash flow” in the first half of 2020.

The shares have undergone a 70% rally from their March lows – taking our position back into positive territory.

Highland to Sell Kayenmivaam Licence For $15m

Highland Gold (HGM) announced last week that it planned to its Kayenmivaam licence in Chukotka, Russia, to an undisclosed buyer for $15m plus a royalty.

The gold miner will receive a 2% royalty on gold produced and sold from the deposit in excess of 500,000 ounces for 30 years.

Kayen is an early-stage gold exploration property covering 1,214 square kilometres, which Highland Gold acquired as an add-on to the Valunisty acquisition in December 2018.

The sale is subject to approval by Russia’s Federal Anti-Monopoly Service and is expected to be completed later in 2020.

Highland’s share price has undergone a pullback in recent weeks due to some weakness in the underlying gold price. However, we remain bullish on gold for 2020 and expect the shares to continue trading higher over the medium to long-term.