28th May 2020. 8.58am

Regency View:

Update

Regency View:

Update

Important reminder:

Tomorrow morning the AIM Investor website address will be changing to www.aiminvestor.co.uk. For further information, please refer to the email you recently received from your Relationship Manager.

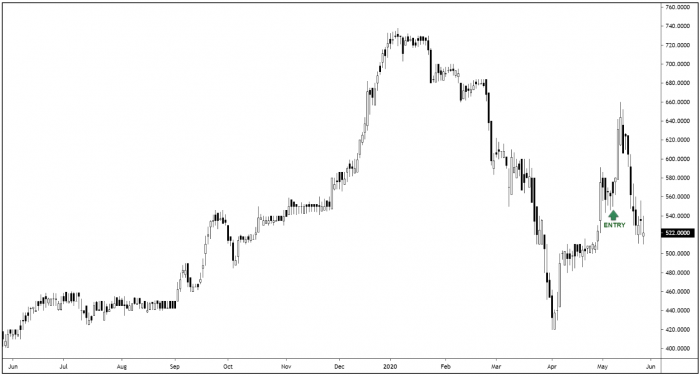

Frontier Surges Higher on Trading Update

The good news just keeps flowing for gaming firm Frontier Developments (FDEV).

After announcing a unique deal with Warhammer, which we highlighted earlier this month, Frontier released a typically strong trading update last Wednesday.

The shares surged to new trend highs as management raised full-year guidance for the second time this month, saying it now expects operating profit to be ‘materially ahead’ of the top of the prior range.

We’re conscious that there’s now an awful lot of good news priced in, but as yet we’re seeing no signs of price exhaustion and we expect the shares to trend higher.

Ergomed Announces Strategic Partnership to Supercharge its Intelligent Automation Strategy

Ergomed (ERGO) announced last week that its pharmacovigilance arm PrimeVigilance has teamed up with Automation Anywhere and DataRobot to accelerate the company’s intelligent automation strategy.

The firm said empowering clients and colleagues with the application of Robotic Process Automation (RPA) and Machine Learning (ML) will facilitate improvements in quality and consistency within safety databases, as well as productivity.

Dr Miroslav Reljanović, executive chairman of Ergomed commented:

“This collaboration provides the foundation to rapidly identify and automate a wide range of business processes, enabling clients to maximise quality and consistency within safety databases as well as increasing productivity”.

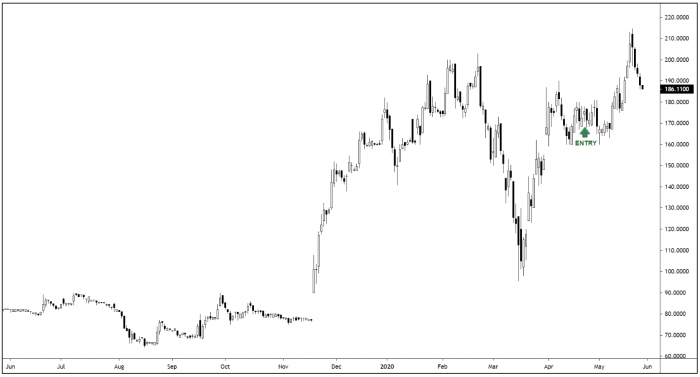

Kape Makes Strong Start to 2020

In a pre-AGM statement released last week, Virtual Private Network specialist, Kape Technologies (KAPE) announced that business has been robust during the pandemic.

Within the Digital Privacy segment, new monthly sign-ups in April 2020 increased by 19% compared with the same period last year and the firm are “track to deliver revenues of $120-123 million and Adjusted EBITDA of $35-38 million in 2020”.

Kape CRO Ido Erlichman stated:

“I’m pleased to report that Kape has made a strong start to 2020, despite the global macroeconomic disruption caused by the COVID-19 pandemic. As announced on 31 March 2020, Kape has experienced increased demand for its products as working remotely has become commonplace across the globe in response to COVID-19.”

It’s early days for our position in Kape but so far so good with prices testing new highs following the AGM statement.

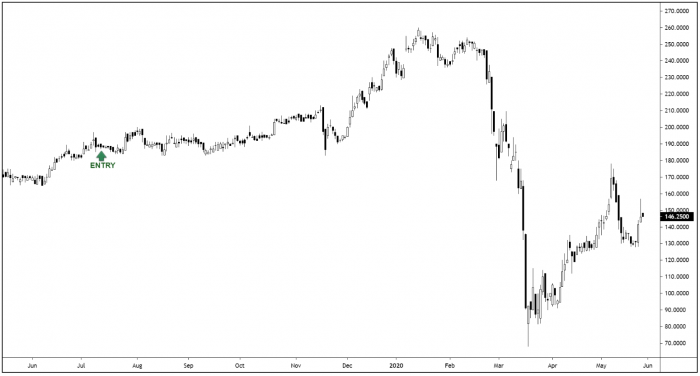

Renew Well Placed Following Half Year Growth

UK essential infrastructure firm Renew Holdings (RNWH) provided the market with some much need reassurance last week following the release of their half year numbers.

Revenues increased 4% to £313.6m for the six months ended 31 March 2020, up from £301m in the same period of 2018/19. Profit before tax also increased to £15.2m from £14.5m the year before.

The group’s Engineering Services division, which accounts for more than 90% of total turnover, recorded a 4% rise in revenue to £293.1m and a 7% increase in operating profit to 20.5m.

David Forbes, chairman of Renew, said:

“Our strong trading performance and cash generation in the first half of the year, is reflective of the reliable long-term nature of the UK infrastructure markets in which we operate, a strategy reinforced in the government’s latest Budget when they committed to investing £640bn in infrastructure over the next five years…

“Where we are able to satisfy the requirements of the Covid-19 safety guidelines, we continue to work closely with our customers directly delivering essential network services. In total, approximately 80 per cent of our activities have continued during the crisis as they are deemed critical to the Covid-19 response.”

Cohort Meets Full-Year Earnings Expectations

Defense technology firm Cohort (CHRT) released a full-year update last week in which revenue was expected to be around £133m, up from £121.2m year-on-year.

Adjusted earnings per share were anticipated to be about 35p, compared to 33.6p in 2019, while adjusted operating profit would come in at £18m, rising from £16.2m.

Net debt as at 30 April had narrowed to £5m, from £6.4m a year earlier and the company’s closing order book stood at £186m, down slightly from £190.9m.

Cohort said trading performance for the 2021 financial year was difficult to predict, given the impact of the Covid-19 coronavirus pandemic, but it was currently expected to be in line with that of 2020.

Ramsdens Rally on Reopening Plans

Ramsdens have rallied this week after providing the market with a robust set of interim results which outlined its store reopening plans.

The results to March 31st, which barely included the impact of the pandemic, saw revenues climb 27% to £59.5m and pre-tax profit jump 30% to £8.5m.

More important though was Ramsdens comments regarding a phased reopening of its high street shops. Ramsdens believe the additional cost of safety measures would be minimal as most of its stores already have full protective screening.

The shares have jumped 20% this week but are still down more than 40% from their January highs.