14th May 2020. 9.03am

Regency View:

Update

Regency View:

Update

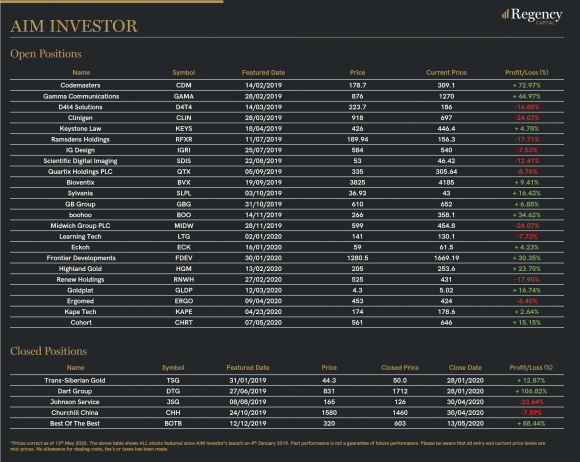

Our AIM Investor portfolio continues to perform well – helped by the profit taken in Best Of The Best (BOTB) and by a surge in game developer Codemasters (CDM). The shares are now trading just below their all-time highs at 318p, achieved in February this year. How prices respond to these highs will likely determine our short-term outlook on the stock.

Frontier Sign Exclusive Warhammer Deal

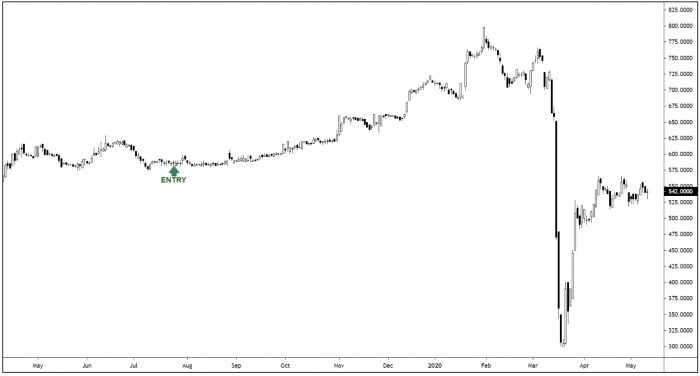

Frontier Developments (FDEV) has been a star performer for us this year and we’re very pleased that we picked up a second tranche during the March sell-off.

The game developer recently announced that it had agreed an exclusive IP licence with Games Workshop to develop and publish a real-time strategy game within the Warhammer fantasy series.

Frontier now expects revenue to be towards the top of the previously stated range of £65-73 million for the current financial year ending May 31 with operating profit, anticipated to be within the range of £11-13m.

CEO David Braben commented:

“Like many companies selling mainly online in the digital entertainment industry we have seen increases in demand for our products.

“This started in China from February and in much of the rest of the world from March and is likely related to global lockdown conditions. We believe the immersive and creative nature of our games and the engaging play times of hundreds of hours makes them particularly popular in today’s uncertain world.”

Eckoh Sees Demand for CallGaurd Remote Surge

The market underestimated how well data security firm, Eckoh (ECK) could perform during the pandemic but this is starting to change…

After a bullish update in April the company released a further statement confirming that demand for its CallGaurd Remote product has significantly increased in recent weeks.

CallGuard Remote enables businesses to continue operating remotely and securely during the COVID-19 crisis. It allows contact centre agents to take payments securely whilst working remotely or at home.

CEO Nik Philpot, commented:

“We originally developed CallGuard Remote to meet the challenge of delivering robust payment security in remote locations, a need which has been growing steadily over recent years. However, the current crisis has driven an unprecedented and sudden move to remote working for contact centres and the demand for CallGuard Remote has risen significantly as a consequence.”

Goldplat Reports Healthy Q1 Operating Profit

Goldplat (GDP) released a reassuringly solid update at the end of April.

The gold recovery specialist reported operating profit of £3.4m for the South African operations (nine months ended March 31), which is a considerable increase on the £1.5m operating profit achieved in the same period last year.

However, it should be noted that their South African operations have seen some disruption due to the pandemic but the impact is expected to be mild.

The shares have gradually started to trend higher in recent weeks and we expect the strong underlying gold price to provide a tailwind for the stock moving forward.

IG Design Warns of ‘Significant Increase’ in Exceptional Costs

Greeting cards company IG Design (IGR) posted strong full-year numbers but warned of a “significant increase” in exceptional costs as a result of coronavirus-related provisions.

Whilst its manufacturing sites in the US, UK, China and Europe had all recommenced production, IG Design said revenues appeared to have been impacted by at least £7m as a result of the pandemic.

The shares have recovered roughly half their March losses and have been treading water in a tight range. In order for the shares to kick on higher we will need further clarity as to when lockdown in the UK and US will be lifted.

Sylvania’s Profit Rises on Higher Output

Sylvania Platinum (SLP) achieved a 56% quarter-on-quarter jump in net revenue to $43.6m for the quarter ended March 31, buoyed by increased production and a 9% increase in the platinum group metals (PGMs) dollar basket price.

The miner is debt free and recorded a net profit of $25.4m for the quarter – a 123% increase quarter-on-quarter.

CEO Jaco Prinsloo commented:

“Traditionally, the third quarter is often the lowest production quarter of the year, but by building on the solid performance from the previous quarter the SDO again performed well and produced 19,968 PGM ounces, surpassing Q2 as the third highest quarter of production in the history of the Company.”

Whilst our outlook for the global mining sector remains very cautious given the current demand shock, Sylvania is a very high quality company which has a unique position within the PGM market. We will continue to hold.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.