30th Apr 2020. 9.06am

Regency View:

Update

Regency View:

Update

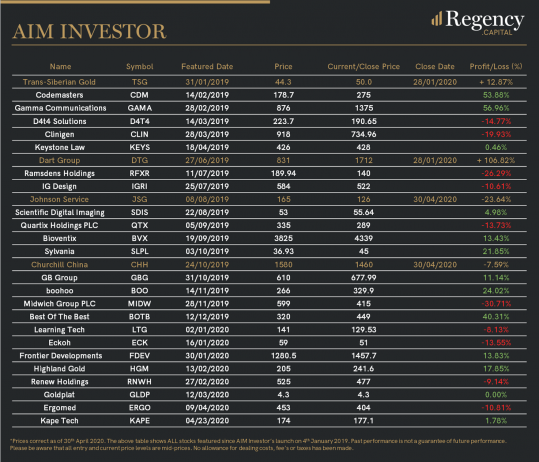

As equity markets around the globe continue to recover, we are pleased with the resilience our AIM Investor portfolio has shown during such a difficult start to the year.

In the last week, Bioventix (BVXP) and Frontier Developmets (FDEV) have broken to all-time highs. This is a clear display of strength which should see them continue to outperform as the wider market recovers.

Boohoo Worth More Than M&S and Sports Direct Combined

Bohoo’s full-year results, released last week, have added considerable weight to the theory that the pandemic will accelerate the death of the high street.

The online fashion store posted revenues of £1.32bn and is now looking to use its £241m net cash pile to snap up struggling brands. With a market cap of £3.34bn, they are now worth more than M&S and Sports Direct combined!

Finance director, Neil Catto commented:

“We have got the ability as we go forward to look at opportunities that may arise and acquire brands that may need to be helped through to the other side of the crisis.”

The shares have surged higher in recent weeks and we are more than happy to continue to hold them within our portfolio.

Clinigen Unveils Licensing and Distribution Deal

Clinigen has signed a global agreement with Porton Biopharma for the drug Erwinase – a treatment for leukaemia patients.

Clinigen is paying Porton an upfront £5m for Erwinase, which last year generated sales of £140m. It will then hand over sales-based milestone payments of up to £20m, alongside tiered royalties.

In the same announcement, the company said trading for the year to June 30th continued to be in line with forecasts, adding that organic gross profit growth was “over 10%” in the nine months ended March 31.

The shares have rallied sharply from their March lows and the April update provides the reassurance we were looking for to continue to hold them.

GB Group’s Profits Jump

GB reported an impressive set of full-year numbers to the market despite ‘modest impact’ of COVID-19.

The data security specialist posted revenue for the year ended March 2020 of £199m, ahead of market expectations and a rise of 38.7% and adjusted operating profit surged 46.7% to £47m, a 46.7%.

CEO Chris Clark commented: “GBG has delivered a strong set of results which are ahead of market expectations despite some, albeit limited, financial impact from COVID-19 in the final quarter”.

Our position in GB Group is now back in profit and the shares have once again started to carve out higher swing lows – we expect this to continue.

Keystone Law Confident After Strong Full-Year Numbers

Keystone Law’s share price was hit very hard during the coronavirus sell-off but this week’s numbers indicate that the panic selling was overdone.

The group reported a “strong” improvement in revenue of 16.3% to £49.6m.

Profit before tax came in at £5.2m for the year ended 31 January, representing growth of 10%, while basic earnings per share (EPS) were 9% higher year-on-year at 13.3p.

Regarding the pandemic outbreak, CEO James Knight commented:

“Our model is designed to service our clients remotely and so it was a very small step to move our central support services onto the same footing, achieving this with no adverse effects to service delivery.

“Furthermore, we are in a strong financial position, both in terms of liquidity, being debt free and having over £4.4m of cash, and in terms of the high proportion of our cost base which is fully variable and on a paid when paid basis.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.