5th Mar 2020. 8.59am

Regency View:

Update

Regency View:

Update

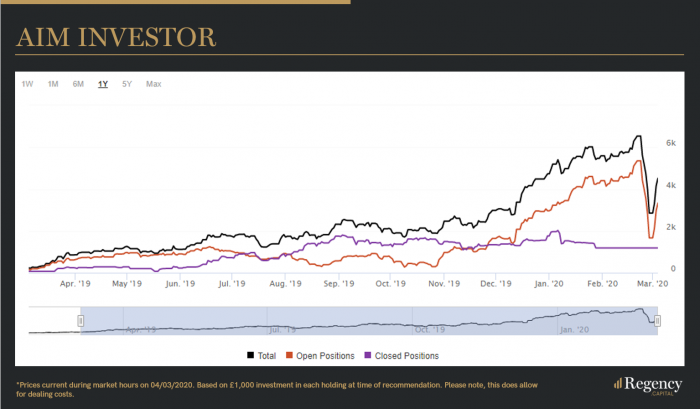

It’s been a tumultuous two weeks across financial markets. The spread of Coronavirus throughout Europe and the sharp reduction in manufacturing output throughout Asia has wiped more than $1.5 trillion off the US stock market alone.

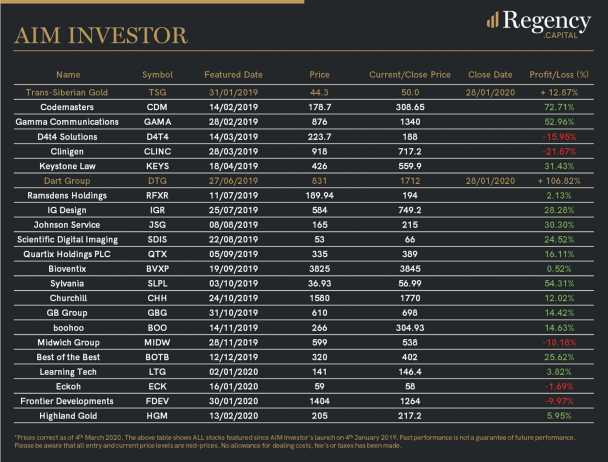

Given the wider context, we are pleased with the resilience of our AIM Investor portfolio and our commitment to quality is serving us well.

We’ve seen strong relative performances from; IG Design (IGR) – see update below, Highland Gold Mining (HGM) – gold demand increases during times of risk aversion, Sylvania Platinum (SLP) – exposure to Rhodium which is in very short supply, and from our gaming stocks Codemasters (CDM) and Frontier Developments (FDEV) – as Coronavirus is unlikely to have much impact on global gaming demand. On the downside, our positions in Clinigen (CLIN), Ramsdens (RFX) and Churchill China (CHH) have been hit hard and are trading back at some key levels of long-term support.

We’ve seen a concerted effort from the world’s central banks to calm the markets this week and it seems to have done its job for now. Stimulus comments from the Bank of Japan were followed by a surprise rate cut from the US Federal Reserve and we could yet see the Bank of England and European Central Bank follow suit.

Despite the stimulus, key questions remain; when will Asian manufacturing output turn a corner? When will the virus peak in Europe? Can the US contain the spread? With this in mind, we will remain cautious with our forthcoming stock selections and look to find high quality companies that have been dragged lower by the market.

Clinigen’s Organic Profit at the Upper End of Expectations

Clinigen released a robust set of half-year numbers last week, which were somewhat buried in the market chaos.

The specialist pharma revealed a 35% increase in gross profit £108.1m, representing underlying growth of 9%.

Adjusted revenues jumped 24% (6% organic) to £224.6m, while underlying earnings (adjusted EBITDA) advanced 42% (10% organic) to £62.1m.

CEO Shaun Chilton commented:

“With the commercial platform in the EU and US now established, we are actively seeking further product in-licensing and acquisition opportunities to leverage across the business. We are also integrating CSM into our Clinical Services division to drive higher organic growth across the Group through greater cross-selling and seeding relationships into our Unlicensed Medicines business.

“We have continued our good performance into H2 and continue to expect organic gross profit growth at the upper end of our medium-term target range of 5-10%.”

Clinigen’s share price has fallen 30% from its January highs and prices are now trading near a long-term area of support. The relative strength index (RSI) recently hit 15, its lowest level ever, indicating that the shares are extremely oversold. We therefore expect Clinigen to bounce back when the markets begin to calm.

IG Design Unaffected by Coronavirus, and Remain Confident to Meet Expectations

In a reassuring update released last week, IG Design told the market that they have not been materially impacted by the outbreak of the coronavirus.

The gift packaging firm does have operations in China, but production volumes are set to rise over the next few weeks.

CEO Paul Fineman commented:

“The Group is closely monitoring the developments regarding COVID-19 and its potential impact on the business. With the current known scale of the outbreak, it is not expected that there will be a material impact to the Group’s current forecasts.”

The shares are displaying very high levels of relative strength, being one of only a few stocks to almost erase all their February losses. IG Design is fast becoming a star of our portfolio and long may this continue.

Johnson Service bumps up its dividend on “strong financial performance”

Workwear and linen supplier Johnson Service Group increased its full-year dividend pay-out by 13% to 3.5p per share and said trading in the first months of 2020 has been in line with expectations.

In the year to 31 December, revenue advanced 9% to £350m with profit before tax up 15% to £38m.

CEO Peter Egan commented:

“We have continued to deliver strong organic growth complemented by the impact of our recent acquisitions. The combination of these has yielded another solid financial year with impressive growth in Group revenues, operating profit and earnings per share.”

The shares have been very quick to bounce back following the market sell-off and are now just 3% below their February all-time highs! This clear relative strength serves to reinforce our bullish long-term outlook on the stock.