20th Feb 2020. 9.01am

Regency View:

Update

Regency View:

Update

Fast Growing Keystone Continue to Make “Excellent Progress”

Keystone Law (KEYS) released a bullish trading update last week, briefing the market ahead of their full-year results.

The fast-growing law firm expect to report full-year results in-line with current market expectations as the group continues to trade strongly through the second half of 2019.

CEO James Knight commented:

“Over the last twelve months we have continued to make excellent progress in driving growth by attracting high-calibre lawyers who are keen to take advantage of the benefits that our distinctive model offers. We look forward to updating the market on our financial and operational performance when we report our full year results in late April.”

After breaking to new highs at the turn of the year, Keystone’s share price has continued to rotate higher, using the broken highs as support in almost text-book fashion.

The firm will announce their final results on Tuesday 28 April and given last week’s update, we are more than happy to continue holding them within our AIM Investor portfolio.

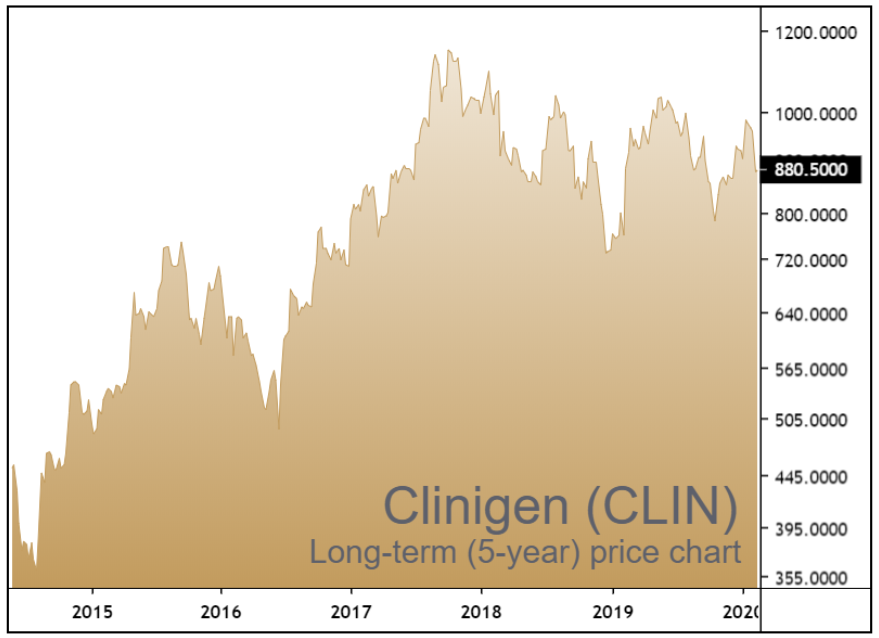

Broker Downgrade Hits Clinigen

Speciality pharma Clinigen (CLIN) dropped 6% last week following a downgrade from broker Liberium who cut their stance from hold to sell.

We believe it’s wise to take broker upgrades and downgrades with a very hefty pinch of salt as the incentive structure for most sell-side analysts is questionable at best. Clinigen’s January trading update stated that revenues should increase 24% and organic earnings growth would come in marginally ahead of expectations.

Another reason to remain calm is Clinigen’s price chart. Whilst the shares haven’t powered higher like some other stocks in our portfolio, the shares are going through a prolonged period of sideways consolidation. Given that Clinigen’s long-term picture is a multi-year uptrend, we still expect this sideways consolidation to resolve in higher prices.

Clinigen will announce its final results for the six months ended 31 December 2019 on Tuesday 25 February 2020. We will look to reassess our position after these results have been published.

Sylvania Surge Past All-Time Highs on Half-Year Results

Sylvania Platinum (SLP) has surged higher following the release of the their first-half numbers.

The low-cost rhodium and platinum producer announced a jump in revenues of 84% over the period on the back of higher production volumes.

Net profit rose to $23.9m, up from $7.0m during the same period last year. The firm remains debt free and continues to generate sufficient cash reserves to fund capital expansion projects.

CEO Terry McConnachie commented:

“I am pleased to present the half-year results to our shareholders and commend our management and operations teams for the record HY1 performance they have achieved, despite the period being known for its challenges experienced due to disruptions relating to the holiday period shut down as well as the additional issues relating to power and water supply constraints. It is evident that the corrective action and implementation of various improvement measures to address challenges experienced during the previous financial year are now showing results and management and the Board remain confident that the operations should achieve the previously announced guidance for production of 74,000 to 76,000 4E PGM ounces. Whilst the results for HY1 are excellent, the Board is mindful of the potential challenges ahead and have therefore decided not to increase guidance until further clarity is obtained.”

Terry also announced his retirement after 14 years at the helm and that he will be replaced by Jaco Prinsloo.

The market’s reaction to the results have been very encouraging with prices surging past all-time highs at 51p. This is especially pleasing given the sell-off at the start of February following their pre-results trading update

Eckoh Break to New Highs

Our position in payment protection firm Eckoh (ECK) is having a very strong February.

The shares have broken and closed through the key November highs at 62.54p on minimal newsflow.

Eckoh is a relative new addition to our portfolio and its very pleasing to see the shares taking out such a key area of resistance so early. We would now expect the broken November highs to provide support going forward. There is also a set of steepening trendlines on the price chart, suggesting that bullish momentum is increasing.

These early signs bode well and we are happy to maintain our bullish stance of this stock.