6th Feb 2020. 9.00am

Regency View:

Update

Regency View:

Update

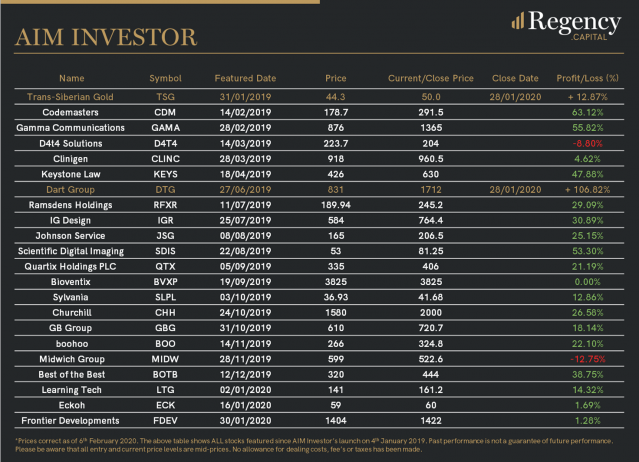

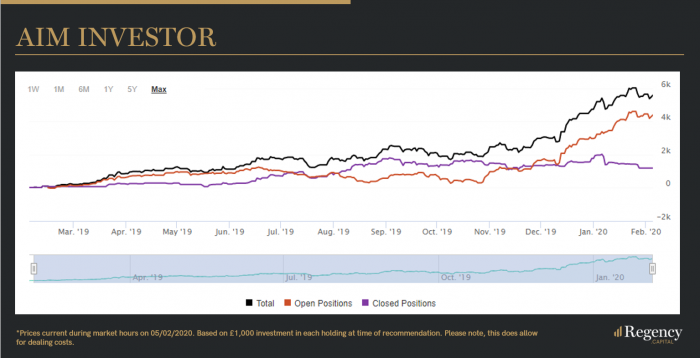

Our AIM Investor portfolio continues to perform well despite volatility in global market increasing during the last three weeks.

The largely domestic focus of small cap stocks has seen them outperform large caps which have been more sensitive to the anticipated fall in Chinese demand from the Coronavirus outbreak and rising political tensions in the US.

In terms of sector diversification and quantity of stocks, we believe our portfolio is well positioned. However, having closed Trans-Siberian Gold (TSG), the portfolio has reduced exposure to gold and this is something we may look to address in the coming weeks.

IG Design to Become Global Leader After CSS Acquisition

IG Design (IGR) recently announced the acquisition of US gift packaging and stationery firm CSS Industries for just under £90m.

The deal is forecast to be earnings enhancing in its first full-year post acquisition, as it is expected to report net sales between $346m and $352m over the period.

IG Design CEO Paul Fineman commented:

“As well as doubling the scale of our US business, the combination of CSS and Design Group further strengthens our position as the global leader in consumer gift packaging and establishes us as a major supplier to the creative craft market.

“We are delighted to have once again identified a compelling opportunity that meets our clear criteria, whilst maintaining prudent levels of average leverage. This acquisition is not only earnings enhancing, it also provides us with tremendous prospects to create further value for our shareholders.”

The shares have been a star performer in our AIM Investor portfolio. As you can see from the price chart (below), prices have carved out a powerful uptrend during the last six months. We’ll be watching closely for signs of exhaustion, but for now we’re happy to hold.

Sylvania Swings on Half-Year Numbers

It’s been a volatile start to the year for Sylvania Platinum (SLP) who released their half year numbers to the market last Friday.

The results were a mixed bag with first-half output hitting record highs but management outlining several challenges – causing the shares to drop sharply following in the initial aftermath, only to bounce back two sessions later.

Sylvania Dump Operations (SDO) declared 19,206 platinum group metals ounces in the period, down from 20,797 ounces in the first quarter – bringing declared ounces for the first half to 40,003, a new half-year record.

In terms of challenges, management sited power interruptions, water management and a depressed chrome market as key factors.

However, Sylvania also highlighted some opportunities, saying that the current platinum group metals basket price was contributing to “higher than planned” profits and cash balance.

The recent increase in the volatility of Sylvania’s share price follows a failed attempt to break to through key resistance at 45.50. The new higher swing low which has formed this week is a bullish sign, but another failed attempt to break through 45.50 would be regarded as a red flag.

BOTB Beat Expectations

Our position in Best of the Best is motoring ahead, helped by the release of a bullish set of half-year numbers.

The online competitions firm posted total half-year revenue up by 6.7% to £7.6m and earnings per share (EPS) surged 37.3% to 12.4p – beating market expectations.

The firm also announced a Special Dividend of 14p per share, underlining the strength of their results. The Special Dividend will be paid on 21st Feb to shareholders on the register at the close of business on 7th Feb (tomorrow).

CEO William Hindmarch commented:

“I am pleased to announce strong profit growth and cash generation as the business has completed its transition to a wholly online operation, from its historic presence in airports and retail sites. Our growth strategy is now exclusively focused on driving digital sales and our ‘Dream Car’ competition and newer ‘Lifestyle’ competition both recently reached milestones, celebrating their 500th and 100th winner respectively.

Sales momentum since the period end has been encouraging, and we now expect pre-tax profits for the full year to be ahead of current market forecasts. We look forward to updating shareholders with further progress in due course.”

Whilst it’s very early days for our BOTB position, we’re obviously very happy with the progress the shares have made since the turn of the year.

Frontier Developments Drops on Interim Results

Our position in game developer Frontier Developments (FDEV) hasn’t got off to the best of starts…

The shares tumbled 9% yesterday following the release of their interim results. This is particularly disappointing given that Frontier only released a trading statement to the market on 15th Jan, so the impact of the interim numbers should have been minimal.

For the six months to the end of November, Frontier posted a pre-tax profit of £4.3m, down 75% from £17.3m the same period the year before but no surprise given previous rhetoric and the cyclical nature of the firms revenues.

Comments from CEO David Braben were very upbeat:

“Planet Zoo’s successful launch and subsequent performance is testament to the superb efforts of our growing team. We now have four successful games in the market each with a clear roadmap of additional content in line with our proven strategy”.

“We have started calendar 2020 in a great position. We’re bringing Planet Coaster to console players and significantly expanding the Elite galaxy this year, and developing two major games for release in the same financial year for the first time as a self-publisher”.

Given that there were no new shocks in yesterday’s statement, we expect the shares to bounce back as the successful launch of Planet Zoo feeds through into the bottom line.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.