23rd Jan 2020. 9.03am

Regency View:

Update

Regency View:

Update

Learning Technologies Boosted by Bullish Trading Update

Our recent addition, Learning Technologies Group (LTG) is off to a flying a start following the release of a bullish trading update on Tuesday.

The shares surged to their highest level since October 2018 after the firm stated that it expects a 38% rise in full-year 2019 revenue to £130m and full-year operating profit will be ‘comfortably’ ahead of expectations – sighting improved margins and synergies from acquisitions.

CEO Jonathan Satchell commented:

“2019 has been a year of encouraging growth across the Group with a strong performance in Content & Services in the second half of the year and outstanding results from our innovative Software & Platform businesses such as BreezyHR, Rustici and Watershed complementing our established PeopleFluent talent and learning business. We are seeing the early successes of the Board’s decision to make focussed investments in R&D and incremental sales initiatives to support sustainable organic growth, driving momentum into 2020…

We have an active pipeline of acquisition opportunities in 2020 and continue to invest in cross-selling initiatives and explore new routes-to-market.”

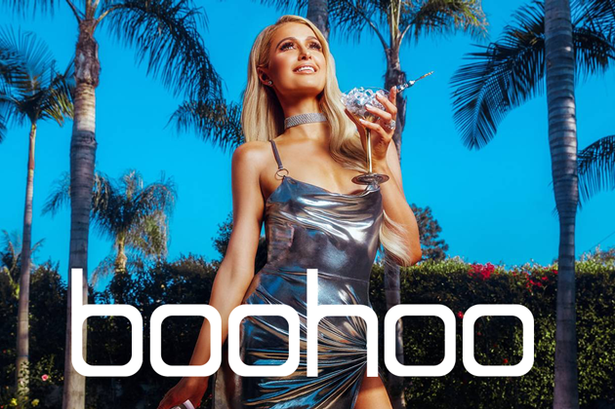

Boohoo Bucks Weak Festive Market With 44% Revenue Rise

Online fashion house Boohoo (BOO) continues to make mincemeat of its high-street peers as it reported robust trading during the festive period and upgraded its full-year guidance.

In a trading update released last week, the company said that it expects full-year revenue growth of 40-42%, up from previous guidance of 33-38%. Sales of the Boohoo brand rose 42%, with PrettyLittleThingup 32% and Nasty Gal up 102%.

CEO John Lyttle, commented:

“I am delighted to report the group has enjoyed record trading in the last four months of 2019. All of our brands have performed exceptionally well and delivered strong market share gains. We have continued to see operating leverage in our more established brands, and will continue to invest into them and our newly-acquired brands. The newly-acquired brands, MissPap, Karen Millen and Coast, are showing great promise and open different target markets for the group, in line with our strategy to build our multi-brand platform.”

The shares have performed well since adding them to our AIM Investor portfolio in November and prices now look to be consolidating ahead of another push higher.

Churchill China On Track to Exceed Expectations

In a short but sweet full-year trading update, Churchill China (CHH) announced that it sees full-year operating performance slightly ahead of expectations.

The ceramics specialist said:

“We have made solid progress against our targets in the second half of the year with good levels of trading in both UK and export markets. As a result the Board now expects that operating performance will be slightly ahead of current market estimates.”

The shares have been a standout performer in our portfolio since November and have clearly benefited from the increased political stability bought about by the election. We’re more than happy to continue to hold them.

Quartix Motors On Following Robust Trading Statement

Vehicle tracking software provider Quartix (QTX) released a robust trading statement last week which underpinned the recent rally in the share price.

Management expect revenue and free cash flow to come in slightly ahead of expectations at £25.6m and £5.9m respectively. Revenues from its fleet business are expected to have grown by around 10%, accounting for approximately 80% of revenues.

CEO Andy Walters commented:

“We are delighted with the progress made in 2019. Growth in all markets was excellent and the Company’s fleet subscription base grew by 22% to 151,000 vehicles. We also completed some exciting new technological developments during the year and will continue to invest in the growth of our fleet subscription business. We look forward to 2020 with confidence.”

The shares gapped higher following the trading statement and this is a very bullish sign. Even more encouraging is that prices have continued to hold their ground and are currently consolidating above the bullish price gap, we expect more upside from here.

Clinigen’s Recovery Continues Following HY Trading Update

Our position in pharmaceutical platform provider Clinigen (CLIN) has undergone a rocky ride since we first highlighted them in March, but after a series of strong trading updates the shares are now firmly back on track.

Last week Clinigen released their half-year trading statement and it made for positive reading…

The company expects to report an increase of revenues of at least 24% on a net constant currency basis compared to last year. Gross profit is also expected to have increased by at least 34% on a constant currency basis.

CEO Shaun Chilton commented:

“We have had a strong start to the year, having grown organic gross profit by at least 8% in H1 2020, validating the Group’s unlicensed to licensed synergy strategy. We reiterate our expectation for FY20 growth to be towards the upper end of our organic gross profit guidance of between 5% to 10%.

“The focus for the Group in H1 FY20 has been to integrate our strategic acquisitions and to capitalise on the Group’s international platform to support synergistic growth. Integration is on-track with further, more meaningful steps to be taken now the earn-out on CSM has been completed.”

Gamma Expects FY Financial Performance Significantly Ahead of Last Year

In a trading statement released last week, Gamma Communications (GAMA) stated that it expects full-year earnings to be at the ‘top end’ of market expectations and for its overall performance to come in significantly ahead of last year.

CEO Andrew Taylor commented:

“We are pleased that Gamma has continued to grow strongly in both the UK and the Netherlands. Our core SIP and Cloud PBX products continue to perform well and we are pleased with the progress of Collaborate. We are excited about the possibilities that the acquisition of the Telsis development capability affords for future product development.”

The shares have been carving out a bullish series of higher swing lows since the summer. This solid trading statement only serves to reinforce Gamma’s powerful long-term uptrend.