19th Dec 2019. 8.59am

Regency View:

Update

Regency View:

Update

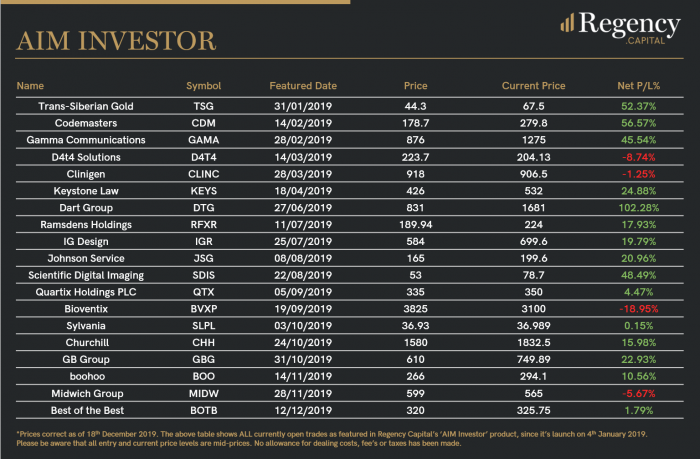

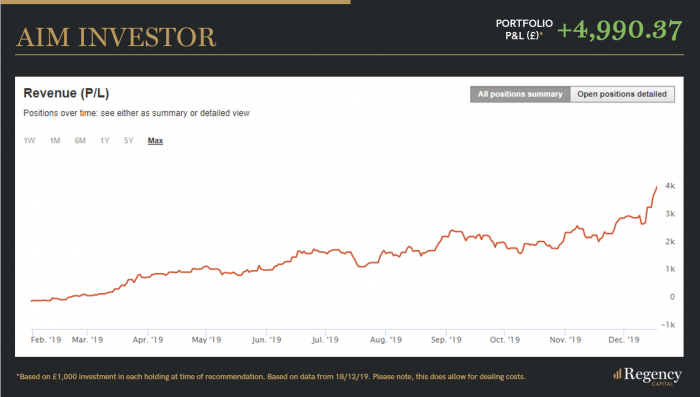

Our AIM Investor portfolio is full of festive cheer after receiving a pleasing post-election ‘Bojo bounce’!

Whilst we have worked hard to limit our ‘hard-Brexit’ exposure levels, the political stability that a majority government brings has been welcomed across all UK equity markets.

Standout recent performances include: Scientific Digital Imaging (SDI) – which hasn’t looked back after breaking to new highs in November; Codemasters (CDM) – which broke to all-time highs yesterday and GBB Group – which has continued its post-earnings drift, rallying over 20% in less than two months.

Given the reduced levels of liquidity on AIM during the festive period, we’ll be sitting on our hands and monitoring the portfolio next week with view to kick-starting the New Year with a fresh recommendation on Thursday 2nd January.

Midwich Cautious On Profit

Midwich (MIDW) released a rather frosty trading update on Wednesday which warned that profits would be lower due to a slowdown in Europe.

The audio-visual distributor expects pre-tax profit to be in the range of £30-£31m, this is below market expectations.

Management site reduced demand in both UK and key territories in continental Europe. They did temper their comments by stating “despite current challenging market conditions, the group is well positioned and the Board remains confident in its future prospects”.

Understandably, the shares have been punished by the market with prices down 6% on Wednesday. However, the shares did close well off their intra-day lows and we will be looking for buying appetite to resume over the coming sessions.

Keystone Law Approaches Key Highs

Along with fundamental newsflow, we continually monitor the key technical levels of each position within the AIM Investor portfolio and Keystone Law (KEYS) are about to test one of these key levels.

Prices have been carving out a bullish series of higher swing lows taking the shares into all-time highs at 550p. We’ll be watching closely to see how Keystone responds to this key structural level.

Christmas Opening Hours

Our office opening hours during the festive period are as follows:

Monday 23rd December – USUAL OFFICE OPEN HOURS

Tuesday 24th December – OFFICE CLOSES AT 12.30pm

Christmas Day – CLOSED

Boxing Day – CLOSED

Friday 27th December – USUAL OFFICE OPEN HOURS

Monday 30th December – USUAL OFFICE OPEN HOURS

Tuesday 31st December – OFFICE CLOSES AT 12.30pm

NEW YEARS DAY – CLOSED

Thursday 2nd January – USUAL OFFICE OPEN HOURS

We would like to take this opportunity to wish you Merry Christmas and Best Wishes for 2020.