21st Nov 2019. 9.01am

Regency View:

Update

Regency View:

Update

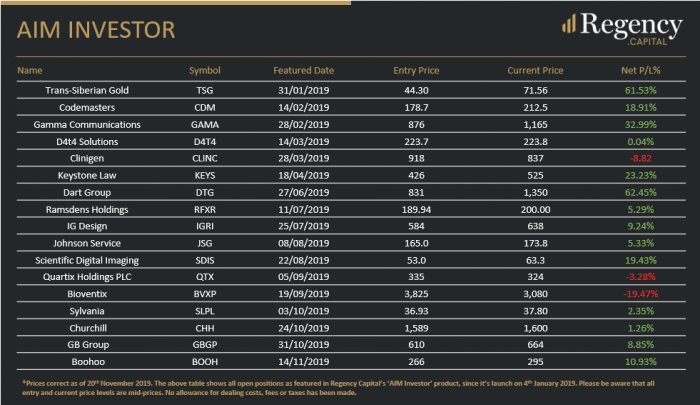

After the manic autumn earnings season, portfolio-related newsflow has been thin on the ground as the market looks towards the December general election.

Our AIM Investor portfolio continues to have a healthy glow with a sea of green under the P/L% column – helped by the strong recent additions of fast fashion group Boohoo (BOO) and cyber security specialist GB Group (GBG).

Biotech Bioventix (BVXP) represents our largest headache as the market continues to punish the shares for an underwhelming set of full-year numbers, released in October.

BOO Off to a Bullish Start

We added Boohoo (BOO) to our AIM Investor portfolio last week and highlighted the potential for a ‘gap and go’ technical setup.

The top of the gap proved to be a valid area of support and prices have rallied strongly during the last three sessions – breaking to new highs.

This early burst of bullish momentum is very encouraging and indicates that the timing of our entry has been favourable.

Ramsdens Recover as Trading Remains In-Line with Expectations

It’s been a volatile week for foreign exchange broker Ramsdens (RFX) as the shares dropped 7% on Monday and a further 8% on Tuesday.

Noting the share price movement, management released a statement clarifying that it did “not offer unsecured personal loans nor high-cost, short-term credit loans as defined by the Financial Conduct Authority”.

The statement went on to confirm that “Ramsdens continues to trade in line with the board’s expectations and looks forward to reporting its results for the six months ended 30 September 2019 on 3 December 2019”.

Price action following the statement has seen the shares bounce back, erasing more that 70% of the drop.

GBG Breaks Key Highs

Cyber security stock GB Group (GBG) has got off to a strong start…

Added to our AIM Investor portfolio at the start of November, GBG has continued to push higher following the bullish reaction to it’s October trading update.

This ‘post-earnings announcement drift’ was a key catalyst behind our entry and prices have gone on to break through resistance at 635p and we are also starting to see evidence that this broken resistance level will be used as support going forward – another very encouraging sign.

Whilst it’s very early days, we’re happy that GBG is maintaining its momentum. And with Half Year numbers set for release next Tuesday, we expect the shares to continue higher.