24th Oct 2019. 8.51am

Regency View:

Update

Regency View:

Update

TSG on Track to Achieve Annual Production Target

Earlier this week, precious metals miner Trans-Siberian Gold (TSG) reported that it was on track to meet the upper end of its full-year production guidance after its Q3 revenues jumped by almost a third.

TSG’s Q3 gold production came in at 12,620 oz, which was 8% higher than for the same period one year before. Total gold production over the first nine months of the year was 34,509 oz, putting TSG on a path to meet the upper end of its annual output guidance of 40-44,000 oz.

CEO Alexander Dorogov, commented:

“I am pleased to announce our production results for Q3 and 9M 2019, that are underpinned by our continued operational improvement. We are particularly delighted to note that following a substantial increase in the average gold price last quarter, we have successfully maintained the high grade of 8.3g/t during this period. Our production to date of 34,509 oz places TSG firmly on track to meet the upper end of our annual output guidance of 40-44,000oz.”

This production update was broadly in-line with market expectations and TSG’s share price has continued to retrace within a small descending channel. The channel has all the hallmarks of bull flag formation and hence we expect this pattern to resolve itself in another push higher, in-line with TSG’s powerful long-term uptrend.

D4T4 Release Robust Trading Update

Big data firm, D4t4 Solutions (D4T4) said on Monday that its revenue and adjusted profit in the first half were in-line with management expectations and that it remains confident in “delivering a solid finish” to full-year 2020.

CEO Peter Kear commented:

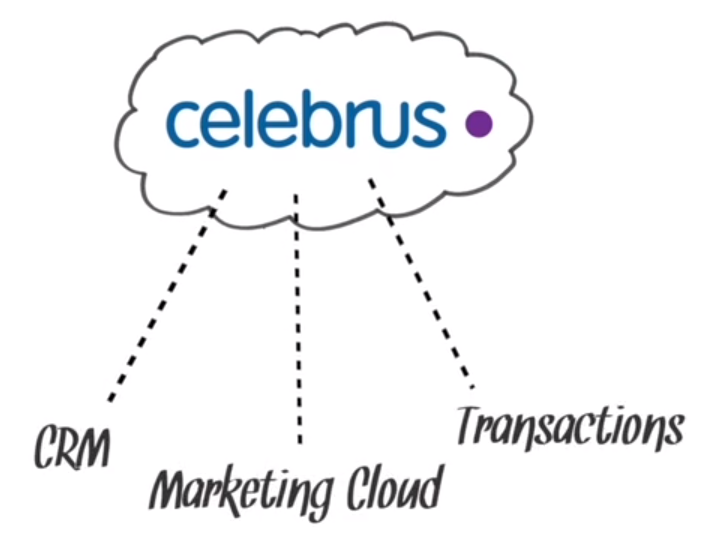

“The first six months of the current financial year have seen some excellent new contract wins particularly with our hybrid Private Cloud Data Platform solution with wins at ESME loans (a challenger start-up backed by Nat West/RBS) and Urenco, a world leading nuclear fuel enrichment company. Celebrus Customer Data Platform software contract wins include a capacity extension for a Chinese bank, a capacity extension for a Taiwanese bank, new functionality for a European insurer and a new European retail customer.”

D4T4’s share price has frustratingly failed to gain much traction over the last six months and we’re broadly flat on our position. However, price action following the trading update has been positive with the shares rallying from the bottom of a descending channel.

We remain happy to hold D4T4 within our AIM Investor portfolio.

IG Design Delivers Double-Digit Profit and Revenue Growth

IG Design (IGR) reported a strong first-half performance last week, delivering double-digit growth in both revenues and profits.

The giftware manufacturer is set for a record festive period and is on track to meet full-year market expectations as it continues to benefit from a strong order book.

CEO Paul Fineman commented:

‘We are delighted with a strong start to the year and the continued momentum across the business, illustrated by the high level of orders going into the second half. Our robust financial performance is underpinned by the investments made in the business and the operational initiatives undertaken to increase efficiencies.

“Our organic growth initiatives throughout the business position us well for FY21 and beyond. These together with an active pipeline of acquisition opportunities throughout all regions provides an exciting outlook for the future.”

IGR’s share price is starting to build momentum as prices trend higher and we’re now comfortably in profit on our position. It’s worth noting that 629p represents a key area of resistance, now only 9p away from current prices so we’ll be watching closely for signs of price rejection at this level.

Bioventix Fails to Inspire Despite 6% Rise in Revenue

Biovenix (BVXP) released their full-year numbers to the market on Monday, reporting a 6% jump in revenue to £9.3m and a 1% rise in profit before tax to £7m.

The blood testing biotech declared a second interim dividend of 43p per share, up from 36p in the prior year, and a special dividend of 47p per share, down from 55p year-on-year.

As mentioned in our original report, Bioventix growth will be heavily linked the success of Siemens blood testing kits which uses troponin – an antibody for which Bioventix receive a royalty payment. Still in the early roll-out stage, troponin sales only amounted to £120,000 but finnCap forecasts they could reach up to £3.5m by 2025.

Bioventix certainly represents our biggest headache within the portfolio. The shares have broken lower from the wedge formation that we highlighted upon entry last month and short-term momentum is bearish.

It is however very early days and given Bioventix high operating margins and positive free cash flow we are happy to give the shares more time to prove themselves a worthy addition to our portfolio.

SLP Doubles its Operating Earnings in the First Quarter

Sylvania Platinum (SLP) said it doubled its operating earnings in the first quarter amid a rise in metal prices.

EBITDA for the three months through September rose to $19.2m, up from $9.3m on-year.

Revenue rose 54% to $31.2m amid a 25% rise in the average gross basket price.

CEO Terry McConnachie commented:

“I am pleased to say that the SDO achieved another solid production performance in the first quarter of our financial year towards our annual guidance of 74,000 to 76,000 ounces. Recovery efficiencies improved well to 59.46% and are attributable to a combination of the Mooinooi MF2 circuit running for a full quarter, improved feed stability and circuit configuration at Lesedi and higher flotation mass pull philosophy at some of the operations.”

We deliberately entered SLP on a pullback to achieve favourable risk/reward and this looks to have worked to our advantage. Prices have broken above the descending retracement line, indicating that SLP’s long-term uptrend is ready to resume.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.