26th Sep 2019. 9.05am

Regency View:

Update

Regency View:

Update

A busy fortnight…

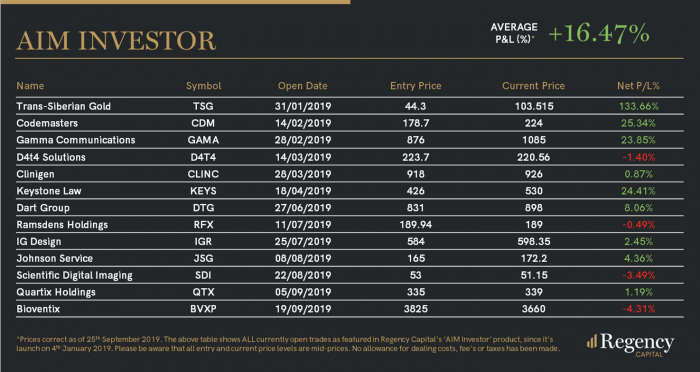

It’s been a busy fortnight of fundamental newsflow for our portfolio with Keystone Law (KEYS), Clinigen (CLIN) and Trans-Siberian Gold (TSG) reporting numbers to the market.

We have also had the collapse of Thomas Cook and landmark developments in the UK political landscape as parliament was recalled following a unanimous ruling from the Supreme Court.

Overall, our portfolio is continuing to show high levels of relative strength, with particularly strong recent performances from Dart Group (DTG) and Keystone Law (KEYS) – both of which are covered in detail below.

Rival Holiday Makers Rally on Thomas Cook’s Collapse

Reveling in the misfortune of others is not something we do at Regency, especially given the thousands of jobs that have been lost and the countless numbers who have had their holidays ruined.

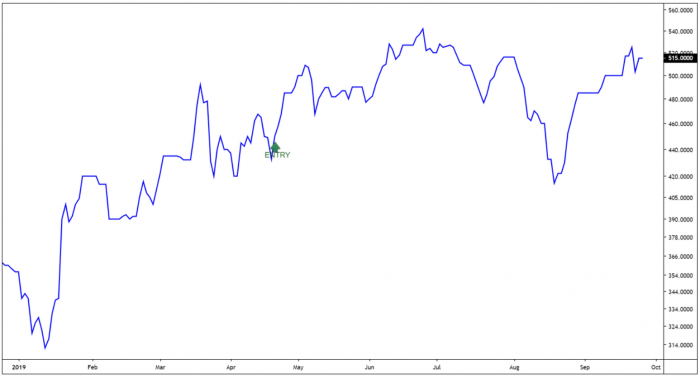

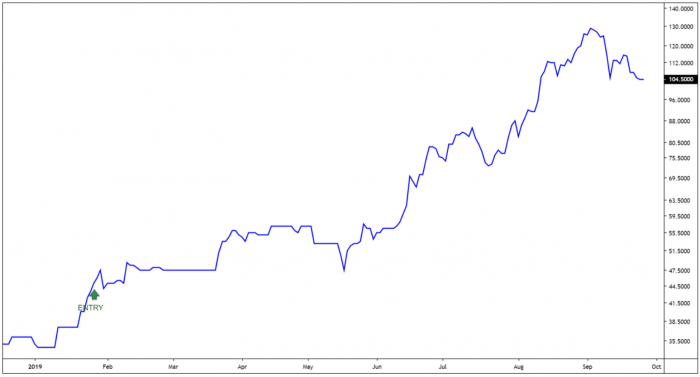

It is however a fact that our position in Dart Group (DTG) has directly benefited from Thomas Cook’s demise. The package holiday and airline group rallied more than 20% in less than two sessions as rival Thomas Cook ceased trading on Monday.

The removal of Thomas Cook from the saturated European holiday market is likely to boost prices in the short-term as capacity is reduced. It also provides an opportunity for Dart Group to increase their market share.

Keystone Law Has Confident Outlook

Keystone Law (KEYS) reported a double-digit increase in profit and revenue for the first half of its financial year, as recruitment activity remained strong.

For the six months to the end of July, the law firm’s pre-tax profit rose by 12% to £2.4m on revenue that grew by 15% to £23m.

Recruitment of lawyers remained strong in the period, with qualified new applicants rising by 7.5% to 114 and accepted offers up by 24% to 36. Overall, the number of new lawyers joining in the period was 34, up from 31 the same period the prior year.

CEO James Knight commented – “The performance of the existing lawyers, together with the strength of the recruitment pipeline at the half year all serve to underpin our confidence in the second half.”

Pleasingly, Mr Knight also declared an interim dividend of 3.2 pence per share, up 28% from 2.5p the year before.

The shares have rallied more than 25% in the last six weeks, taking our position nicely into profit. With short-term price momentum now realigned with Keystone’s multi-year uptrend, we expect prices to break to new highs over the coming weeks.

Clinigen’s Gross Profit Climbs 30%

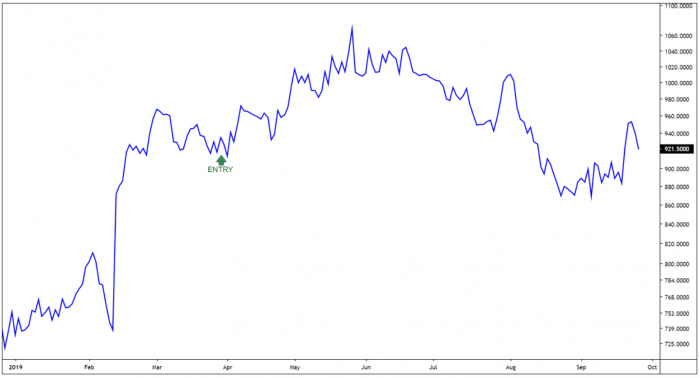

Clinigen (CLIN), the specialist pharma services company, reported a robust set of numbers to the market last week, in-line with expectations.

Adjusted gross profit jumped 30% to £182m – due to ‘transformational’ acquisitions with organic profit growth up 1%.

The firm continued their record of delivering double-digit earnings growth every year since their AIM IPO – with earnings per share (EPS) up 20%.

The company released its first formal five-year guidance for expected growth in annual organic gross profits of 5% to 10%.

CEO Shaun Chilton commented – “we have continued our run of double-digit EPS growth each year and 22% CAGR overall since the IPO. We have grown through a combination of transformative acquisitions and organic growth to create an international platform which is now taking shape and supporting synergistic growth. This year’s performance reflects the results of this strategy.”

The market reacted positively to Clinigen’s statement and whilst we’re pretty much flat on our position, Clinigen’s technical and fundamental backdrop remains strong enough to keep it in our AIM Investor portfolio.

Trans-Siberian Says H1 Profit Up 170%

Trans-Siberian Gold (TSG) said its first half 2019 profit was up 170% to $8.5m on production of 21,889oz of gold ore and 32,155oz of refined gold.

Earnings surged 62% to $14.4m – helped by a strong average selling price of $1,312/oz and a 39% increase in its average gold grade.

During the first half, the company paid a special interim dividend of 5c per share and completed a 21% share buyback, using debt financing.

As mentioned in previous updates, TSG acquired a development and exploration licence for its Rodnikova deposit, and said it was on track to achieve its annual production guidance for 40,000-44,000oz.

CEO Alaxander Dorogov commented – “With the issuance of our seventh consecutive dividend, I am very pleased to be confirming our commitment to continued shareholder returns, and we look forward to the remainder of the year with optimism.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.