Regency View:

BUY Yellow Cake (YCA)

Uranium supply squeeze leaves Yellow Cake looking tasty

As those of us who queued for hours to refuel this week will know, when the herd fear a supply squeeze, panic buying sets in fast.

These ‘animal spirits’ apply to any market, and no more so than the once sleepy uranium market.

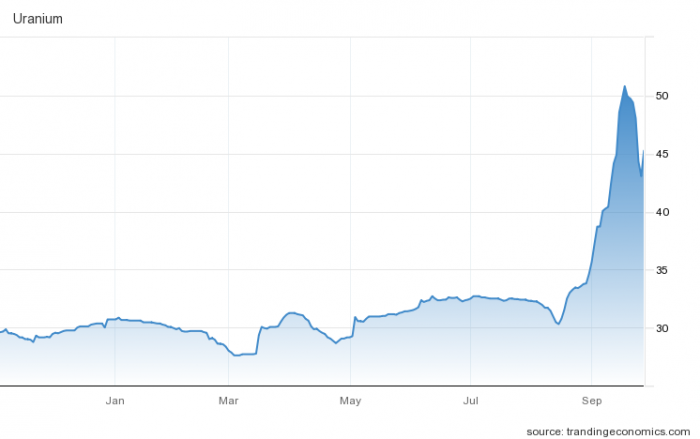

The price of uranium oxide (U3O8) or ‘yellowcake’ as it is commonly known, has surged in recent weeks from $30/lbs in August to more than $50/lbs earlier this month.

Several demand-side factors have left the market in a ‘fundamental supply deficit’, and Yellow Cake (YCA) offer pure exposure to this supply squeeze…

Yellow Cake is a uranium holding company that listed on Aim in 2018.

With a low-cost structure and a clear mandate to buy and hold physical uranium, Yellow Cake has no exposure to risky exploration, development, mining, or processing. It is essentially a uranium commodity ETF, but in a corporate vehicle.

Yellow Cake have a long-term contract with Kazatomprom, the largest, and one of the lowest cost, producers of uranium globally. The contract enables Yellow Cake to acquire substantial volumes of uranium at undisturbed prices.

So far, Yellow Cake has purchased approximately 13.9 million lbs of uranium oxide, which is held in a storage account at Cameco’s Port Hope facility in Ontario, Canada and in Orano Cycle’s Malvési storage facility in France.

Nuclear energy essential to net zero ambitions

Nuclear energy produces less carbon dioxide than wind, solar or hydropower.

It is also more reliable than many alterative energy sources and can be deployed on a large scale.

And whilst the uncomfortable tail risks associated with nuclear energy remain, an increasing number of governments have put nuclear energy at the center of their carbon-neutral plans…

Demand for uranium is expected to climb from about 162m lbs this year to 206m lbs in 2030 — and even further to 292m lbs in 2040 — according to the World Nuclear Association.

There are currently 57 reactors under construction globally and a further 101 planned, including 37 in China as Beijing plans to cut emissions.

China has pledged to increase nuclear power generation to 70 Gigawatts by 2025, from 50GW currently, as part of President Xi Jinping’s plans to move away from coal.

In addition, India, Russia and the Middle East are switching to nuclear power, with the United Arab Emirates announcing its first nuclear power plant in April, the first Arab state to do so.

At the same time, US President Joe Biden has included nuclear in his “clean energy standard” that would mandate utilities to produce power that is carbon-free by 2035.

Financial investors want a bigger slice of Yellow Cake

The under-supplied uranium oxide market has caught the attention of financial investors…

A newly launched investment trust run by Canadian asset manager Sprott is said to be one of the main reasons for uranium’s recent rally.

The Sprott Physical Uranium Trust has snapped up more than 10m lbs of uranium oxide, worth about $240m, since launching on July 19.

Sprott’s aggressive buying has put pressure on utility companies that need to secure supplies of uranium oxide for electricity generation – sending the tight uranium oxide market into a panic-buying frenzy.

The asset manager plans to buy even more after increasing the firepower of the trust, which trades on the Toronto stock exchange, from an initial $300m to $1.3bn.

Fundamental supply deficit

Alongside the demand-push factors outlined above, the uranium market is also set for a supply squeeze…

Global supply of uranium is set to fall 15% by 2025 and by 50% by 2030, caused by a lack of investment in new mines.

The sustained period of low uranium prices which followed the Fukushima Daiichi nuclear disaster in 2011 has seen supply diminish over the last decade. Yellow Cake estimate that more than 77m lbs of uranium oxide has been removed from the market since 2014.

And with just five companies producing two thirds of global supply, these supply squeeze cycles can be more drawn out than in other metals and minerals markets.

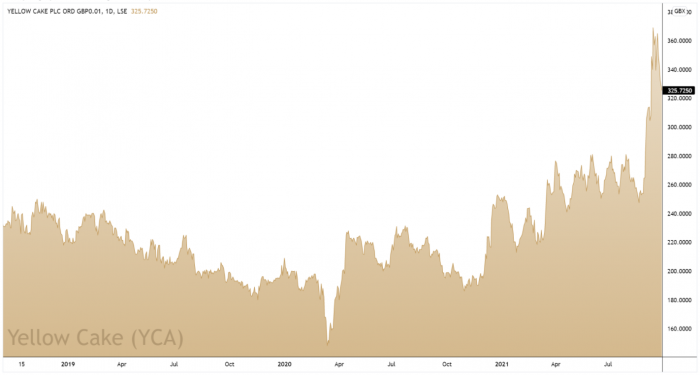

Pullback creates buying opportunity

We’ve sat patiently on the sidelines while Yellow Cake’s share price surged through resistance earlier this month.

As tempting as it is to chase hot stocks higher, waiting for a pullback lowers the probability of being caught out by the ‘fakeouts’ and capitulation.

During the last week, our patience appears to have paid off as Yellow Cake’s share price has undergone a steady pullback from highs.

With the shares now trading back at a key level of support, we believe the timing is right to join the breakout.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.