Regency View:

BUY Xpediator (XPD)

Xpediator enjoying post-Brexit Britain

Brexit followed by a global pandemic, hardly the ideal backdrop for freight business to thrive, but Xpediator (XPD) is doing just that…

Xpediator is a fast-growing international freight management company providing logistics and transport support solutions.

They operate across 34 offices throughout the UK and Europe and have just completed a new purpose-built 200,000 sq ft facility at Southampton’s Container Port.

Xpediator is delivering consistent revenue growth and has recently upgraded its profit guidance twice in two months.

The business generates plenty of cash, and the stock trades on an undemanding valuation as well as offering a decent dividend yield.

Asset-light model reduces risk

Xpediator have three core service divisions, Freight-Forwarding, Warehousing & Logistics, and Transport Solutions.

The divisions are managed autonomously on a day-to-day basis but directed centrally to cross-sell services to the Group’s customer base.

Xpediator have an ‘asset-light’ business model where the majority of warehouse and haulage capacity is leased. This approach reduces its capital requirement and allows Xpediator to more accurately match costs to volumes – de-risking the business.

Freight-Forwarding is by far Xpediator’s largest division – accounting for more than 70% of the Group’s £221m total revenues in 2020. Xpediator operate as a broker, offering an end-to-end service – managing shipments via third-party carriers across road, sea and air. Their key brand in this space is Delamode which has been established for over 30 years.

Warehousing & Logistics accounts for around 20% of Group revenues and includes storage as well as value-add activities such as labelling, repacking, product preparation and e-commerce fulfilment, along with domestic delivery of palletised freight.

Transport Solutions only accounts for 2% of Group revenues and provides bundled fuel and toll cards, financial and support services for hauliers in Southern Europe.

Exposed to fast-growing Eastern European markets

“The economies of countries in Central and Eastern Europe (CEE) will grow at a faster rate than those in western Europe in the next few years”, the words of Kristalina Georgieva, Managing Director of the International Monetary Fund speaking at a summit of the Three Seas Initiative last week.

Ms Georgieva said she expected about 1.2% higher annual economic growth in CEE countries than in their western neighbours between now and 2025.

This is good news for Xpediator, who have a unique foothold in the Baltic and CEE regions…

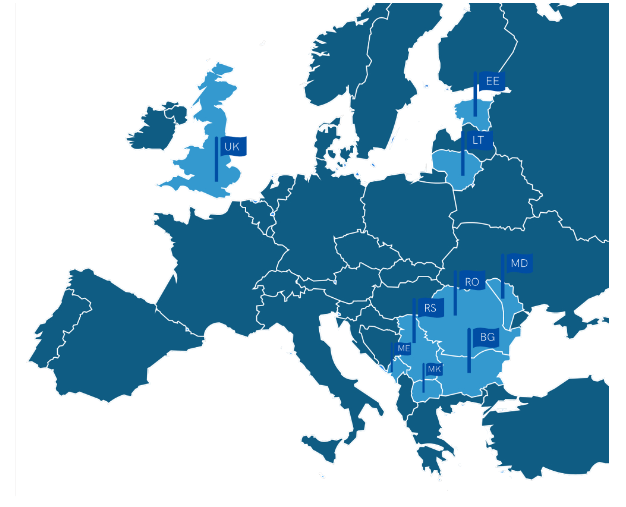

Alongside its UK offices, Xpediator have bases in Bulgaria, Lithuania, Estonia, Macedonia, Montenegro, Moldova, Romania and Serbia.

This network provides regular and direct services linking Eastern Europe, the Balkans and the Baltics with Western Europe, together with logistics and warehousing capabilities in the UK and Romania.

Baltic states and CEE account for around 60% of Group revenues, and this region has outperformed as Europe bounces back from the pandemic. Romania has been a standout with the Group’s Pall-Ex franchise, hitting record numbers during the first quarter of 2021.

Benefiting from Brexit

The Brexit free-trade agreement, which came into effect on Christmas eve 2020, has bought with it significantly more red tape and this has played straight into Xpediator’s hands…

As part of their Freight-Forwarding service, Xpediator process all documentation required to transport goods across different jurisdictions – a service which has been in great demand since Brexit.

Xpediator has had to significantly expanded its customs clearance team to administer the additional paperwork. And whilst cross channel freight volumes have been lower, this has been more than offset by the additional administrative revenue – making Brexit a net positive for the Group.

It is also, worth noting that as UK agrees more trade deals with non-EU countries, demand at ports handling non-EU trade will increase.

One such port is Southampton where Xpediator have just completed a new purpose-built 200,000 sq ft facility at Southampton’s Container Port. The new facility will bring with it increased capacity and additional cost savings in the region of £0.25m to £0.5m annually.

Growth at a reasonable price

In the past two months, Xpediator have released a series of bullish trading statements – upping profit expectations by 10% from £7.7 adjusted pre-tax profit to £8.5m.

Xpediator trade on a forward price/earnings (PE) multiple of 15, which is about middling for the Freight & Logistics Services sector, but when compared to its forecast earnings per share (EPS) growth rate of 29.1% (top three in the sector) the valuation starts to look attractive…

Indeed, Xpediator have a forward Price to earnings growth (PEG) ratio of 0.7, where anything below 1 is attractive. They also have an enterprise value to cash profits (EV/EBITDA) of 7.45 – one of the best in its peer group, and a steadily rising dividend with a forward yield of 2.47%.

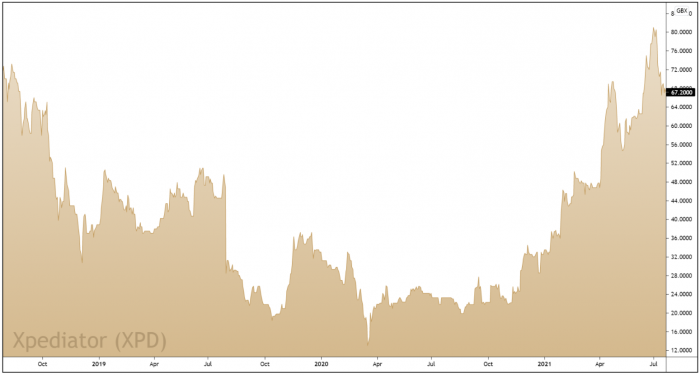

The shares have recently undergone a 20% pullback from their earl-July highs – taking prices back to their ascending trendline (gold dotted line).

This pullback has taken place during a period of market-wide weakness; hence we are not concerned that the trend has run its course.

Given Xpediator’s upgraded earnings forecast, its foothold in fast-growing markets and its strong post-Brexit positioning, we expect the shares to deliver for us!

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.