27th Jul 2023. 8.59am

Regency View:

BUY Water Intelligence (WATR)

Regency View:

BUY Water Intelligence (WATR)

Pioneering water solutions for a sustainable future

Water, our planet’s most precious asset, sustains life, supports ecosystems, and fuels our industries. Yet, as water scarcity and environmental concerns rise, the need for effective water management and leak detection becomes paramount.

At the forefront of this mission is Water Intelligence (WATR), a pioneering company offering innovative solutions to conserve water, prevent leaks, and optimise water-related systems.

Unlike many ‘green stocks’, Water Intelligence have high quality financials and an impressive track record of delivering profitable growth.

The stock looks cheap across a number of metrics and we believe the time is right to add them to our list of AIM Investor open positions.

A ‘one-stop-shop’ for water management

Water Intelligence operate across two core brands – American Leak Detection and Water Intelligence International which together offer a ‘one-stop shop’ for all water-related needs.

American Leak Detection specialises in advanced leak detection services. They deploy state-of-the-art technologies to locate and prevent water leaks, ranging from concealed pipe leaks to hidden issues within buildings. By addressing leaks promptly, they not only save water but also prevent potential damage and reduce operational costs for their customers.

Water Intelligence International offers smart irrigation solutions, catering to the growing need for water-efficient practices in gardens and landscapes. Their technology-driven approach ensures water is utilised wisely, promoting sustainable and eco-friendly irrigation practices.

An integral part of Water Intelligence’s model is franchising, which has driven their global growth. Their extensive franchise network spans the United States, Canada, Australia, and the United Kingdom, ensuring localised services with consistent expertise and quality. Each franchise location caters to residential, commercial, and municipal clients, delivering a wide range of services.

Record-breaking results and growth prospects unveiled

Last month, Water Intelligence reported impressive financial figures, along with strategic insights into potential areas for future growth.

Financially, Water Intelligence delivered robust revenue growth, with an increase of 31% to $71.3m (FY22) compared to the previous year. While Network Sales (franchise revenues) grew by 11% to approximately $165 million.

Adjusted earnings (EBITDA) saw a substantial rise of 20% to $12.4m and adjusted Profit Before Tax increased by 12% to $7.8m.

The company’s results also shine a light on strategic areas with strong potential for expansion. The acquisition of IntelliDitch, Inc. in 2021 positions Water Intelligence to explore new opportunities in the agriculture and property management sectors. Leveraging IntelliDitch’s patented technology, which minimises water loss, the company is poised to offer innovative solutions and drive growth in these industries.

Furthermore, Water Intelligence’s expansion into the UK market through the acquisition of Wat-er-Save Ltd. presents exciting prospects for growth in the residential and commercial sectors. Capitalizing on cross-selling opportunities between their brands, American Leak Detection and Water Intelligence International, the company gains a strategic advantage in maximising market reach.

With a strong financial performance and a strategic vision for future growth, Water Intelligence is set to solidify its position as a leader in the water management industry.

High-quality financials

For a stock with a market cap less than £100m, Water Intelligence has very high-quality financials.

Over the last five years, the company’s revenues have surged at a compound annual growth rate (CAGR) exceeding 30%, and profits have grown at a similar pace.

Water Intelligence’s five-year operating margin is comfortably in double digits – indicating that the business has a sustainable competitive advantage.

Return on equity (ROE) is 12.2% (CAGR/Avg 5yr) and this provides clear evidence that management can deploy shareholder capital effectively.

Cashflow is another strong indictor when it comes to quality and Water Intelligence generate plenty of it (47.8m FY22) with more than 87% translating into free cashflow.

This cashflow has created a rock-solid, debt free balance sheet and creates a platform for the business to grow without diluting shareholders.

In terms of valuation, Water Intelligence trade on a forward price-to-earnings (PE) ratio of 16. This looks very reasonable given the quality of Water Intelligence’s financials and forecast earnings per share (EPS) growth of 28.7%.

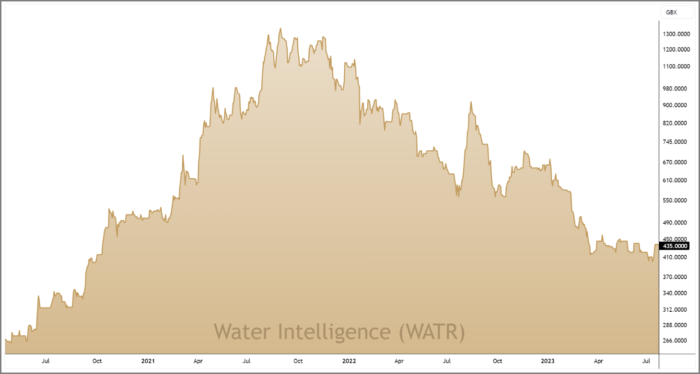

Prices pull back to long-term support

After hitting highs north of £13 in September 2021, Water Intelligence’s share price has undergone a deep and prolonged pullback.

This pullback has taken prices back into a crucial zone of trend support, formed by multiple resistance levels between 2018 and 2020.

Encouragingly, recent price action has seen the shares stabilse at this support level with the shares bouncing from £4 on multiple occasions during the last two weeks.

With more than 200% headroom to the 2021 highs, the technical risk-to-reward is starting to look compelling, especially wihtin the context of Water Intelligence’s long-term uptrend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.