Regency View:

BUY Warpaint London (W7L)

Warpaint looking good after bullish November update

Independent beauty brands have taken the global cosmetics market by storm…

Smartphones and social media have democratized the information of beauty and wellness, transforming customers from big-brand following zombies into independent-thinking consumers.

Smaller, nimble cosmetics companies have done a much better job at adapting their marketing approach to the social media age, forcing established brands to pay substantial premiums to acquire the innovators…

Notable examples include L’Oreal acquiring IT Cosmetics for $1.2 billion, Estee Lauder snapping up Too Faced for $1.45 billion, and L’Occitane buying Elemis for $900 million.

This week’s stock, Warpaint London (W7L) is a nimble cosmetics company with accelerating online sales growth and strengthening partnerships with major retailers in the UK and US.

The company is cash-generative and profitable with a robust, debt-free balance sheet debt and an eye-catching forecast earnings per share growth rate.

Warpaint sells own brand cosmetics under the lead brand names of W7 and Technic…

W7 is sold in the UK primarily to retailers and in the US and China to local distributors or retail chains.

The Technic brand is sold in the UK and continental Europe with a significant focus on the gifting market, principally for high street retailers and supermarkets.

Under its lead brands, Warpaint operate a number of more niche brands including Very Vegan, Man’s Stuff, Chit Chat and Body Collection.

Warpaint also supply own brand white label cosmetics produced for several major high street retailers. And they have a separate division which trades in close-out and excess inventory of branded cosmetics and fragrances from around the world.

Warpaint’s value positioning fits well with Tesco

Warpaint’s market positioning is firmly at the value end of the market, and the underling marketing message across its family of brands is clear ‘high quality products at affordable prices’.

Given the impact of Covid-19, the need for affordable quality brands is greater than ever…

Consumer confidence is extremely low with 39% of those furloughed said to be concerned about having enough money to pay bills and get essentials.

And Warpaint are taking full advantage of the rising demand for value via its blossoming partnership with the UK’s number one value retailer, Tesco…

Warpaint launched with Tesco last year, and the relationship has expanded rapidly with the number of Tesco stores stocking W7 branded products jumping from 56 in June 2020 to over 1,300 a year later.

Tesco have a total of 4,008 stores in the UK and Republic of Ireland, so there is significant scope for this relation to deepen further.

Warpaint also launched with value retailer WILKO in 2020 and recently signed an agreement with Boots to stock a range of 80 W7 products in an initial 84 stores from February 2022.

Online growth accelerates

Alongside the substantial scope to grow through UK retail chains, Warpaint are also seeing accelerating levels of growth online in the US and China…

Warpaint’s e-commerce sales surged 115% in H1 2021 compared to H1 2020, and international revenue increased by 41% to £9.5 million.

Further expansion of online sales is expected with the launch in China of official W7 brand stores owned by the Group on Taobao Mall (Tmall), the most visited B2C online retail platform in China and Xiaohongshu (Red), one of China’s foremost social media, fashion and luxury shopping platforms.

There’s also enormous potential for growth in the US, where Warpaint’s products are stocked in the likes of TJ Maxx and Five Below.

This top line growth is set to translate into the earnings growth, with Warpaint’s earnings per share (EPS) growth rate forecast to hit 33.3% next year.

The projected EPS growth also makes Warpaints forward price/earnings (PE) ratio of 21.9 more palatable.

Asset light structure equates to high cash conversion ratio

Warpaint has an asset light structure which outsources manufacturing overseas to ensure competitive pricing and rapid production.

They employ just 120 staff worldwide and has c.145,000 sq ft of warehouse and office space in the UK, US, Hong Kong and China.

Warpaint’s asset light structure is essential given the lower margins at the value end of the market, and it also delivers a high level of cash conversion…

In 2020, 88% of the Group’s £9.71m operating cashflow converted to free cashflow, and on a trailing twelve-month (TTM) basis the cashflow conversion ratio is even higher at 94%.

This high level of cash conversion has built a debt free balance sheet and allowed Warpaint to reward investors with a healthy dividend, paying out 5.8p per share in 2020 and putting the stock on a forward dividend yield of 3.38%.

The stock trades a price to free cashflow ratio of 16.2, which is one of the best in the Personal & Household Products & Services market.

Bullish November trading update

Having released a strong set of Interim Results in September, which saw H1 sales jump 36% to £18.4m, Warpaint followed this up with a bullish trading update on November 2nd…

Warpaint expects Full-Year sales to come in ‘ahead of market expectations’ and reach pre-pandemic 2019 levels, when the business turned over £49.3m. And gross margins are running ahead of those achieved in 2020 and 2019 despite increased supply chain costs, ‘particularly with freight’.

CEO Sam Bazini said Warpaint is continuing to see “particularly strong growth in the UK, significant growth elsewhere internationally and further increases in online sales”.

He added that Warpaint has “significant opportunities for further growth, both with our existing retailers, those such as Boots where we are expecting to launch soon, and with others that we are in discussions with.”

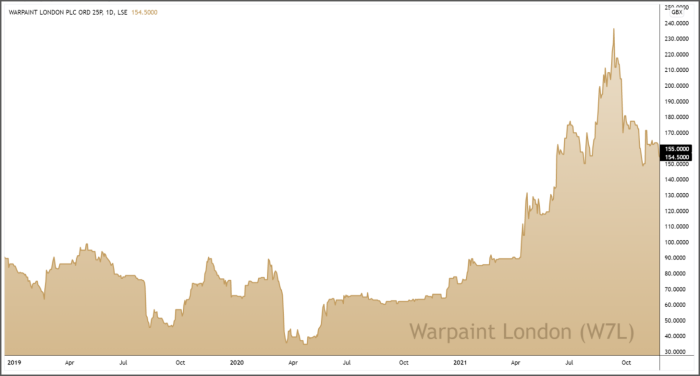

The trading update was well received by the market with the share gapping higher and breaking above the descending retracement line which has been in place since Warpaint hit highs of 236p in September.

Warpaint’s autumn retracement has taken prices back towards multiple levels of long-term support. And with prices now 35% below their September highs, the technical timing of our entry looks attractive from a risk / reward perspective, especially in the context of November’s bullish trading update.