3rd Dec 2020. 9.00am

Regency View:

BUY Tracsis (TRCS)

Regency View:

BUY Tracsis (TRCS)

Click here for printer friendly version

Ready to ride the recovery

This time last month, a raft of positive vaccine news sent equity markets giddy at the prospect of a quicker than expect return to some form of normality.

Whilst there was the typical ‘dash for trash’, which saw almost every beaten-up stock get a bounce, there were also, high quality stocks for which an early, more effective vaccine would be a game-changer.

One such stock is transport technology company Tracsis (TRCS)…

Tracsis develop software and hardware products designed to enhance the efficiency of our transport services and public events.

They’ve created innovative products like smart ticketing and automated delay repay, and have been one of the poster boys of the ‘big data’ revolution, utilising integrated data capture to unlock powerful insights. And with the 5G rollout underway, our ‘Smart Cities’ of the future will see big data play an integral role in how we manage assets, resources and services more effectively.

Tracsis’ revenues (£47.1m 2020) are well diversified, with roughly similar contributions from its two core business areas:

1. Rail Technology & Services

This division includes Ontrac – a safety and risk management software, scheduling software TRACS and MPEC – a remote conditioning hardware and software business.

Tracsis unaudited Final Results, released in November showed that this division has been “generally unaffected by the pandemic”, delivering 17% revenue growth along with a 33% jump in adjusted earnings. The group also managed to secure a “large multi-year contract secured with a major Train Operator”.

Operating margins on this side of the business are more than double that of the Traffic & Data Services business (below), and CEO Chris Barnes believes that “providing rail infrastructure services will become the dominant growth engine for the group”.

2. Traffic & Data Services

Tracsis are the leading international provider of transport surveys, passenger analytics and Geographical Information Systems (GIS) location analytics. They also offer event logistics and management services through their SEP Events and CTM subsidiaries.

Clearly this side of the business has been hit much harder by the pandemic – losing an estimated £10m of revenue versus budgeted expectations.

However, Tracsis moved swiftly to reduce its cost base in the areas most impacted by the pandemic and a strong performance by the Rail Tech division has helped to soften the blow.

Cashed up and ready for a recovery

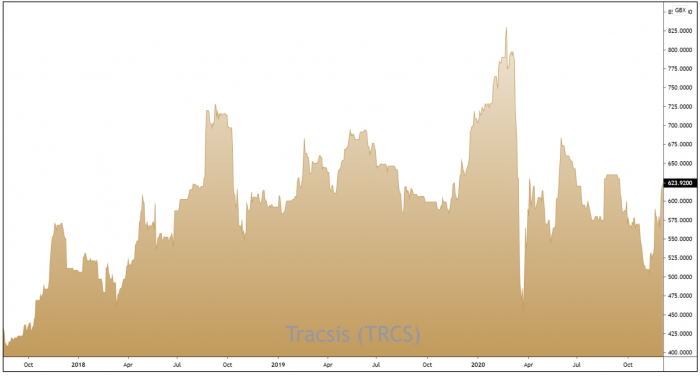

Being predominantly a software and data business, Tracsis boast high levels of recurring revenue and cash generation.

Whilst their net cash pile has reduced from £24.1m (2019) to £17.9 (2020), Tracsis are debt free and have a very low cost base.

A staggeringly high level of cash from operations drops straight through to free cash flow. We can see from the table (above) that over the past four years, on average, 94% of operating cashflow converts to free cashflow. This means that the shares stand to gain from operational leverage – if the company can continue to grow its Rail Technology & Services business while Traffic & Data Services recover.

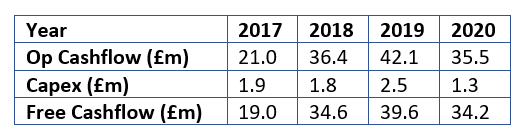

Following a sharp post-lockdown sell-off, the shares are now changing hands on a less demanding forecast earnings multiple of 21.3 – top quartile in the Software & IT Services sector.

And despite cancelling their dividend earlier this year, their well-covered pay-out looks set to be reinstated when there is more visibility over a return to holding public events.

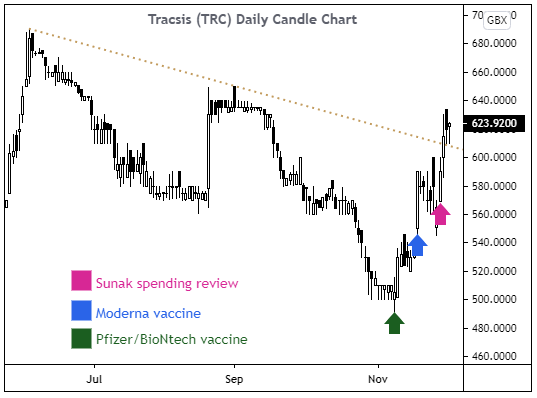

Three positive catalysts in three weeks

The last month has been hugely positive for Tracisis on multiple fronts.

On 9th November, Pfizer/BioNTech announced that its vaccine achieved a greater than 90% efficacy in preventing COVID infections. This was followed by an even stronger set of numbers from US biotech Moderna, who showed a near perfect efficacy.

The third catalyst in as many weeks came from Chancellor Rishi Sunak who unveiled a “once in a generation” investment in UK railways and infrastructure during last weeks Spending Review.

The chancellor said the government will pour billions into the transport and infrastructure network to keep services running following a collapse in passenger numbers during the pandemic.

The rail network will receive more than £2bn in subsidies next year and a further £4.8bn will be used to support buses, regional light rail, cycling and Transport for London.

These multiple catalysts have seen Tracsis share price put in a strong push higher – breaking above the descending line which had formed from the lower series of swing highs, and creating the trigger momentum we require for entry.

Whilst a return to ‘normal life’ may still be some way off, we believe Tracsis strong financial position make them well positioned to ride the recovery.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.