Regency View:

BUY TPX Impact (TPX)

TPX Impact plan to quadruple revenue-run rate by 2025

Legendary British investor, Jim Slater once famously stated “elephants don’t gallop” to illustrate the idea that big companies rarely double in size, but small ones can.

This principle is at the heart of our AIM Investor portfolio, and we believe a focus on aggressive growth does not mean investors should compromise on quality.

If you know where to look, you really can have your cake and eat it. And this week’s stock, TPX Impact (TPX) is a prime example…

Formerly known as The Panoply, TPX is a ‘digital enabler’ consultancy, designing tools, products and services that can fast track clients’ e-commerce.

The company is growing at break-neck speed and CEO, Neil Gandhi has ambitious plans to quadruple revenue-run rate to £200m by 2025.

Digitally transforming the sleepy public sector

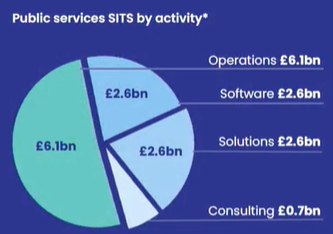

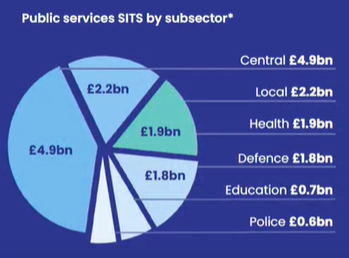

TPX primarily operate in the UK Software and IT Services market which is worth £51.8bn, of which public sector is £12.1bn.

The public sector is typically light-year’s behind the private sector when it comes to the pace of digital change and TPX have used this to their advantage…

Over 70% of TPX £51.1m (FY21) revenues come from the public sector with 20% from central government and 24% from local government.

Their client list includes most government departments from NHS Jobs to Homes England, along with large organisations such as Cancer Research UK and Dow Jones.

A typical project involves use TPX network of specialist IT companies to solve a problem for an organisation through fast-paced decision making.

Recent examples include working with the Department for Environment, Food & Rural Affairs (defra) to make the process of moving food products between Northern Ireland and the rest of the UK as efficient and smooth as possible. And working with NHS Jobs to build a digital platform to solve staffing shortages.

Public sector projects tend to be ‘sticky’ in nature and TPX have a recurring revenue rate of more than 60%. They also have a very strong cash conversion ratio, at 106% (FY21) with £5.7m cash in bank (FY21)…as Neil Gandhi said in his summer investor presentation, “we’re pretty old fashioned, we like to make profit and convert it into cash!”

Strong management and smart acquisitions

You can’t fail but be impressed by TPX co-founders and Neil Gandhi and CFO, Oliver Rigby. They have used a ‘buy and build’ strategy to grow TPX aggressively without compromising on financial solidity.

“The story has always been about bringing small companies together to help them work together to win larger deals” commented Neil Gandhi in July, and this is clear in TPX’s Full-Year 2021 results…

In fiscal 2020, TPX had 6 customers worth more than £1m and no customers over £3m. In fiscal 2021, the number of customers worth more than £1m has nearly doubled to 11 with 4 customers worth more than £3m, and average contract spend over the year leapt 48% to £176,000.

Recent acquisitions have also helped TPX to access new segments of the public services sector:

KITS – KITS are known for running life services on managed service basis. Prior to the acquisition, TPX were only playing in the solutions and consulting segments of the market, the addition of KITS means TPX gives them a foothold in Operations, meaning they now have access to over three-quarters of the £12.1bn Public Services Software & IT market.

Arthurly – The acquisition of IT consultancy Arthurly has really strengthened TPX’s Microsoft capabilities, and post-acquisition, TPX were able to achieve Gold Partner status which they have been able to leverage.

Difrent – The acquisition of digital services specialist Difrent has helped TPX to expand into the Healthcare segment, an area that TPX have identified as key for growth with personalised healthcare outcomes. In a follow-up to the acquisition, TPX have appointed Noel Gordon as a senior advisor to the group, Noel is former on board of NHS England and chaired NHS digital.

Growth at a reasonable price

We started with a quote from the late Jim Slater, and we believe Jim would have approved of TPX…

In his investment classic The Zulu Principle, Jim outlined the concept of Growth at a Reasonable Price by comparing Price Earnings ratio (PE) to earnings growth.

This concept is effective because growth stocks tend to trade on higher PE’s, and a punchier PE can be justified if the forecast earnings growth is strong enough.

TPX trade on a forward PE of 24.1, hardly bargain basement at first glance. However, when compared to a forecast earnings growth of 176.9%, TPX valuation looks very reasonable indeed.

And with management recently outlining an ambitious 2025 roadmap which should see revenue run rate hit £200m, there’s plenty of scope for a re-rating and the company moves into profitability.

Hammering out support

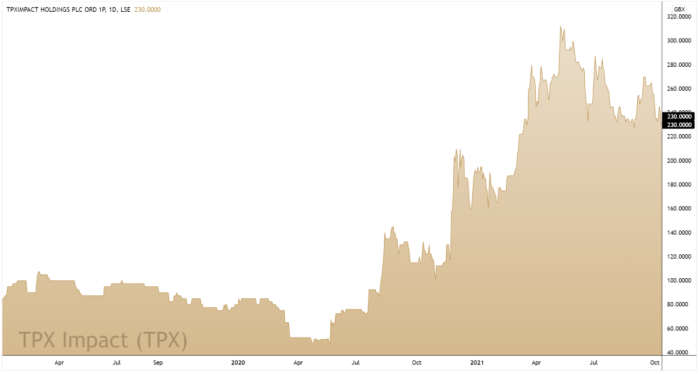

On the price chart, TPX have been in ‘consolidation mode’ since the summer…

Periods of price consolidation within an established uptrends are healthy as it reduces the risk of buying into an over-extended market.

During the consolidation phase, the shares have hammered out a strong area of support at 221p, just above the November swing highs and not far from the ascending trendline (gold dotted line).

We believe this bullish technical backdrop, combined within strong long-term fundamentals, makes TPX an exiting new addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.