6th Apr 2023. 9.18am

Regency View:

BUY TinyBuild (TBLD)

Regency View:

BUY TinyBuild (TBLD)

TinyBuild trade on big discount to peers

If I told you two years ago that the gaming sector offers rich pickings for those looking for a bargain, you’d have thought I was mad!

COVID-19 lockdowns had created the ultimate environment for gaming to flourish.

It was boom time for the entire industry and gaming stocks were given extraordinary valuations as investors expected pandemic habits to become embedded.

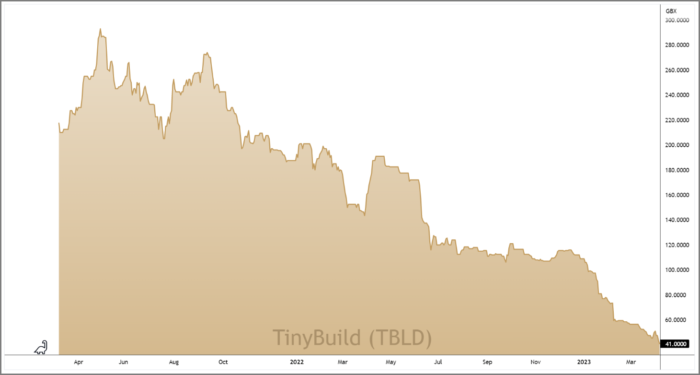

With lockdowns lifting, it was somewhat inevitable that we were going to see some valuations deflate, but what we’ve seen over the last eighteen months has been nothing short of a bloodbath.

Rising interest rates, falling discretionary spend, and the war in Ukraine are all headwinds that have seen gaming stocks big and small get heavily punished for missing growth targets.

What’s left, is a collection of exciting growth stocks trading on heavily discounted valuations, and our pick of the bunch is US-based, independent games developer TinyBuild (TBLD).

TinyBuild’s share price is 80% cheaper than it was two years ago without a single profit warning.

The stock trades on a lowly single-digit valuation despite offering attractive levels of double-digit earnings growth. And with a rock-solid balance sheet and impressive portfolio of popular games, TinyBuild look too cheap to ignore.

Portfolio approach lowers development risk

The video games industry, much like its film industry cousin, is a hit-driven business.

Once in a blue moon, a single title can boost a company’s revenue overnight by adding a few surprising zeroes to its bottom line, and the pursuit of such intellectual property (IP) is the goal of most teams within game studios.

Relying on a single hit though, is not always a sound strategy, because there is no blueprint for engineering a runaway success.

This is why TinyBuild’s game production strategy takes a “portfolio approach”…

“The larger our portfolio grows, the more resilience and predictability is built into our forecasts and operations” said Alex Nichiporchik, TinyBuild’s charismatic co-founder and CEO.

Alex has seen the gaming industry from every angle, he started as a pro-gamer, before becoming a gaming journalist, games producer and finally a marketing exec before founding TinyBuild in 2013.

“Overperforming titles make up for those falling short of the estimations, and on aggregate we are able to predict quite accurately our yearly revenues while still leaving the door open to the eventual runaway hit, the ultimate aim of every game project in production at the Group’s studios”.

This portfolio approach has created a diversified back catalogue of more than 80 games, of which 77% are self-owned IP, and TinyBuild’s top three games account for less than 40% of total revenue.

The back catalogue, which includes the popular franchise Hello Neighbour and cult hits such as Not For Broadcast and Potion Craft, represented 80% of revenue last year, which suggests the assets have a long shelf life.

Looking ahead, TinyBuild’s pipeline for 2023 and beyond is strong and includes a number of larger budget games.

Last year TinyBuild invested some $36m across more than 20 game developments, with no game accounting for more than 15% of total spend – giving its development pipeline a low level of concentration risk.

“In 2023 we will be seeing plenty of groundbreaking AAA titles, alongside standout AA/indie games that really set new trends” said Alex Nichiporchik.

“Our goal is to make sure we deliver high quality games on as many platforms as possible, and pave the way for them to become franchises. I can’t wait until we start revealing our upcoming products in 2023 and beyond” he added.

Multi-bagger potential at a bargain basement price

TinyBuild IPO’d at the peak of the gaming boom in March 2021, and after an initial pop the shares have experienced a significant drop.

Those of you who follow our research will know that we don’t make a habit of trying to ‘catch falling knifes’, but TinyBuild’s quality financials and solid preliminary results make them a worthy exception.

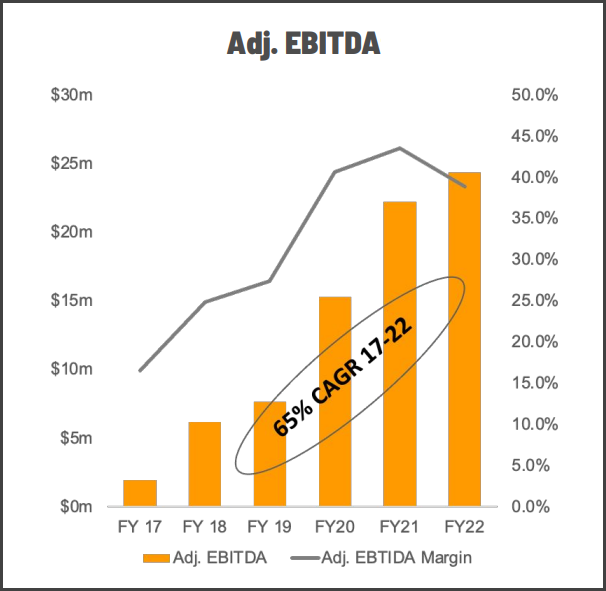

TinyBuild’s high level of self-owned IP mean that they pay less in licence fees, giving them strong operating margins north of 25% – larger than the majority of its peer group.

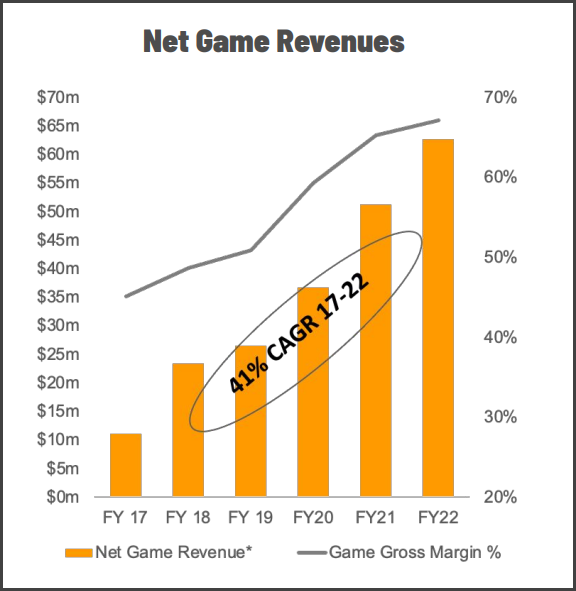

And with TinyBuild’s diversified portfolio strategy delivering consistent revenue growth at a compound annual rate (CAGR) of 41% over the last six years, adjusted earnings (EBITDA) have outpaced this growth over the same period.

TinyBuild also has a solid balance sheet, which has a net cash position of $26.5m, creating a buffer against negative free cashflow of -$10.6m (FY22) caused by the investment in new games.

The shares trade on a tiny forward price to earnings (PE) ratio of 5.9. This is significantly less than many of its peers and very reasonable given forecast earnings per share growth of 33.4% – putting TinyBuild on a price to earnings growth (PEG) ratio just 0.2 (where anything less than 1 is considered cheap).

Should TinyBuild deliver on their forecasts for 2023 and the short-term headwinds facing the gaming sector ease, the shares offer multi-bagger potential at a bargain basement price.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.