24th Apr 2025. 9.02am

Regency View:

BUY Time Finance (TIME)

Regency View:

BUY Time Finance (TIME)

Time Finance: Undervalued, under the radar

In a market where small cap lenders often struggle for airtime, it’s easy to miss the quiet compounders — the ones with rising profits, solid underwriting, and a habit of doing the basics very well.

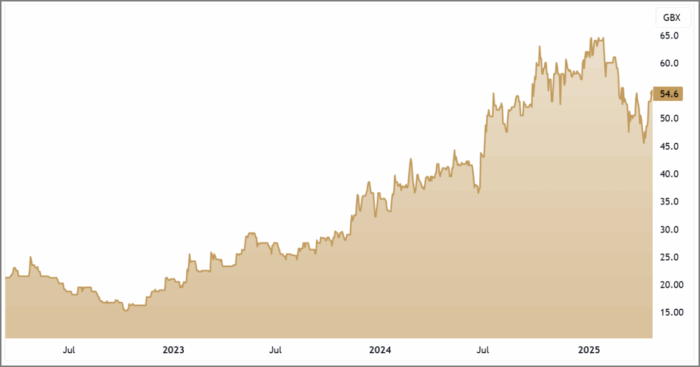

Time Finance (TIME) has spent the last couple of years strengthening its balance sheet, growing its loan book, and building a reputation as a reliable funding partner for UK SMEs. And now, with the numbers improving and the share price bouncing back in a weak market, we believe the time is right to take a closer look.

Time Finance’s latest trading update paints a picture of disciplined growth, operational momentum, and undervaluation — a rare combination in the current climate. This isn’t a speculative turnaround or a blue-sky story. It’s a profitable lender with a growing book and a valuation that still looks modest, even after a strong run in recent weeks.

Making money flow for UK SMEs

Time Finance provides tailored funding solutions to more than 10,000 UK businesses, with a focus on small and medium-sized enterprises that often sit below the radar of larger financial institutions. Their core lending activities span asset finance, invoice finance, and commercial loans — all geared toward helping businesses invest in equipment, manage cash flow, or seize growth opportunities.

The company’s model is relatively straightforward: it originates loans, earns interest and fees, and manages credit risk through a well-diversified loan book. With over £200 million currently deployed — up 18% year-on-year — and exposure spread across multiple sectors, Time is insulated from over-concentration in any single industry. This broad base, coupled with a management team boasting over 150 years of combined lending experience, has helped the company steadily scale while keeping a lid on risk.

Growth engine kicking into gear

The numbers are starting to tell a very consistent story. In its trading update for the nine-month period ended 28 February 2025, Time reported a 17% increase in revenue to £18.2 million for the first half, with pre-tax profits for the full year expected to come in at £5.9 million — up 40% from £4.2 million the year before. EPS is up 33.4% over the past twelve months, and the company has delivered compound EPS growth of over 27% per year across the last three years.

Crucially, this isn’t being driven by a stretch for yield or riskier borrowers. The group’s operating margin now sits at a healthy 20.6%, and gearing remains low. Time’s Piotroski F-Score — a quick health check used by value investors to screen for quality — has improved to 7 out of 9, reflecting rising profitability, improving return on assets, and strong operating cash flow.

What’s also encouraging is that the growth appears self-funded. Net debt has continued to fall, and with positive free cash flow once again on the table, the business is beginning to generate the kind of surplus capital that offers flexibility — whether that’s reinvestment, bolt-on acquisitions, or eventually, the return of a dividend.

Valuation: One of the cheaper lenders on the market

Even after a 12% rise in the share price over the last month, Time Finance still looks cheap. The shares trade on a forward P/E of just 8.2, well below what you’d typically expect for a lender growing earnings at this clip. The PEG ratio sits at 0.9, suggesting the valuation still doesn’t reflect the pace of growth.

Meanwhile, the company’s price-to-book ratio is just 0.74x, despite its improving returns and stable book quality. For context, banks and non-bank lenders with similar loan books and risk controls often trade at or above book value. Add in an EV/EBITDA of 6.2x, and you’re looking at a business generating strong cash profits but still being priced like a cyclical or distressed play. It’s not.

It’s worth noting that there’s no dividend on offer right now. But that may not be the case forever. With profitability rising and the balance sheet in better shape, the conversation may soon shift from survival to capital return. And in a market increasingly drawn to income and capital efficiency, that pivot could catch attention.

Time Finance won’t grab headlines like AI chipmakers or oil majors, but it doesn’t need to. What it offers is quieter, but no less compelling: double-digit earnings growth, solid underwriting, and a valuation that still looks stuck in the past. We believe Time is a compelling choice for those looking for a high quality growth story.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.