21st Nov 2024. 8.54am

Regency View:

BUY The Property Franchise Group (TPFG)

Regency View:

BUY The Property Franchise Group (TPFG)

Scaling new heights: TPFG’s transformative growth

The Property Franchise Group (TPFG) is no longer just another name in property franchising…

With the Hunters merger in 2021 and this year’s acquisitions of Belvoir Group and GPEA, including their flagship brands, The Guild of Property Professionals and Fine & Country, TPFG has transformed into one of the UK’s most dominant multi-brand property players.

These moves have created a property powerhouse with a combined network of 1,946 outlets and an increasingly international footprint, positioning the company to capitalize on the evolving property market.

Business model & strategic strength

TPFG’s business model thrives on simplicity and scalability. The company operates through a franchise model, providing branding, compliance, and marketing services to independent operators, while collecting recurring management fees and licensing revenue. This model ensures low capital requirements and high operating margins.

The numbers tell the story. By integrating the Hunters, Belvoir, and GPEA networks, TPFG has unlocked significant economies of scale. Hunters brought a robust high-street presence, while Belvoir added a financial services arm that processed nearly £11 billion in mortgage lending in 2023. The GPEA acquisition delivered an additional £13.2 million in revenue, of which 73% comes from recurring income streams like memberships and licenses.

What’s particularly exciting is the addition of Fine & Country’s international reach, with 65 offices outside the UK, spanning Europe, Africa, Asia, and Australia. This diversification extends TPFG’s addressable market and provides exposure to more resilient segments of the global property sector.

Growth drivers: Expanding horizons

TPFG’s growth drivers are firing on all cylinders. The Belvoir acquisition alone is expected to boost group revenue by £40 million annually, and when combined with GPEA, it contributes an adjusted EBITDA uplift of £7.2 million. These aren’t just pie-in-the-sky projections; they’re underpinned by hard data, including audited pro forma financials.

Meanwhile, the UK mortgage market is showing signs of stabilisation after last year’s turbulence. Mortgage approvals rose by 11% in Q3 2024 compared to Q2, and rental demand remains robust, with average rents increasing by 8.2% year-over-year. These macro tailwinds complement TPFG’s expanded service offerings, allowing the group to capture growth across multiple segments.

Recurring revenue is another standout driver. With 73% of GPEA’s income and 65% of TPFG’s overall revenue coming from repeatable sources, the business is insulated from market volatility.

Financial resilience: Robust interim results

The first half of 2024 demonstrated TPFG’s ability to execute its ambitious strategy. Combined pro forma revenue for 2023 reached £74.7 million, supported by the contributions of Belvoir and GPEA. Adjusted EBITDA came in at £26.9 million, representing a healthy margin of 36%, and pro forma pre-tax profits were £21.4 million.

Even with the £15 million initial cash payment for GPEA, TPFG has kept its balance sheet strong. Net debt post-acquisition remains below one times adjusted EBITDA—a level that provides ample flexibility for further growth investments. These figures highlight a company that is not just growing but doing so in a disciplined, sustainable manner.

Shares from new swing low at value zone

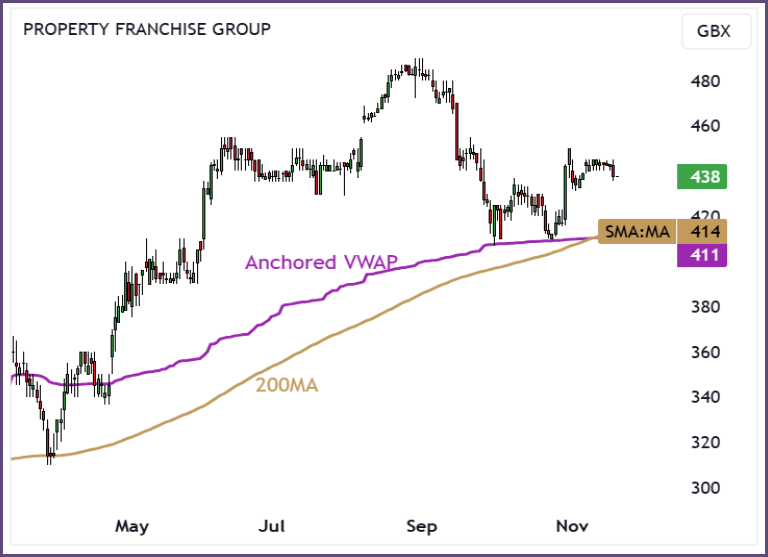

The technical setup for TPFG’s shares reinforces its fundamental story. For over a year, the stock has traded comfortably above its 200-day moving average, signalling sustained investor confidence.

Recent price action saw the shares pull back to a value zone defined by the confluence of the 200-day moving average and the Volume Weighted Average Price (VWAP) anchored to January’s lows. This area, which reflects the average institutional buying price for the year, has acted as a springboard.

A new swing low has formed, and the stock is once again moving higher, suggesting the long-term trend has resumed. We believe this offers a quality entry point for snapping up a first tranche of this stock.

Valuation: Paying for quality

TPFG’s shares currently trade at a forward P/E of 17x, a modest premium to the sector average of 14x. While some might hesitate at paying above-average multiples, the underlying fundamentals more than justify this valuation. TPFG offers a combination of stability and growth, driven by its high levels of recurring revenue, expanding international presence, and the synergies unlocked by its acquisitions.

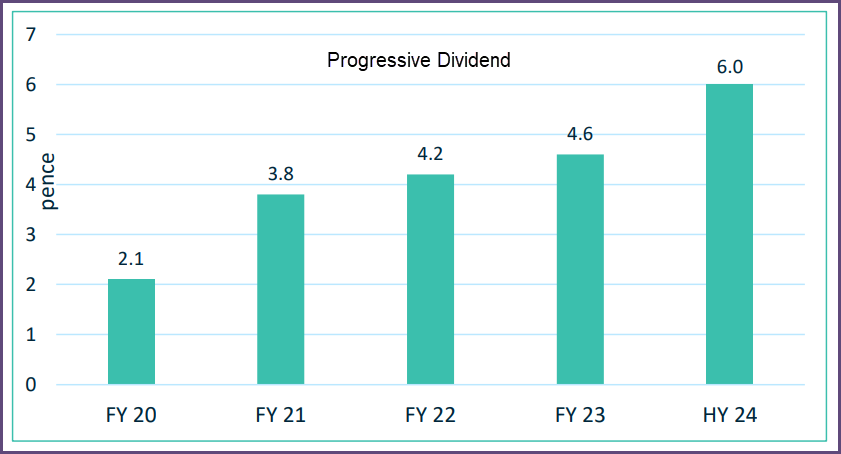

One standout aspect of TPFG’s value proposition is its progressive dividend policy. Since the IPO, the Board has consistently increased dividend payouts, reflecting the company’s strong cash generation and shareholder focus. This commitment was evident in the H1 2024 interim dividend, which rose 30% to 6.0p per share. The payout underscores management’s confidence in TPFG’s financial health and its ability to balance growth investments with returning capital to shareholders.

Moreover, the recent acquisitions are expected to further enhance free cash flow, providing additional capacity for dividend growth. With TPFG’s pro forma adjusted EBITDA forecasted at £26.9 million for 2024 and leverage remaining below one times EBITDA, the company is in an enviable position to reward shareholders while maintaining financial flexibility.

In addition to its attractive dividend, the £20 million paid for GPEA—a mere 5.7x its 2023 EBITDA—highlights the accretive nature of TPFG’s acquisition strategy. This disciplined approach ensures that shareholders benefit from value creation at every level, whether through organic growth, accretive deals, or consistent dividend increases.

For investors seeking a well-rounded portfolio addition, TPFG combines growth potential, steady income, and strategic execution—making it a name to watch in the property sector.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.