11th Apr 2024. 8.56am

Regency View:

BUY Synectics (SNX)

Regency View:

BUY Synectics (SNX)

Big Brother is watching you: Synectics’ AI-powered surveillance

In today’s digital age, the concept of “Big Brother” watching over us has taken on new dimensions with the advent of advanced surveillance technologies.

Synectics (SNX) a leading provider of security and surveillance solutions, is at the forefront of this evolution, harnessing the power of artificial intelligence (AI) to enhance its surveillance capabilities.

AI integration in surveillance solutions

Synectics has seamlessly integrated AI capabilities into its surveillance solutions, transforming traditional security systems into intelligent and proactive guardians.

Through its flagship Synergy software platform, Synectics leverages AI algorithms for various tasks, including video analytics, pattern recognition, and anomaly detection. This integration enables Synergy to provide more intelligent and efficient surveillance capabilities to its customers, ensuring enhanced security and situational awareness.

- Enhanced video forensic search:

One of the standout features of Synectics’ AI-powered surveillance is its embedded video forensic search capabilities within the Synergy platform.

This cutting-edge feature empowers users to swiftly and accurately search through vast amounts of video footage to pinpoint specific events or incidents.

By leveraging AI algorithms for video analysis, Synectics streamlines the process of reviewing and extracting relevant information from surveillance footage, significantly improving operational efficiency and incident response times.

- Integration with third-party AI tools:

In addition to its native AI capabilities, Synectics offers seamless integration with third-party AI tools within the Synergy platform.

This flexibility allows customers to leverage specialised AI algorithms and analytics solutions tailored to their unique security needs.

By collaborating with best-of-breed AI technologies, Synectics ensures that its customers have access to cutting-edge capabilities for security and surveillance applications, further bolstering their defences against evolving threats.

- AI-enabled cameras:

Synectics is also pioneering the integration of AI capabilities directly into its camera hardware, ushering in a new era of intelligent surveillance.

Through features such as edge AI processing, Synectics’ cameras can perform advanced analytics and decision-making locally, without relying on centralized servers. This enables the cameras to adapt to dynamic environments and changing conditions in real-time, providing more responsive and effective surveillance solutions.

Small stock, strong financials

Despite its tiny market cap, Synectics stands tall with its robust financials…

In 2023, Synectics reported total revenue of £49.1 million, marking an impressive increase of £10 million or 25.6% compared to the previous year. This surge in revenue was driven by growth across both its Systems and Security divisions. Systems revenue soared to £32 million, representing a substantial increase of 32.3% from 2022, while Security revenue surged to £18.3 million, reflecting a solid 10% gain.

Synectics’ financial prowess extends beyond top-line growth, as evidenced by its prudent management of intra-group sales. Despite a decrease in intra-group sales of £532,000 compared to the previous year, the company’s strategic focus on optimising internal operations and maximizing revenue from external sources has further fortified its financial position. This is reflected in its impressive operating margin, which averaged 10% over the past three years.

Synectics’ strong financial performance is underpinned by its diversified revenue stream, which include upfront sales of security solutions, recurring service contracts, and software licensing fees. This diversified income mix not only enhances revenue stability but also mitigates risk, providing a resilient foundation for long-term growth.

With a strong balance sheet of £4.6 million in cash reserves and negligible debt, Synectics possesses the financial flexibility to pursue strategic investments, explore new market opportunities, and weather unforeseen challenges with confidence.

Momentum and value

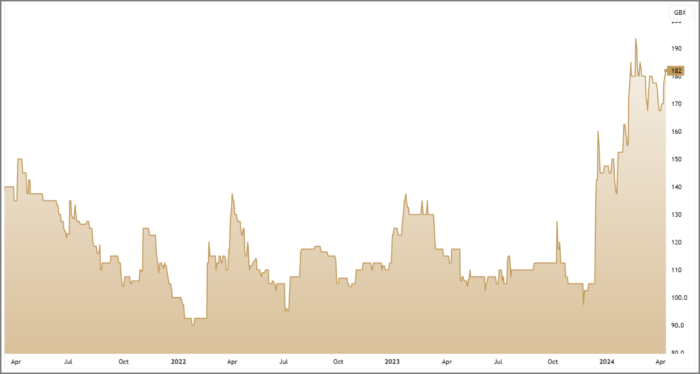

On the price chart, Synectics’ share price has been trending higher since the release of its strong FY23 trading update in December.

This uptrend has seen the shares carve out a bullish series of higher swing lows and stay above its upward sloping 50 day moving average.

In terms of valuation, Synectics looks cheap. Earnings are forecast to grow by 23.7% and the company pays a well-covered dividend yielding 2.9%. In contrast, the stock trades on a forward PE multiple of just 9.3 and a Price to Book Value of 0.82.

With a solid foundation built on profitable growth, diversified revenue streams, and efficient capital allocation, we believe Synectics is well-positioned to create long-term value for shareholders.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.