29th Aug 2024. 9.04am

Regency View:

BUY Synectics (SNX) Second Tranche

Regency View:

BUY Synectics (SNX) Second Tranche

Watching profits rise: Time for a second look

Back in April, we published a buy report on an exciting surveillance company that was leveraging cutting-edge technology to revolutionize the security industry—Synectics (SNX).

This micro-cap stock stood out for its innovative approach to security and surveillance, offering state-of-the-art solutions tailored to a variety of sectors. Our initial recommendation was driven by Synectics’ strong market position, impressive product offerings, and appealing valuation.

As we revisit the stock, it is clear that Synectics has not only met but exceeded expectations, making it an even more compelling investment opportunity today.

A recap of our initial buy

When we first highlighted Synectics, the company was making headlines for its advanced Synergy software platform. This platform, known for its integration capabilities and user-friendly design, was seen as a significant differentiator in a competitive market.

Synectics’ ability to deliver comprehensive security solutions across diverse sectors—from gaming and public safety to oil and gas—was a key factor in our positive outlook. The company’s focus on technological innovation and its strategic investments in AI and analytics positioned itself as a potential takeover target.

Updates and achievements since April

Since our initial buy recommendation, Synectics has continued to make substantial strides. A highlight of recent developments is the company’s success in securing a $10 million contract to enhance and expand its Synergy system at a prominent gaming resort in South-East Asia. This contract is a testament to Synectics’ growing global presence and its ability to manage large-scale, high-profile projects. Such achievements not only validate the company’s technological prowess but also reflect its expanding market footprint.

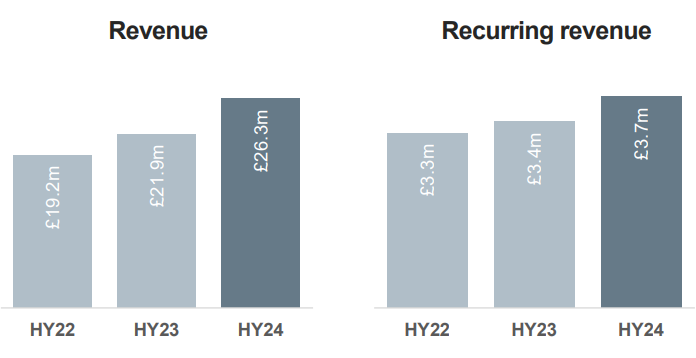

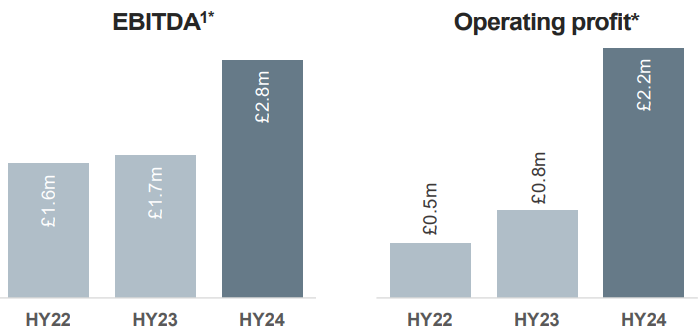

The company’s half-year report for the period ending 31st May 2024 further underscores its impressive performance. Synectics reported a notable increase in revenue to £26.3 million, up from £21.9 million in the same period last year. Additionally, operating profit increased to £2.2 million compared to £0.8 million previously, highlighting Synectics’ effective cost management and enhanced operational efficiency.

Looking ahead, Synectics remains well-positioned for continued growth. The company’s strong order intake and positive sales momentum reflect a solid pipeline of opportunities. The recent appointment of key board members, including the highly experienced Bob Holt OBE as Non-Executive Chair, adds further strength to the leadership team. The Board’s optimism about the company’s prospects and its commitment to investing in technology and expanding into adjacent markets provide a solid foundation for future success. Synectics’ strong cash position and strategic focus on innovation are expected to drive sustained growth and enhance shareholder value in the coming quarters.

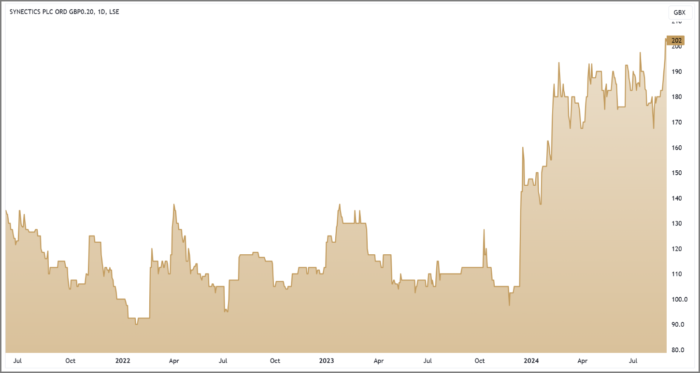

Consolidation phase coming to an end

On the price chart, Synectics’ uptrend looks set to resume. After a strong surge higher at the beginning of the year, which saw the 50-day moving average move above the long-term 200-day moving average, the share price entered a phase of consolidation. This period of sideways movement allowed the stock to stabilise and consolidate its gains.

This consolidation phase has provided a solid base of consensus from which to mount another trending move higher. Recently, the shares have started to break out from this established range, indicating that the period of consolidation may be coming to an end. The renewed upward momentum suggests that Synectics is poised to resume its uptrend, creating a technical catalyst for snapping up a second tranche of the shares.

Valuation: Still attractive

Despite Synectics’ share price recently breaking to new trend highs, the shares remain attractively priced…

A forward price-to-earnings (PE) ratio of 9.2 looks cheap relative to sector peers and relative to forecasted growth in earnings per share (EPS) of 35.2%, suggesting the stock is trading at a discount relative to its earnings potential. This low PE ratio relative to EPS growth signals that the market may not fully recognise the company’s potential.

The price-to-book (P/B) ratio stands at 0.91, indicating the stock is priced below its book value. Similarly, the price-to-free cash flow (P/FCF) ratio of 9.3 underscores that the stock is inexpensive compared to the cash flow it generates, adding to its attractiveness.

Overall, while Synectics’ small market cap of £36 million does bring some degree of volatility and elevated risk, we believe the company’s strong fundamentals, consistent revenue growth, and ability to secure high-profile contracts significantly outweigh these risks. The potential for substantial growth, coupled with the stock’s current undervaluation, makes Synectics a compelling option for investors looking for a micro-gap with big potential.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.