27th Mar 2025. 9.01am

Regency View:

BUY Sylvania Platinum (SLP) – Second Tranche

Regency View:

BUY Sylvania Platinum (SLP) – Second Tranche

Sylvania Platinum: A deep value play with rebound in sight

Sylvania Platinum (SLP) has been through the wringer over the past two years, with its share price taking a hit amid softer platinum group metals (PGM) prices and a sharp drop in earnings.

Investors have understandably been cautious, given the sector’s struggles, but Sylvania’s latest half-year results suggest that the worst may be behind it. With earnings showing signs of stabilisation, a fortress-like balance sheet, and an undemanding valuation, the risk-reward equation is becoming more compelling.

For contrarian investors looking for a solid small-cap miner with the financial strength to weather commodity cycles, Sylvania could be worth a closer look.

Cash-rich, low valuation—but can earnings recover?

SLP has seen both ends of the spectrum when it comes to earnings cycles. Revenues peaked in 2021 at over $200 million during the PGM boom, allowing the company to accumulate a substantial cash reserve. However, as with any resource company, the good times didn’t last forever. Falling metal prices put pressure on margins, and Sylvania’s earnings declined sharply over the past two years.

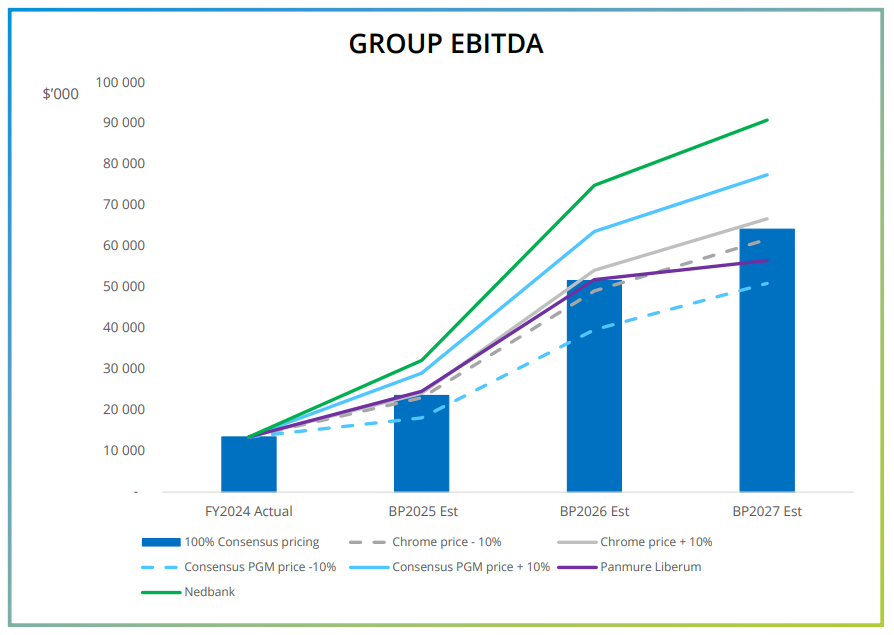

Despite this, the latest half-year results suggest a potential turnaround. Revenues climbed 17% year-on-year to $47.6 million, while earnings per share (EPS) jumped 133%—a sign that operational efficiency and cost control measures are paying off. It’s still early days, but this kind of improvement is not something the market can ignore.

Yet, despite this earnings rebound, Sylvania remains priced as if no recovery is coming. With a forecast price-to-earnings (P/E) ratio of just 10.2, the stock trades at a discount to both its historical average and peers in the sector. The price-to-earnings growth (PEG) ratio of 0.3 is particularly interesting—it suggests that the market is underestimating the company’s ability to generate higher profits if PGM prices hold steady or improve.

While earnings remain dependent on commodity pricing, the company’s lean operating model and efficient tailings recovery process provide some insulation against downturns. If the current momentum continues, SLP’s earnings multiple could quickly look too low.

Fortress balance sheet and strong cash generation

One of the biggest advantages Sylvania Platinum holds over many of its mining peers is its rock-solid financial position. The company has zero debt, a net cash balance of $97.8 million, and a current ratio of 7.88—an incredibly strong liquidity position for a small-cap miner.

This level of financial security means Sylvania isn’t under pressure to issue new equity or take on debt, even during weaker market conditions. Unlike many of its competitors that rely on financing to fund operations, Sylvania’s self-sufficiency is a major asset, particularly in an inflationary environment where borrowing costs have risen.

Operating cash flow per share remains positive, reinforcing the company’s ability to fund its own operations without external support. However, free cash flow per share turned negative in the latest period due to increased capital expenditure. This isn’t necessarily a red flag—rather, it suggests Sylvania is reinvesting in its processing infrastructure to maintain efficiency and long-term production stability. Given the company’s strong cash reserves, this investment should be seen as a strategic move rather than a sign of financial weakness.

Ultimately, balance sheet strength is one of Sylvania’s most underappreciated qualities. It provides a level of resilience that many small-cap miners simply don’t have, reducing downside risk for investors.

Dividend stability and potential upside

One of the main attractions of Sylvania Platinum—beyond its valuation and cash reserves—is its dividend. The company currently offers a forecast dividend yield of 3.85%, which is nearly twice covered by earnings. This level of coverage indicates that the dividend is sustainable even if PGM prices remain subdued.

That said, it’s important to acknowledge that dividend payouts have been on a downward trend. After reaching a high of 8p per share in 2022, the dividend was cut by 75% in 2024 as earnings contracted. This is a natural response for a cyclical business, but it also means income-focused investors should be realistic about the level of yield they can expect going forward.

If earnings growth continues, there’s a chance Sylvania could gradually rebuild its dividend. With a substantial cash buffer and limited financial obligations, the company has flexibility in how it returns capital to shareholders. For those willing to be patient, the current valuation offers the potential for both capital appreciation and future dividend growth.

A contrarian bet on PGM markets?

Platinum and palladium prices have been under pressure for some time, with demand concerns weighing on sentiment. However, the supply side of the equation could start to shift the balance. South African production issues, power constraints, and potential supply deficits may lead to a tightening market, creating a more supportive environment for prices.

Sylvania’s recent share price performance suggests that investors may already be warming up to this idea. Over the past month, the stock is up 11.9%, extending its three-month gain to 23.1%. However, it still trades 27% below its 52-week high, leaving room for further upside if market sentiment improves.

From a technical perspective, the stock has reclaimed both its 50-day and 200-day moving averages—a key signal of shifting momentum. If this trend continues, traders will be watching for the next resistance levels to see whether Sylvania can sustain its recovery.

Of course, there are risks. The PGM market remains highly volatile, and if prices were to fall further, it would limit Sylvania’s ability to build on its recent earnings recovery. However, given its strong financial footing, the company is better positioned than most to ride out any near-term turbulence.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.