Regency View:

BUY Sylvania Platinum (SLP)

Sylvania Platinum looks too cheap to ignore

High quality, small cap mining stocks are rarer than the minerals they seek to mine…

Many AIM-listed miners are all story, no substance, and lack the type of quality financials that make for a worthwhile long-term investment. Sylvania Platinum (SLP) is different…

Sylvania is a low-cost, cash-rich producer of platinum group metals (PGM’s) – platinum, palladium and rhodium. The shares trade on a single-digit earnings multiple whilst offering attractive levels of growth and income.

We’ve followed the stock closely in recent years, adding them to our portfolio in March 2019, taking a substantial profit a year later. And after a prolonged pullback from last year’s highs, the timing looks right re-enter this high-quality mining stock.

A portfolio of attractive cash generating operations

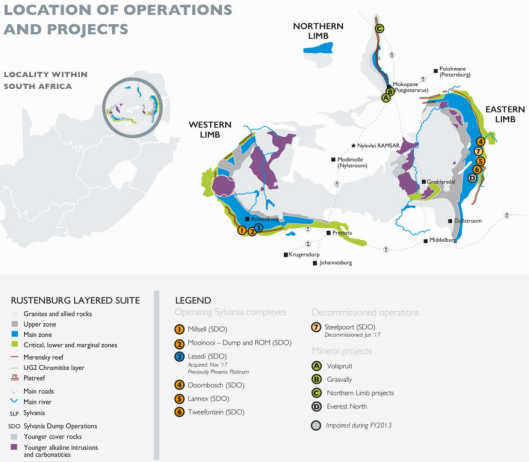

Operating out of South Africa’s Umpopo and North West provinces, Sylvania has a portfolio of attractive cash generating operations as well as several exploration assets that offer future growth potential.

In its production base, Sylvania has two distinct lines of business:

- The re-treatment of PGM-rich chrome tailings material from mines in the region.

- The development of shallow mining operations and processing methods for low-cost PGM extraction.

Its Sylvania Dump Operations (SDO) are six active PGM recovery plants that treat chrome tailings from surrounding chrome mines across the western and eastern limbs of the Bushveld Igneous Complex – which contains the world’s largest reserves of PGM’s.

The Mining Projects include three ‘hot spot’ PGM exploration targets, located in close proximity to one another in the Northern Limb.

Sylvania’s operations generate plenty of cash…

In 2021, Sylvania generated revenues of $206m, delivering operating profits of $142m and operating cashflow of $24.6m of which 90% flows through into free cashlow.

This has created a debt-free balance sheet with net cash of $106m (FY21) which will be used to fund exploration projects and acquisitions.

Long-term drivers for pollution-battling PGM’s remain

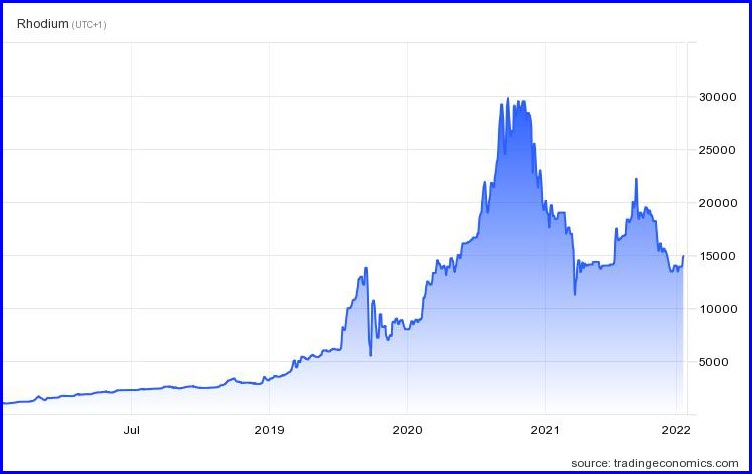

Sylvania is unique relative to its PGM producing peers because its Rhodium recovery rate is higher than average.

Rhodium has been in high demand in recent years due to it being the most effective PGM at reducing nitrogen oxides (NOx) emissions when used in vehicle exhaust systems (catalytic converters).

The great Rhodium bull run of 2019-2020 (see chart right) has cooled due to the global supply crisis which hit car production following a shortage of computer chips.

However, there are signs that the auto supply crisis may be starting to bottom out. Volkswagen, for example, said in late June it expected chip shortages to ease in the second half of the year.

And given PGM’s key role in reducing near term emissions in diesel and petrol cars, as well as platinum being a key component of the electrodes of fuel cell engines, we expect demand for pollution-battling PGM’s to remain robust over the next five years.

Sylvania bounce from key support

Stocks in long-term uptrends, will from time to time, go through prolonged periods of consolidation…

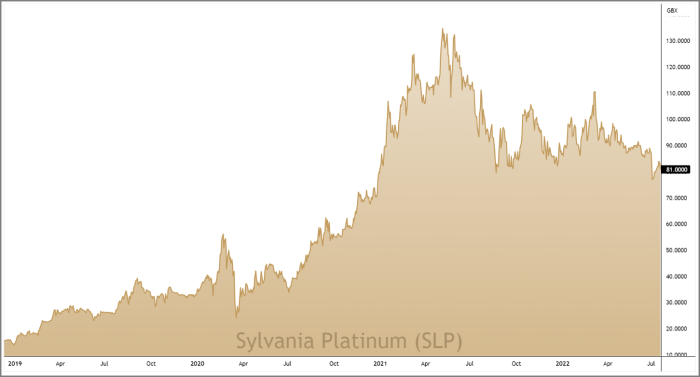

Having surged to highs of 141p in May 2021, Sylvania’s share price has gone through a choppy and drawn own consolidation phase – broadly mirroring the pullback in the price of rhodium.

We’ve kept a close eye on this consolidation phase, because when a high-quality stock in a long-term uptrend undergoes a deep pullback, it often represents attractive levels of risk / reward.

Sylvania’s recent price action has seen the shares retest the lows reached in August last year at 77p – a level which represents key technical support.

Buyers have clearly stepped in to defend 77p, and this indicates that support should hold firm – creating an opportune moment to buy the shares at attractive levels of risk / reward.

Rock-bottom valuation

The pullback in Sylvania’s share price has also made the stocks forward valuation look highly attractive…

Sylvania currently trade on a forward Price to Earnings (PE) multiple of just 3.0, one of the most attractive in the Metals & Mining sector, and one of the most attractive in the entire UK stock market.

The forward PE compares very favourably to forecast earnings per share (EPS) growth of 45.9% – giving the stock a Price to Earnings Growth (PEG) ratio of just 0.1 (where anything less than one is considered good).

Sylvania also score well across a number of other value metrics…

Price to Free Cashflow is just 3.6, and enterprise value to adjusted earnings (EV to EBITDA) is 1.27 – one of the best in the Metals & Mining sector.

This rock-bottom valuation helps to more than offset the potential for weak economic conditions threaten industrial demand in the near term.

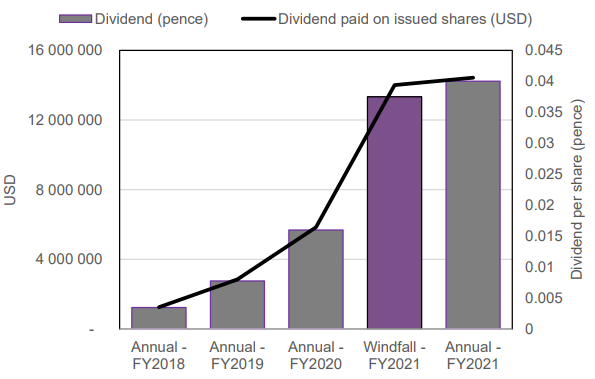

And Sylvania also pay a market-beating dividend…

The shares currently trade on a forward dividend yield of 5.98% (including windfall dividend) making Sylvania one of the top income stocks in the market. This dividend is very well covered by earnings – dividend cover is 3.5 on a trailing twelve-month basis (TTM), meaning the security around the payout is high.

Given Sylvania’s recent pullback, improving fundamentals and market-beating dividend, we believe the time is right to add Sylvania to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.