Regency View:

BUY Surface Transforms (SCE)

Surface Transforms ready to ramp up production as growth accelerates

When we buy a luxury item, we tend not to skimp on the accessories…

Especially when others can see if we’ve skimped on the accessories!

You wouldn’t fork out for a Savile Row suit only to wear it with a Primark tie, would you?

This principle applies to the world of fast cars and carbon-ceramic brakes…

When you’ve spent a small fortune on the latest Mercedes-AMG, you want people to see those brightly coloured flashes under your pristine alloys…

More importantly, you do not want the performance of your sporty new runaround to be negatively impacted by heavy cast iron brakes.

This superior performance, combined with distinctive aesthetics have made carbon-ceramic brakes a non-negotiable for all luxury car manufacturers.

And for over two decades, the carbon-ceramic brake market has been dominated by one monopolist player, but with a superior product and a series of ‘transformational’ contracts in place, a small British company, is set to provide some much-needed competition…

Surface Transforms (SCE) expect revenue increase ten-fold in the next two years.

The Merseyside manufacturer of carbon-ceramic brakes has spent the last 15 years refining their product to make it ‘best in class’. And now, with the backing of several multi-year contracts, SCE is about to transition into higher volume production and profitability in the next few months.

Superior technology

“We make plywood, and our competitor makes chipboard” proclaimed CEO, Dr Kevin Johnson in a recent investor presentation as he attempted to explain why his technology is superior…

“They both have their place, but they give you different properties” he added.

SCE has developed patented ‘next-generation’ Carbon-Ceramic Technology that transforms Carbon-Carbon into Carbon-Silicon Carbide (CSiC) ceramic.

The carbon-ceramic discs you find on production road cars conventionally use discontinuous (chopped) carbon fibre.

Instead, SCE interweaves continuous carbon fibre to form a ‘3D multi-directional matrix’, producing a stronger and more durable product with 3x the heat conductivity of standard production components.

The superior heat conductivity keeps the brake system temperature down and the brake performance consistent.

It’s incredibly light weight which increases fuel efficiency and the range of electric cars, and it is incredibly durable, lasting the lifetime of the car and generating minimal brake dust, which keeps your alloy wheels looking prettier for longer and is better for the environment.

And whilst carbon-ceramic brakes are a significant step up in price relative to iron brakes, SCE have worked hard to refine their production process to enable the price of their product to be ‘competitive’ relative to their monopolistic competitor Brembo while still generating margins north of 60%.

‘Transformational’ contracts

Having spent the last five years securing an independent and robust supply chain, SCE have ‘come of age’ within the last year, signing multiple multi-year contracts.

SCE’s total revenue for FY 2020 stood at £1.95m, by 2022 revenue is expected to be £12.9m, going to £50m by 2025…

The £50m projection is based on their prospective contract pipeline, the vast majority of which is with existing customers.

SCE currently have £20m/yr installed production capacity, and the capacity has been built as a ‘cellular’ plant which is expandable as more contracts are won at a ‘cell cost’ of approx. £1.8m.

Max capacity for their Merseyside plant stands at an estimated £100m/yr, and SCE project the total addressable market for Carbon-Ceramic brakes will hit £2bn over the next decade as more mid-tier luxury cars adopt the superior technology.

SCE’s management are clearly confident that they will hit their revenue growth targets…

In November, SCE granted options over 1,810,105 new ordinary shares of 1 pence each and will be exercisable subject to the following criteria being met:

- Achieving a minimum of £20m of sales in a rolling twelve-month period.

- Achieving a minimum of £5m profit before tax in a rolling twelve-month period.

- Installing capacity capable of achieving annual sales of at least £60m.

Buying the dip

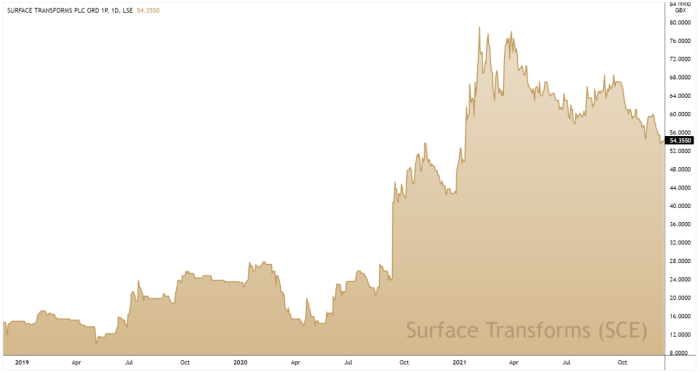

After hitting highs of 81p in early spring, SCE’s share price has been in ‘consolidation mode’ – forming a long-term bullish wedge pattern.

Prices have drifted back towards multiple levels of long-term support on only positive newsflow and trading updates.

There is now more that 50% headroom to the 81p highs and we believe the technical timing looks attractive.

And whilst we don’t make a habit of buying loss-making companies, SCE’s financials are robust…

They have a debt-free balance sheet with £17.2m cash in the bank on a trailing twelve-month basis (TTM) – making their current ‘cash-burn’ rate of £2.1m (TTM) relatively insignificant given their revenue projections over the next five years.

And as SCE transition into higher volume production, profitability will follow, making SCE an exciting addition to our AIM Investor portfolio.