13th Jul 2023. 8.57am

Regency View:

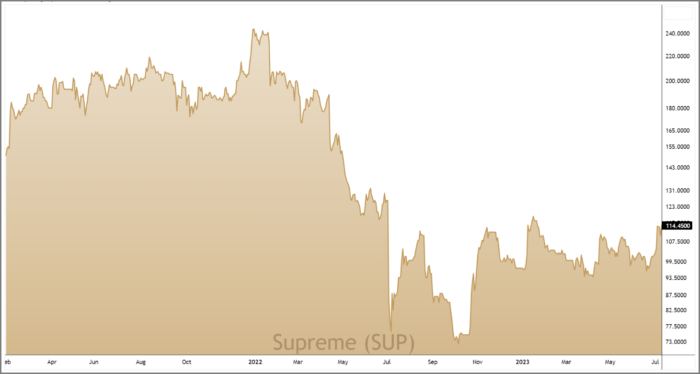

BUY Supreme (SUP)

Regency View:

BUY Supreme (SUP)

Supreme: Fuelling growth through vaping dominance

As household budgets face the challenges of higher interest rates and the cost-of-living crisis, UK consumers are increasingly turning to reliable and value-conscious brands.

Among these brands, Supreme (SUP) has emerged as a prominent player in the fast-moving consumer products industry.

Supreme offers a diverse range of affordable everyday products in categories such as Vaping, Batteries, Lighting, and Sports & Nutrition. Their presence spans various distribution channels, including retail, wholesale, independent outlets, supermarkets, and the export sector.

By adopting a diversified approach, Supreme effectively taps into complementary markets with high-repeat purchase potential, resulting in a steady revenue stream.

Growth propelled by vaping

Vaping has become a driving force behind Supreme’s impressive growth story. Supreme’s headline revenue jumped 19% to £152.3m for the year ending March 2023, but this growth rate was comfortably eclipsed by vaping which saw revenues double to £76.1m.

Supreme’s dominance in the vaping industry has propelled its success to new heights. With a staggering production capacity of over 5.2m bottles of e-liquid per month, Supreme has firmly established itself as a key player in the market.

One of the reasons behind Supreme’s success in the vaping sector is its popular £1 88vape e-liquid range. This affordable option has resonated with consumers, making it a go-to choice for many vapers. Additionally, Supreme has also recognised the demand for premium vaping products and introduced the KiK range, which has garnered a reputation for its high quality.

Supreme’s recent announcement of a significant distribution agreement further solidifies its position in the market. The company has secured a master distributor contract with iMiracle Technologies, a leading Chinese manufacturer, to distribute the popular ElfBar and Lost Mary disposable vapes.

These products will be supplied to major supermarket chains, including Tesco, Morrisons, One Stop, and WHSmith Travel. This partnership opens up new avenues for revenue growth and strengthens Supreme’s distribution network, providing access to a wide customer base.

The timing couldn’t be better for Supreme to capitalise on the vaping market’s growth. Shifting consumer preferences towards vaping, coupled with endorsements from UK public health bodies, have provided a strong tailwind for the industry. As more people turn to vaping as an alternative to traditional smoking, Supreme is well-positioned to meet the increasing demand.

By leveraging its manufacturing prowess, expanding retailer network, and keeping a pulse on evolving consumer preferences, Supreme is poised to continue its impressive growth trajectory in the vaping market.

Strong financial performance

Alongside its strong topline sales growth, Supreme’s financial stability and cash-generating capabilities further enhance its investment appeal.

In its recently announced Full Year 2023 numbers Supreme reported a 63% jump in operating cash flow to £19.3m. Furthermore, Supreme improved its net cash position, ending the year with adjusted net cash of £3.2m compared to net debt of £1.9m in the prior year.

This healthy financial position provides Supreme with the flexibility to pursue growth opportunities and deliver long-term shareholder value.

Looking ahead, CEO Sandy Chadha said Supreme has started the 2024 financial year on a solid note, with its “core business and recent acquisitions performing strongly”. Mr Chadha expects adjusted earnings (EBITDA) for the year ending March 2024 to be “ahead of latest expectations by at least £1m”.

Additionally, the distribution agreement with iMiracle Technologies is projected to generate an additional £25-30m in revenue and around £2m in incremental adjusted EBITDA for 2024.

This optimistic outlook positions Supreme for significant growth and highlights its ability to capitalise on market opportunities.

45% discount to Fair Value

Supreme has an impressive track record for generating profitable growth. Sales have grown at a Compound Annual Growth Rate (CAGR) of 28.1% over three years and Earnings Per Share (EPS) have grown at a similar rate of knots (19.65% 3yr CAGR).

The business has sustained double-digit operating margins over five years, indicating that Supreme has a strong position in the market. Furthermore, with a return on equity (ROE) of 30% based on the trailing twelve months to March 2023, the company’s management has proven its capability to convert investments into profitable returns.

In terms of valuation, Supreme is trading at a forecast price-to-earnings (PE) ratio of 8.9, which appears very reasonable when compared to its peer group. This is particularly attractive considering the forecast EPS growth of 33.7%. Investors can therefore acquire Supreme shares at a relatively low price in relation to the company’s anticipated earnings growth.

It is worth noting that Supreme pays a well-covered dividend, and the shares currently offer a forward yield of 3.87%. This dividend payout, coupled with the potential for capital appreciation, contributes to the potential for favourable long-term investor returns.

Moreover, based on discounted cash flow analysis, Supreme’s current share price trades at a significant discount of 45% to the estimated Fair Value per share of £2.16. This indicates that the market may have undervalued the company, presenting an opportunity for investors to benefit from future price appreciation.

Considering Supreme’s consistent profitable growth, strong financial metrics, attractive valuation ratios, and potential dividend income, it is evident that the company offers a compelling investment opportunity for individuals seeking long-term growth and returns.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.