7th Nov 2024. 8.57am

Regency View:

BUY Supreme (SUP) Second Tranche

Regency View:

BUY Supreme (SUP) Second Tranche

Budget boost for Supreme: Why the road ahead looks bright

When we first recommended Supreme (SUP) in the summer of 2023, the stock had already shown strong growth. Since then, it has delivered solid returns, rising more than 50%. As we move into the final quarter of the year, there are more reasons to be optimistic.

The recent UK Budget has removed a significant cloud of uncertainty hanging over the company, and with the government’s evolving health policy, we believe there’s even more upside potential in this high-quality market leader.

A market leader in consumer essentials

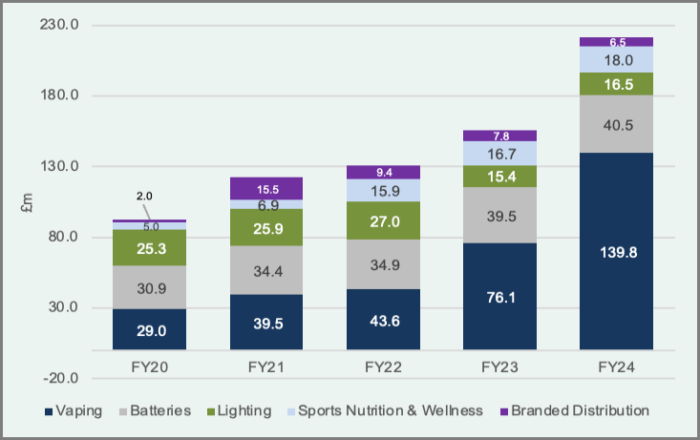

Supreme is a prominent player in the fast-moving consumer goods (FMCG) sector, manufacturing and distributing a diverse range of products across five categories: batteries, lighting, vaping, sports nutrition, and wellness. Their market position is strengthened by an established portfolio of both owned and third-party brands, which has helped build a robust, diversified revenue stream.

The company’s most recent trading update from September revealed a significant acceleration in momentum, with record organic revenue growth and strong profitability. Supreme is also free of debt, offering them the flexibility to execute their growth strategy effectively. The £100m non-vape annualised sales target demonstrates the business’s ability to successfully diversify, with the acquisition of Clearly Drinks enhancing their portfolio.

In addition, Supreme has consistently shown resilience in the face of market changes, whether through regulatory adjustments or shifting consumer preferences. Their continued ability to adapt to these changes has kept them ahead of the competition, and they remain well-positioned to capitalise on emerging trends in health and wellness, especially as the vaping market evolves.

UK budget a counter-intuitive net benefit for Supreme

The Chancellor’s recent announcements in the UK Budget have removed much of the uncertainty that previously clouded the vaping industry. While many had feared stricter regulations on vaping, the Budget’s provisions actually offer Supreme a considerable advantage.

The new vape tax, set to begin in 2026, has given the company ample time to adjust its business model in response to this change, without the immediate disruption that some other businesses may face.

What’s more, the Budget’s plans to raise tobacco prices in the coming years are expected to push more consumers towards alternatives like vaping. With Supreme already well-established in the vaping market, the company stands to benefit as the demand for their products grows.

While the government’s ongoing health policy to curb smoking may seem challenging, it actually strengthens Supreme’s position as a trusted brand in an expanding category, where they have a competitive edge.

Additionally, the government’s strategy to restrict vape branding and single-use vapes is likely to further consolidate Supreme’s standing. Many of the smaller or newer entrants to the market may struggle with these regulatory changes, while Supreme’s extensive experience and compliance infrastructure allow them to operate without significant disruption.

Strong financials and cheap valuation

Supreme’s financial profile is equally compelling. The company consistently demonstrates high return on equity, with a healthy operating margin of 14.5% and strong cash generation, evidenced by an increase in free cash flow to £17.5m in FY 2024. These figures highlight Supreme’s ability to deliver robust profits while managing costs effectively.

From a valuation standpoint, Supreme is trading at an attractive price. With a forward P/E ratio of just 8.9, the stock is significantly undervalued relative to its intrinsic worth. In fact, the shares are currently priced more than 70% below estimated fair value, making them an appealing proposition for investors looking for growth at a reasonable price.

As the company continues to perform well, this disconnect between price and value presents a compelling opportunity.

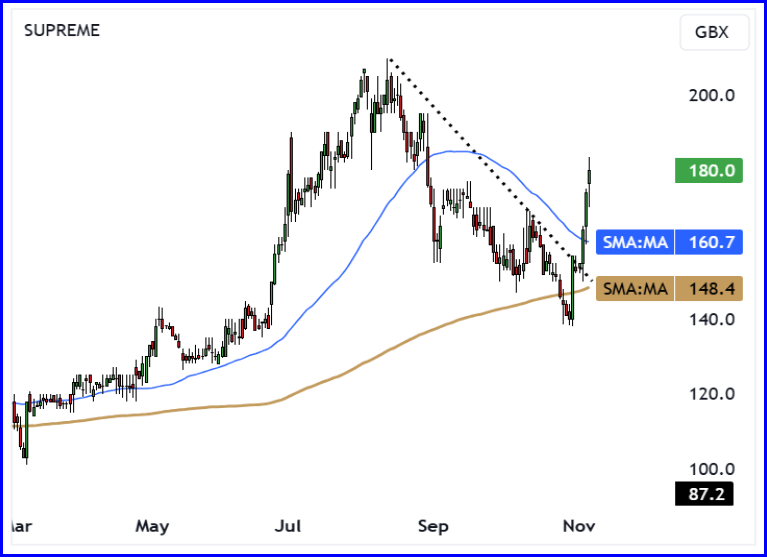

Short-term momentum realigns with long-term trend

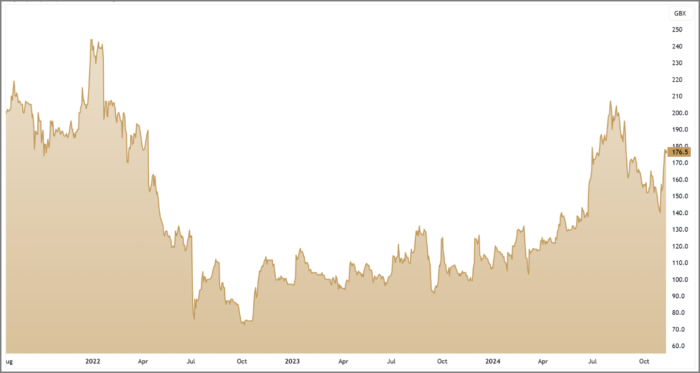

On the technical side, Supreme’s share price has shown encouraging signs of momentum realignment. After hitting two-year highs in August, the stock underwent a period of retracement and consolidation, largely due to uncertainty surrounding the Labour government.

However, since the UK Budget, the stock has surged higher, breaking above its 50-day moving average and aligning with its longer-term upward trend.

The shares are now positioned back above the upward-sloping 200-day moving average, signalling a renewed bullish trend.

With short-term momentum restored and the fundamental picture stronger than ever, we expect this positive technical outlook to continue, confirming that the stock is well on its way to further gains in the coming months.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.