22nd May 2025. 9.01am

Regency View:

BUY Staffline (STAF)

Regency View:

BUY Staffline (STAF)

Staffline: A hiring story that’s finally delivering

It’s been a long road back for Staffline (STAF). Once a darling of the small-cap world, the group’s share price was hammered by accounting issues and operational stumbles back in 2020, and it’s spent much of the last four years trying to repair both its balance sheet and its reputation. Investors who stuck around have needed serious patience—and, until recently, a strong stomach. But when a stock jumps nearly 30% in a day and follows it up with steady newsflow, it’s often a sign the tide is finally turning.

The 4th February trading update marked a clear shift. It was concise, confident, and importantly devoid of the usual hedging language. Earnings were up, net cash was stronger, and management signalled the business was firmly on track for its 2024 targets. A few months later, that message has been reinforced with a strong start to 2025, a chunky new contract win, and an AGM statement that hinted at more to come. It’s not flashy, and it’s certainly not without risk but for the first time in a while, Staffline feels like a business in control. The market is starting to believe it too.

From rescue job to re-rating story

Staffline is essentially a high-volume operator in the UK recruitment sector, with a focus on temporary labour solutions. It supplies thousands of workers to logistics, manufacturing, and agriculture clients every week. This isn’t a sexy business, but it is a scale game and when it’s run well, it throws off a lot of cash. That’s what was missing during the rocky years. But in 2023, the rebuild efforts started to show through.

Revenue rose 14% to £993m last year, while operating profit surged from £1.5m to £9.9m. That’s still a low margin, yes but in a sector where 2–3% operating margins are the norm, it’s a meaningful improvement. Better yet, the company ended the year with net cash on the balance sheet and announced a £4.8m share buyback. That’s over 9% of the market cap, repurchased at an average price of 31.2p smart capital allocation, and a clear signal that management thinks the shares are undervalued.

Recent trading suggests the momentum’s real

What got the market excited back in February was the combination of improving earnings and stronger guidance. But the follow-through in May confirmed that it wasn’t a one-off. The AGM trading update showed a 6.2% increase in gross profit for the first four months of 2025, driven by rising temporary worker volumes. That’s key. Temp volumes tend to be the canary in the coal mine for labour market confidence—and seeing them rise in a tight economic environment suggests Staffline is getting its strategy right.

The kicker came just a few days earlier, when Staffline landed a major new logistics contract. It’s hard to overstate how important these wins are. Logistics is a core vertical for the group, and big clients bring not just revenue but cost leverage and visibility. The nature of temp recruitment means contracts often roll month to month, but when large organisations commit to a new supplier, it speaks to trust—and that often leads to longer-term relationships.

Valuation still in the bargain bin

Even after a 67% rally in the share price over the past three months, Staffline still looks cheap by almost any measure. It trades on a forward P/E of 9.2 and just 3.0x free cash flow. The EV/EBITDA multiple is sitting at 3.5x, and price-to-sales is barely 0.05x. These are distressed multiples, but this is no longer a distressed business.

Importantly, the company has been returning capital at a meaningful rate. The share buyback reduced the float, improved per-share metrics, and sent a signal of confidence. The balance sheet, too, is now in decent shape with £5m in net cash and a return on capital employed of 21.5%, there’s evidence the business is generating value again. That ROCE figure is particularly interesting: in a low-margin industry, it shows management is making better decisions with the capital they have.

Technical tailwinds are kicking in

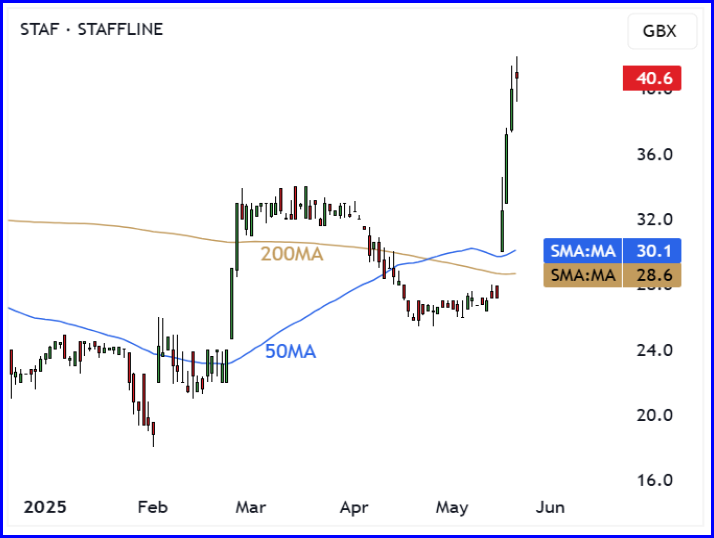

For most of 2024, Staffline’s chart was as uninspiring as the newsflow with the shares going nowhere fast in the 20–30p range. But that changed dramatically after the February update. The shares broke out above 35p, then surged to 40p, with volume picking up sharply. Price action has since held those gains, and we’re now hovering near 52-week highs.

The rally has been strong, but it hasn’t been irrational. There’s been no sign of blow-off tops or parabolic runs just steady upward movement backed by improving fundamentals. That makes it more sustainable. The shares have formed a higher swing low and broken through descending trendlines. It’s still early days, but this is what the start of a long-term re-rating looks like.

Why it matters now

There are plenty of micro-cap ‘value’ stocks on the UK market but most of them are value traps. What makes Staffline different is that it has both recovery credentials and early signs of growth. The operational turnaround is well underway, and now the business is winning contracts, generating cash, and returning money to shareholders. That’s a rare mix.

More importantly, the market has finally woken up to the shift. You don’t get a 28% one-day jump without institutional buyers stepping in, it’s the kind of move often marks the start of something bigger. If the operational momentum continues and margins inch higher, there’s a good chance we look back at the 30p–40p range as the base of a much larger move.

For now, the story is simple: when price action and fundamentals align, it’s usually worth paying attention. And for the first time in years, Staffline looks like it’s delivering.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.