22nd Oct 2020. 9.07am

Regency View:

BUY Spectra Systems (SPSY)

Regency View:

BUY Spectra Systems (SPSY)

Click here for printer friendly version

Banknotes and bull flags

Think counterfeit goods and it will probably conjure up images of dodgy DVD’s being sold in a busy Beijing market, or a shiny ‘Rolex’ being offered to you on a beach in Lanzarote.

But if I told you that 1% of all drugs in circulation were fake, or that 10% of the aeroplane you just boarded was constructed from counterfeit parts, you might just put down your in-flight G&T.

Counterfeit products represent a $4.2 trillion headache which has grown three-fold in the last decade.

Today’s stock, Spectra Systems (SPSY) is an established global player in the authentication market.

Spectra have developed advanced materials designed for multi-level authentication. They’ve also developed the hardware and software systems which verify the unique signatures of these authentication materials.

Their end-to-end role in the authentication process allows them to benefit from both software licensing and hardware servicing revenue streams – both inherently sticky and recurring in nature.

This is a debt free business, delivering revenues of $13.2m (FY 2019), and performing well ahead of expectations for the current year. Let’s take a closer look at what they do and why they’ll make a great addition to our AIM Investor portfolio…

Access to mature and high-growth markets

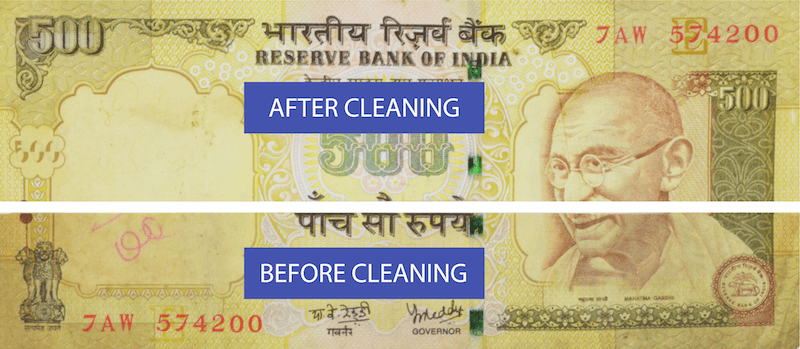

Spectra first made its name by developing the world’s first banknote cleaning technology.

Their Aeris system can remove oils and other contaminants from banknotes, protecting processing staff from hazardous contaminants and extending the life of banknotes which can save central banks up to $10bn dollars annually.

Spectra now has two G7 central banks using their technology along with a further 19 central banks on their customer list. The firm also now offers an array of other banknote security technology including a smartphone-based solution to examine banknotes for authenticity, as well as a denomination for the visually impaired.

Whilst Spectra has a strong foothold in mature markets like banknote security, its technology is also used across a number of high-growth markets like sports betting, online gaming and energy drinks…

Global gaming and international lotteries:

Spectra’s patented internal control system (ICS), Premier Integrity ICS, is a fully automated independent real-time monitoring system which supports both online and instant lottery games. It offers accurate tracking of game sales, winners, and outstanding liabilities and is used by a number of global gaming and international lotteries including Norsk Tipping in Norway, Puerto Rico, and Malaysia and 15 US lottery jurisdictions.

Tobacco, spirits and apparel:

Spectra’s TruBrand technology enables customers to verify product authenticity with a smartphone, which detects a taggant signature.

Embedded in printed and holographic labels, TruBrand presents a covert signature for analysis on smartphones. TruBrand authentication can be used for a variety of products such as spirits, footwear and apparel and is currently used by Chinese tobacco giant Zhejiang Tobacco Company to track a number of its most high-value brands.

A business that’s beating expectations

Spectra’s trading this year has been very strong…

The firm’s half-year numbers, released in September, made for pleasant reading and CEO Nabil Lawandy expects performance for the Full Year 2020 to “significantly exceed market expectations for 2020”, in spite of the Covid-19 pandemic.

Spectra posted pre-tax profit of $2m for the first half ended June 30, broadly flat with the year prior and revenue increased by 2% to $6.5m.

Lawandy said revenue will be weighted towards the second half, as the company focuses on both brand authentication and a “robust effort” to commercialise its security technologies with an emphasis on polymer banknotes and technology driven existing central bank customers.

This certainly seems to be the case as Spectra have recently delivered a raft of new central bank contract wins, the latest of which came yesterday…

The deal, to provide new sensors for a central bank’s cash operations, is worth as much as $41.5m across a three-phase development contract, and also includes a service component worth approximately $7.5m.

These central bank contracts offer multi-decade revenue streams and fit perfectly alongside Spectra’s shorter-term brand authentication contracts. And whilst a forward Price to Earnings ratio of 22.1 isn’t cheap when compared to its peer group or earnings growth, Spectra have an impressive track record of revenue growth, a debt free balance sheet and have a top quartile Return of Equity (17.4%) in its sector – indicating that it’s adept at putting shareholder cash to good use.

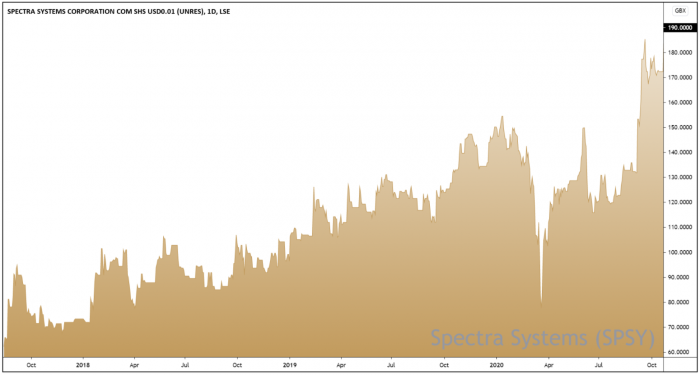

Bull flag breakout triggers entry

Technical timing is the last piece in the puzzle when it comes to investment selection and Wednesday’s price action represents a key technical catalyst.

The shares have established a strong post-lockdown uptrend, and after breaking above key resistance at 157p in September, prices had been coiling in a classic bull flag formation for much of this month.

That was until yesterday’s contract win saw the shares break decisively above the bull flag – signalling the start of a new trend leg and creating a clear technical catalyst for our entry.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.