21st Jan 2021. 9.05am

Regency View:

BUY Somero (SOM)

Regency View:

BUY Somero (SOM)

Click here for printer friendly version

US construction boom shows no sign of slowing

US construction spend hit $1.459 trillion in November, the highest level since the US government started tracking the data in 2002.

Rock-bottom interest rates, the mass adoption of working-from-home and a housing shortage have led to a robust US housing market. Combine this with a $900 billion fiscal stimulus package, and its not hard to see why US construction numbers are at record levels.

The impact of this boom is being felt in the UK…

Take a glance at the price charts of plumber Ferguson (FERG), cement maker CRH (CRH) or tool-hire firm Ashtead (AHT). These three FTSE 100 stocks all have high levels of exposure to US construction and all three have surged to new highs in recent weeks.

Today’s stock, Somero (SOM), offers high quality exposure to this emerging theme…

Faster, flatter, fewer people

Somero are US-based concrete leveling specialists.

They make and sell laser-guided concrete screeding equipment. Their patented machinery uses a process called ‘wide placement’, which means that it can put down concrete slabs flatter, and four to five times faster than the other method of spreading concrete, which is basically a manual method.

Somero sell and service all their customers direct and whilst long standing CEO Jack Cooney admits that “anybody can reverse engineer mechanical equipment”, he believes it is their service that gives them an edge which makes them the market leader…

“We are much more than just an equipment company, we supply the education, the training, and the ongoing technical support to make our customers highly successful.”

Concrete sets in an hour, so if the machine breaks down on site, the operator only has an hour to find out what the problem is and fix it. If it can’t be fixed, then the entire job is put on hold, costing the main contractor precious time.

Somero have 24/7 phone support in 65 different languages, where they guarantee that you will get a certified engineer on the phone in ten minutes, that’s not something that any of their competitors offer.

US market in rude health

Somero’s US-focus has served them well during the last year, and they have passed the stress test of the pandemic with flying colours.

In their November trading update, they said that due to a good trading momentum from the end of the first half of 2020 into the second, it expects to beat its previous expectations for the year.

Somero sighted “healthy trading in the US market”, along with strong contributions from new products such as the remote operated SRS-4 levelling machine and a revenue increase from the SkyScreed family of products designed for screeding on structural high-rise platforms.

This positivity has been reiterated in this morning’s second half trading update. Full-Year 2020 revenue is expected to be approximately $88m, a dip from the 89.3m posted in 2019, but materially ahead of prior expectations. Adjusted earnings will hit $61m and net cash will be $35m – well ahead of even November’s guidance.

Australia, China and Middle East represent long-term growth markets

In the wake of the pandemic, the US is not the only country implementing Keynesian-style stimulus packages.

The Australian government launched a $470 million construction-focused stimulus package in the summer, just in time for Somero’s strategic move into the region.

Somero Australia opened in September, and through the acquisition of ANCON Beton Pty Ltd they have a ready-made client base. They also signed a new dealer partnership with Queensland-based Premier Concrete Equipment to service clients in South-East Asia (Singapore, Malaysia, Thailand and The Philippines).

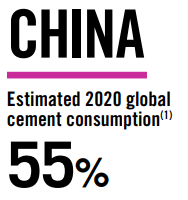

There is also significant potential to expand into China and the Middle East, which currently only account for 6% and 3% of group revenues respectively.

It goes without saying that the opportunity in China is mind-boggling huge. It is estimated that China is responsible for 55% of global cement consumption.

There is also a growing acceptance of ‘Western flatness’ floor levelness specifications, and Somero believe they can gain greater access to this region through their multinational client base…

“Growth has given us some advantages in China, because the B&Qs and the IKEAs and the Prologis’s who have used flat floors and laser screeded floors in other parts of the world, when they go to China they want them, and they ask for them” said Jack Cooney…

“It is a long, long term investment in China. We are going to have ups and downs, and we understand that, that doesn’t change the investment and the activities we make, because we have done this in all the other countries before.”

High quality financials

With a modest compound average revenue growth over five years of 8.5%, Somero cannot be described as a growth stock.

However, take a closer look at their financials and you’ll see the hallmarks of a thriving company…

Somero have a high ratio of free cashflow to sales (17.6%), enabling them to payout a sector-leading dividend, putting them on a forward dividend yield of 4%.

They also have five-year average Return on Capital Employed (ROCE) of 43%, the second highest in the Machinery, Equipment & Components sector.

Their balance sheet is strong with a net cash position of $26m and their operating margin of 28% ensures consistent earnings.

Whilst the UK listing of a US incorporated firm is a potential red flag, we believe Somero listed on AIM in 2006 for valid reasons. At the time, they were owned by private equity firm The Gores Group who had taken several other smaller companies public on AIM.

On Somero’s AIM listing, Jack Cooney said:

“Given our size, we wouldn’t fit well on the NASDAQ in the US market, and I believe we are the right size for the AIM. And we have been very, very pleased with the calibre of the investors and the shareholders we have got.”

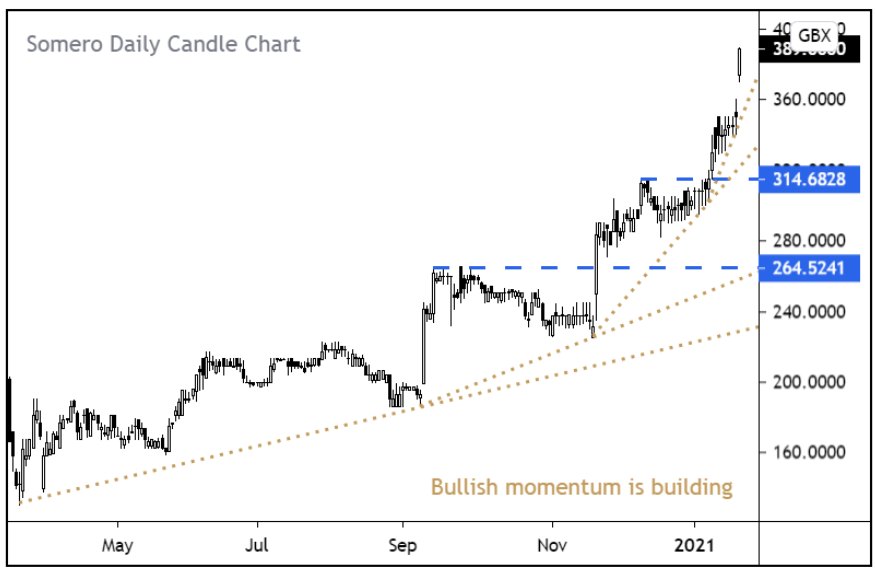

Bullish momentum is building

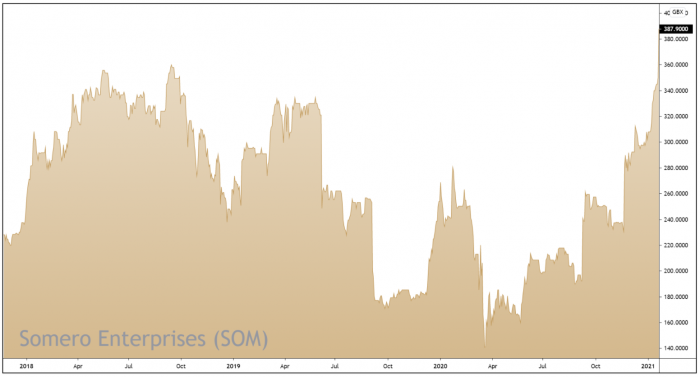

Somero’s share price is really starting to build momentum.

Prices have carved out a powerful uptrend, characterised by a series of steepening trendlines.

Each level of broken resistance represents a new area of technical support, and hence while we will see pullbacks in the coming months, there is a strong long-term foundation to this trend.

The market’s reaction to today’s update only serves to reiterate our view that Somero is very well positioned to ride the global recovery.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.