Regency View:S

BUY Serica Energy (SQZ)

Serica remains significantly undervalued

When it comes to finding high quality AIM stocks, you’d be hard pushed to beat Serica Energy (SQZ).

The North Sea gas producer has an impressive asset base which generates plenty of cash and profits are soaring.

And despite a Return on Equity just shy of 70% and operating margins north of 50%, the stock continues to trade on a single digit forward PE and a deep discount to Fair Value.

We’ve been big fans of the stock for several years and after taking profits in late 2021, we believe the time is right to buy back in.

High-quality production base

Serica produces predominantly gas from five fields in the UKCS (UK Continental Shelf) region located in the North Sea.

Its high quality production base includes the Bruce, Keith and Rhum fields (known as BKR) which it bought from BP, Total and BHP via a five-year staggered earn out in 2018. Serica also operates the Columbus Field and is a partner in the Erskine Field

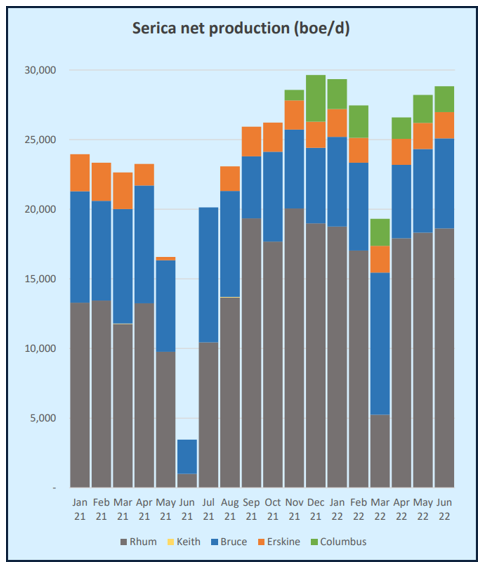

Production levels surged 40% in the second half of 2021 due to increased uptime on BKR and new production from its Rhum R3 well and the Columbus field.

Net production is now consistent at around 26,000 barrels of oil equivalent per day (boe/d) and Serica have set full-year 2022 net production guidance at to 26,000 – 28,000 boe/d.

Significant cashflows to self-fund growth and diversification

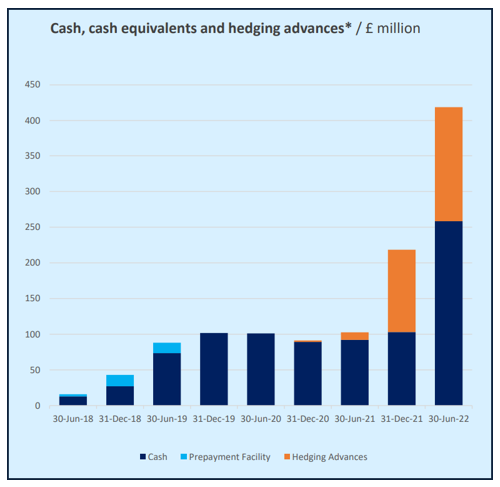

The completion of Serica’s BKR earn-out in 2022 coincided with an unprecedented rally in European natural gas prices.

Net profit has more than doubled within the last twelve months to £195m (TTM) and operating cashflows have tripled to £172m (TTM).

This has created a debt free, cash rich balance sheet which is now being used as an acquisition war chest to grow and diversify its production base.

Last month, Serica agreed to buy privately-owned North Sea rival Tailwind in a mostly share-based deal worth £644m.

The deal will see Serica’s production grow to over 40,000 barrels of oil equivalent per day (boe/d) in 2023 from around 27,000 boe/d in the first half of 2022. It will also significantly grow its oil production, which contributes 15% of Serica’s output.

Buying Tailwind will allow Serica to offset its windfall tax burden through historic tax losses as well as investments in new well drillings around Tailwind’s Triton oilfield.

And as part of the acquisition, energy trader Mercuria will become a 25% shareholder in Serica with two non-executive board seats. Mercuria will also buy oil and gas from Serica and supply financial hedging.

Serica’s cash pile post Tailwind is close to £300m which will allow it to make further acquisitions according to CEO Mitch Flegg:

“We still have cash and we will have more from the enhanced portfolio going forward so we are in a good position to make more deals,” he told Reuters.

Serica will focus on opportunities in other European countries and possibly North Africa, he added.

78% below Fair Value

Despite Serica’s cash generative asset base, investors are being asked to pay just over four times future earnings.

This looks very reasonable given the average forward PE multiple for the Industrial Gas sector is closer to 7.

Serica’s valuation also looks attractive on a discounted cashflow (DCF) basis – a financial model which that determines whether an investment is worthwhile based on future cash flows.

DCF calculates Serica’s Fair Value at £11.80, meaning the shares are trading at a 78% discount.

There are of course a number of limitations to DCF analysis and we are not ones for believing the market is inefficient.

However, the DCF analysis indicates that there is a significant buffer to support Serica’s share price in the long-term, even if natural gas prices normalise.

It is also worth noting that Serica pay an attractive dividend and the shares trade on a forward yield of 6%.

The dividend is covered by four times future earnings, meaning there is scope for payouts to steadily rise should the right acquisition opportunities not present themselves.

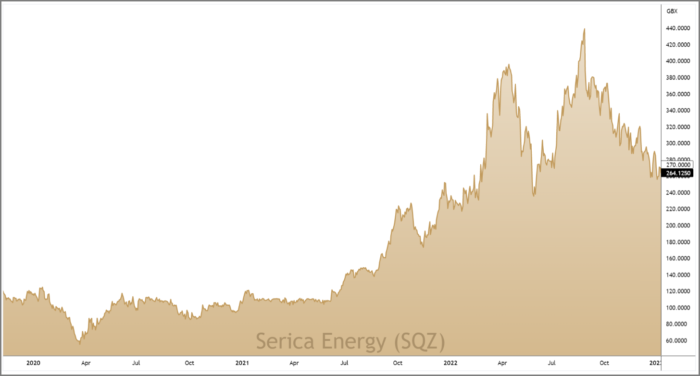

Serica pulls back to key support

Serica’s price action in recent months has seen the shares steadily pullback from their summer highs.

The sustained pullback has taken prices down into a key area of long-term support created by the October 2021 swing highs and the May 2022 swing lows (see chart right).

Within the last month we have already seen prices start responding to the top of the support area, forming two small swing lows since December.

Given the context of Serica’s powerful long-term uptrend, we believe this support zone will be well defended, creating a bullish short-term catalyst from which to time our entry.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.