Regency View:

BUY Science Group (SAG)

Science as a service

When running a business of any size, the benefit of using a consultancy to tackle certain problems should not be underestimated…

A fresh perspective, deep technical expertise and up-do-date innovative thinking are just some of the reasons why over 80% of medium-sized British business hire consultants.

Science Group (SAG) is an international consulting services group who use cutting-edge science and technology to solve R&D challenges.

They are diversified across several vertical markets (markets operating under a specific niche), including consumer, food & beverage, medical devices, and industrial chemicals & energy.

This vertical market focus allows Science Group to build expertise and offer clients higher margin solutions which support the entire product innovation lifecycle.

The business is building plenty of momentum and delivered record revenue and adjusted operating profit last year despite the impact of the pandemic.

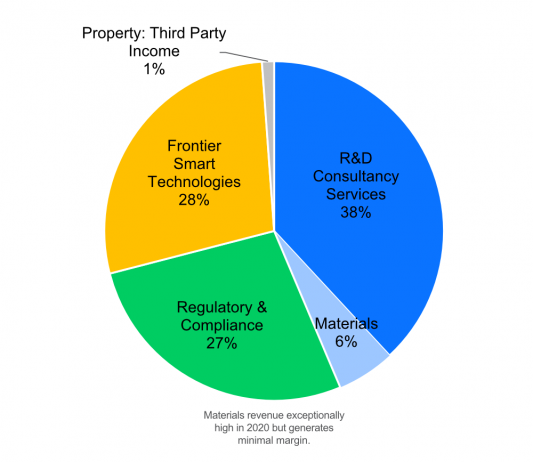

Diversified business model

Science Group has three core revenue streams, each contributing roughly a third of revenues between them:

1. R&D Consultancy

Earlier this year, Science Group merged its three R&D consultancy divisions to form Sagentia Innovation.

The advisory skills of Oakland Innovation and OTM have been brought together with the product development capabilities of Harston-based Sagentia.

Sagentia have teams of mathematicians, physicists, chemists, toxicologists, electrical & mechanical engineers as well as scientific experts in biological sciences, food & nutrition, sensory & environmental sciences working from sites across Europe and the U.S. “Every project can now be viewed through three interconnected lenses” says Paul Wilkins, Sagentia Innovation’s managing director.

The combined R&D division delivers revenues of £32.2m (FY 2020), and key trends driving growth in this space include sustainability, digital transformation and consumer health.

2. Regulatory & Compliance

Science Group own two key players in the regulatory and compliance consulting industry…

Leatherhead Food Research provides scientific and regulatory affairs advice to the food and beverage industry through a membership-based consultancy and have over 1,500 members.

TSG is a regulatory and scientific consulting service specialising in the chemicals industry. Services include product registration, product life cycle management and regulatory intelligence.

Science Group’s Regulatory & Compliance division delivers a combined revenue of £20.1m (FY 2020).

3. Technology

In October 2019, Science Group acquired Frontier Smart Technologies, a pioneer in technologies for digital audio delivering revenues of £20.5m (FY 2020).

Based in Harston (UK), Shenzhen (China) and Hong Kong, Frontier Smart Technologies is a market leader in DAB/DAB+ radios and SmartRadio solutions. Customers include big industry names such as Sony, Philips, Panasonic.

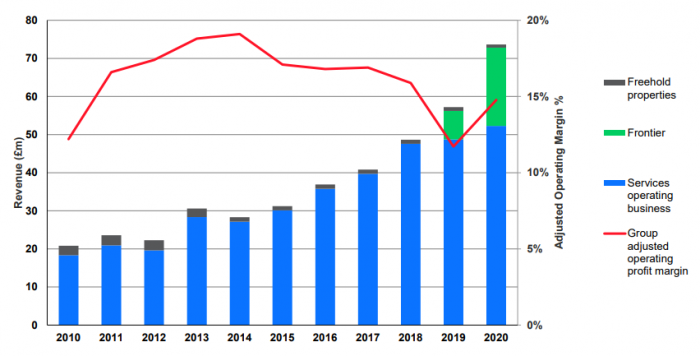

Revenue at record levels with 2021 off to a strong start

Science Group’s Full Year 2020 numbers were highly impressive and underlined the diversity and resilience of their business model in challenging market conditions…

Group revenue hit record levels of £73.7m (FY 2020), up from £57.2m in 2019 – achieving the group’s sixth consecutive year of revenue growth.

Adjusted operating profit jumped by 62% to £10.9m (2019: £6.7m) while adjusted basic earnings per share (EPS) increased by 67%.

A bullish trading update in May indicated last year’s momentum has continued with all three divisions having “a good start to the year”.

“The R&D Consultancy division has seen particularly strong momentum in the Medical sector, while the Regulatory & Compliance division has continued the progress demonstrated in 2020. The Frontier product division continues to perform well with material supply constraints likely to be the biggest risk in the current year” read the update.

Science Group expect to report adjusted operating profit (AOP) for the first half of 2021 around 30% higher than in the same period of the prior year.

This is a particularly impressive performance given H1 2020 reported a record AOP for the Group. And with 57% of Group revenue in US dollars, this year’s appreciation in sterling has created a significant currency exchange rate headwind relative to 2020.

It’s also worth noting that Science Group have a strong balance sheet with gross cash at 30 April 2021 of £29.5m and net funds of £13.3m.

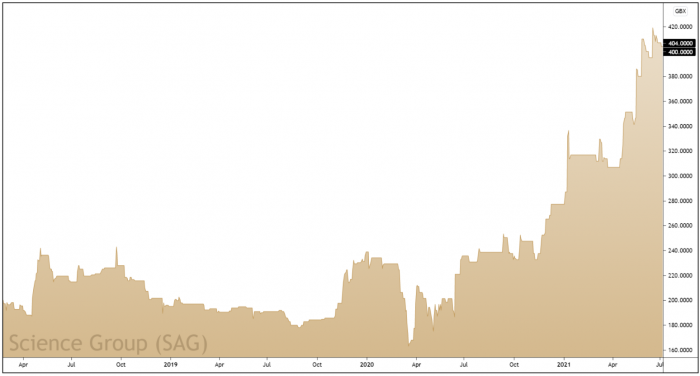

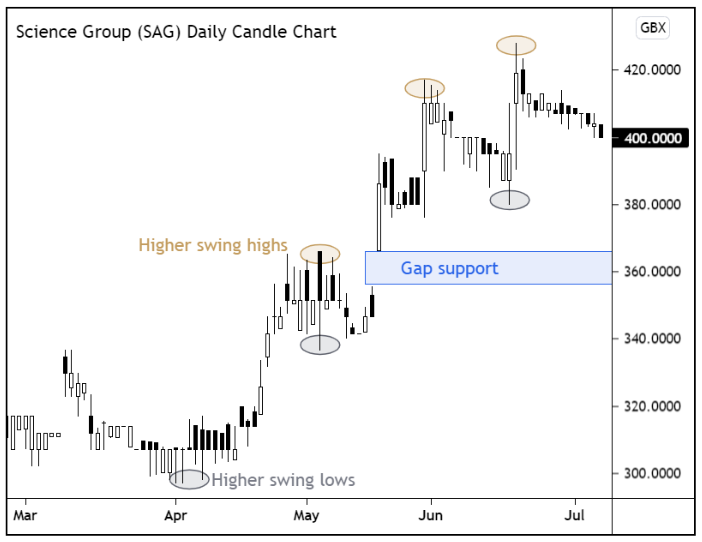

Share price is stepping higher

Science Group’s share price has carved out a powerful uptrend in recent months…

Prices have been stepping north through a series of higher swing highs and higher swing lows – creating a strong uptrend.

We have also seen several bullish price gaps print on the back of market-beating trading updates. These gaps indicate that the uptrend is built on strong foundations, and they also create layers of support.

Recent price action has seen the shares pull back from highs, and we’re backing Science Group’s share price to form a higher swing low.

Despite being up more than 40% year-to-date, the shares are still changing hands on a relatively modest forward Price to Earnings ratio (PE) of 18.1 and an attractive Price to Free Cashflow ratio of 9.5.

We believe Science Group represent a high-quality addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.