16th Jul 2020. 9.00am

Regency View:

BUY Robinson (RBN)

Regency View:

BUY Robinson (RBN)

The little packaging firm with big name clients

Those of us who scrambled to try and buy Detol and Domestos during lockdown will be only too aware of how demand for consumer staples tends to spike during times of crisis.

And whilst the initial shock of the pandemic is an extreme example, demand for consumer staples is set to continue growing as we move into a period of economic contraction.

Today’s stock, Robinson (RBN) is an innovative packaging company with strong ties to the consumer staples market.

Having a market cap of just £19 million, Robinson may not be a household name, but its roster of multi-national clients most certainly is…

Nestle, Unilever and Tesco are just a few of the consumer staples stalwarts that Robinson have built bespoke packaging for.

Robinson specialise in making packaging that helps products standout on the shelves and they work very closely with their clients to ensure that the packaging can be seamlessly integrating into the manufacturing process.

Examples include, helping Nestle to redesign the packaging for their Azera Barista style instant coffee – creating a new plastic lid which enabled better on-shelf stacking and improved merchandising opportunities. And helping Procter & Gamble to create attractive packaging for their Gillette deodorant brand.

Robinson’s exposure to the consumer staples market has helped them to more than offset the contraction in their luxury gift packaging segment. Recent numbers showed that the pandemic had been “net positive” for sales in Q1 – delivering growth of 5% versus the same period last year.

Dividend reinstatement is a clear display of strength

The pandemic has hit income investors very hard. Over 380 individual dividend cut announcements have been made so far in 2020 across the Main Market and AIM, at a cost to shareholders of £32 billion.

At the start of the pandemic, Robinson, made the prudent decision to cancel the final dividend payment for 2019 – conserving cash at an extremely uncertain time. However, in a pre-AGM trading statement, at the end of June, Robinson Chairman, Alan Raleigh, announced that the firm would be reinstating its dividend pay-out due to “greater clarity on the impact (of the pandemic) on the business”.

The firm declared, what is calls a “first interim dividend” of 3.5p per share, to make up for the cancellation of the 2019 final distribution. The wording of this suggests there could be further payments to follow.

Robinson’s modest net debt position of £6m, solid interest cover and customer base that have relatively steady end-markets all serve to reinforce the firm’s ability to maintain its payout.

As Russ Mould, AJ Bell Investment Director recently commented:

“Robinson’s return to paying dividends offers some hope and also a template for investors of the type of company than can keep on paying dividends, or resume paying them fairly promptly, once they get a better feel for the impact of Covid-19 upon their business model and customers.”

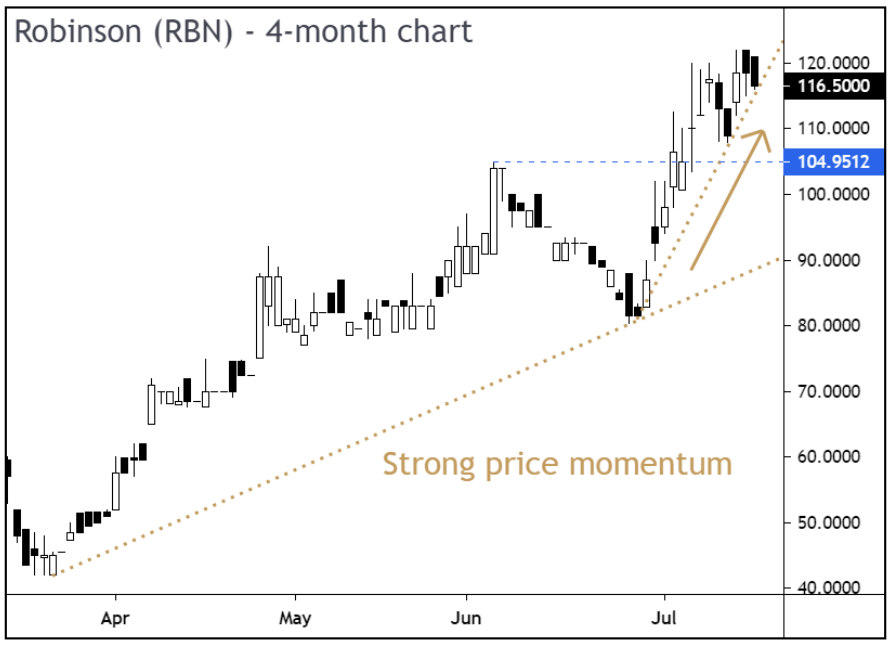

Bullish price momentum starts to build

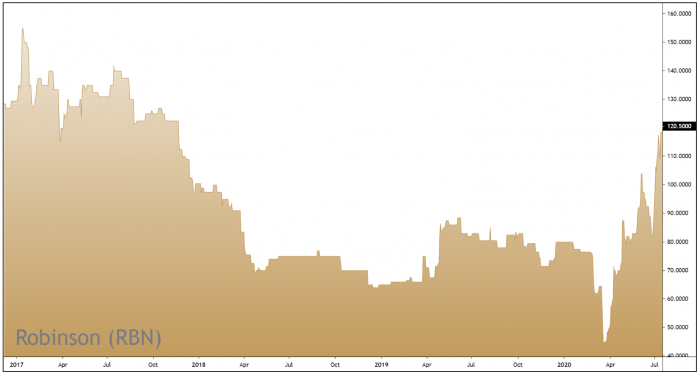

The market has certainly enjoyed Robinson’s dividend reinstatement – the shares ascending trendline has steepened since the end-June trading update and this signals that momentum is increasing.

We now also have multiple layers of support on the price chart, the short-term ascending trendline, the broken horizontal resistance level at 105p and the long-term ascending trendline at 90p. And whilst detailed technical analysis is less effective on micro-cap stocks, these broad support levels will provide useful reference points moving forward.

Along with momentum, the shares also score highly on several quality metrics…

In both Price to Book Value (0.86) and Price to Free Cashflow (0.56) Robinson ranks second out of nine companies in the Containers & Packaging market. And whilst their earnings growth rate is forecast to drop by 2.8% over the next year, effective cost controls mean that operating expenses have been kept flat so margins have gone up.

Overall, we believe Robinson’s strong position in relatively stable end markets makes for an attractive addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.