17th Dec 2020. 9.03am

Regency View:

BUY Restore (RST)

Regency View:

BUY Restore (RST)

Click here for printer friendly version

Restore ticks all the right boxes

This week, we continue with our ‘bounce back 2021’ theme by highlighting another high-quality AIM stock that looks well positioned to recover next year.

Restore (RST) deliver essential business services that centre around physical and digital data storage.

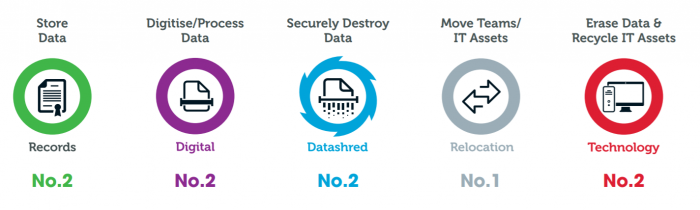

Alongside the data storage businesses, which generate the bulk of Restore’s revenues, the group also have a shredding business, which securely destroys and recycles paper, an office relocation business called Harrow Green, and an IT hardware recycling business.

As the graphic below shows, Restore are either the biggest or second biggest player in their respective markets, and through a series of smart acquisitions, they’ve been a key consolidator of what was a highly fragmented market.

The beauty of Restore’s services is they can be neatly integrated into an upsell journey. A client that comes on board for document storage will be upsold digital storage, shredding and IT recycle services – meaning that their contracts are sticky and offer plenty of organic growth.

Key macro drivers for growth include

Speaking at their recent Capital Markets day, CEO Charles Bligh outlined four long-term market trends which serve to underpin Restore’s long-term growth:

1. Digitisation

This is counterintuitive given that digitisation is likely to be a slight negative for physical box storage and shredding, but according to Charles this will be “more than offset by the growth in digital data store revenues during the next decade”.

2. Flexible working

This is likely to drive a move towards smaller office spaces, and when this happens, all the records they have been stored in their offices will become available for storage. Flexible working is also expected to be a tailwind for the relocation and IT recycling businesses.

3. Security of data

The importance of both physical and digital data security is growing rapidly, driven by tightening regulation and significant increases in data-breach fines. Restore offer much higher security than their customers could ever achieve, and they also have the highest level of document tracking available.

4. Environmental

Increasing environmental conscience is an obvious tailwind for their IT recycle and secure destroy business. Restore also offer much lower environmental impact than many other offerings because they have high-density storage sites, which are far more efficient and better for energy use.

Cash generation the engine of Restore’s acquisitive growth

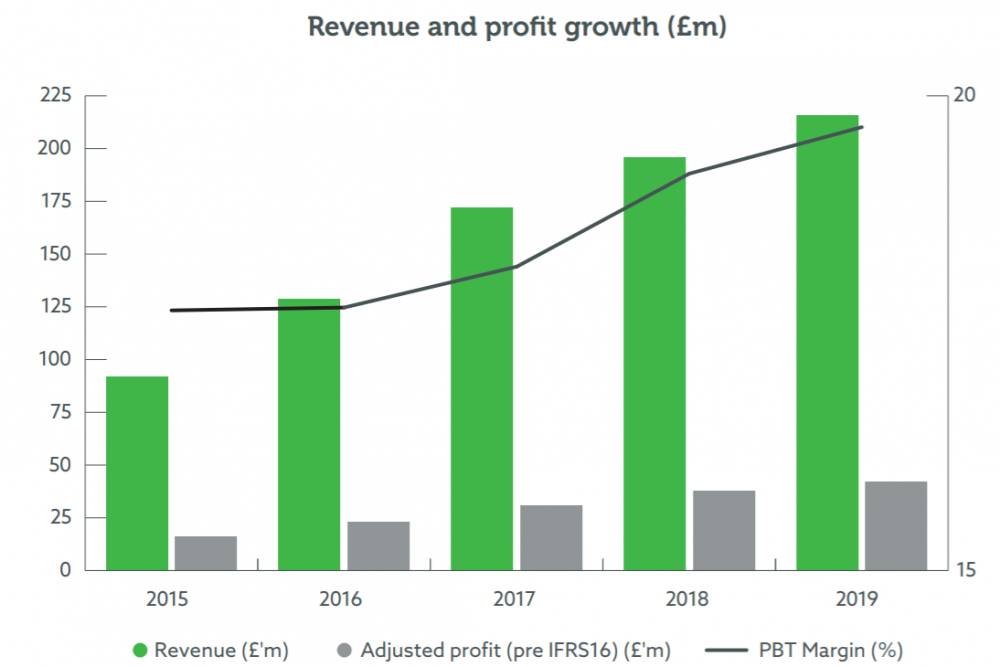

Strong track records for revenue and earnings growth tends to be one of our key stock selection criteria and Restore is no exception…

They have grown from revenues of less than £20m a decade ago to over £215m last year. This growth was achieved both organically, at a rate of around 1-4% per annum, and through over 50 acquisitions that together have delivered an average growth rate of 20% over the last five years.

Restore is also highly profitable and has margins north of 20%, allowing the business to generate cashflows of around £25-£30m a year.

According to CFO Neil Ritchie, Restore’s current level of cash generation, combined with a flexible credit facility, will create an acquisition warchest of £200m over the next five years, whilst allowing the group to keep leverage below 1.5 x book value. And under Restore’s current acquisition policy, all additions to the group will be immediately earnings enhancing.

Good things come to those who wait

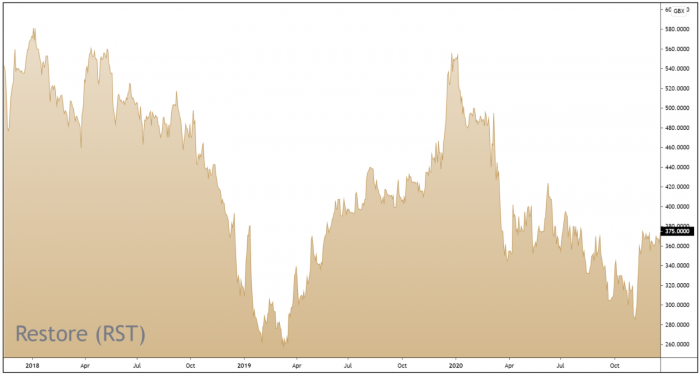

Like many stocks in the Profession & Commercial Services sector, Restore’s share price has been hit hard this year. And as those of you who follow our AIM Investor portfolio will know, we’re not in the business of catching falling knifes and trying to call a bottom without hard fundamental and technical evidence.

During the last month, we’ve seen this confirmation on both the price chart and in the soundbites from the board room…

Restore’s Q3 profits came in around 50% higher than Q2, and overall sales are now tracking 80% of the levels seen last year. Costs have been carefully managed and Restore expect trim the fat by £2m next year, helping to maintain its trend of falling net debt levels.

On the price chart, the shares have broken above a descending trendline which had been in place all year. This decisive break of structure has been followed by a healthy period of sideways consolidation – signalling that a change in trend is ready to emerge.

With technical and fundamental confirmation now in place, we expect Restore’s share price to have a strong 2021.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.