26th Sep 2024. 9.02am

Regency View:

BUY Renold (RNO)

Regency View:

BUY Renold (RNO)

Chain reaction: Renold has room to grow

In a sea of small-cap stocks, Renold (RNO) stands out for more than just its industrial chains…

This 150-year-old company has carved out a unique niche as the second-largest player in the fragmented global market for power transmission products.

With less than 10% market share, Renold has substantial room to grow. Its stronghold in a diverse global market, combined with the capacity for organic expansion and strategic acquisitions, positions Renold as a high-quality AIM stock that we’ve been enthusiastic about for some time.

Reliable products in high-stakes industries

Renold specialises in producing industrial chains and specialist torque transmission products, serving industries that demand reliability and durability.

While industrial chains may sound mundane, the high-stakes industries that utilise them—from manufacturing to cutting-edge automation—depend on their precision and resilience. Renold’s premium products are designed to minimize downtime, and companies are willing to pay a premium for the assurance of quality.

With an established reputation for crafting durable, top-tier products, Renold is not just providing industrial solutions; it’s also building trust with a global client base. The company’s business model, which targets high-margin, quality-driven markets, sets it apart, positioning it as a leader in both traditional sectors and faster-growing, high-tech applications.

Capitalising on the automation revolution

The industrial landscape is rapidly shifting towards automation, and Renold is positioned at the forefront of this movement…

As industries increasingly adopt automated processes, the demand for high-quality, reliable chains is growing exponentially. Automation requires precision, and Renold’s products deliver exactly that. This trend provides Renold with a significant tailwind, enabling it to outpace the broader industrial markets it serves.

In its recent trading statement from 10 September 2024, Renold reported solid financial performance over the past five months, generating £102.3 million in revenue. While slightly down due to exchange rate impacts, the company saw a 14% increase in order intake, underscoring strong demand for its products. Even when excluding a large military contract, the core business demonstrated healthy growth, reinforcing its ability to generate consistent revenue.

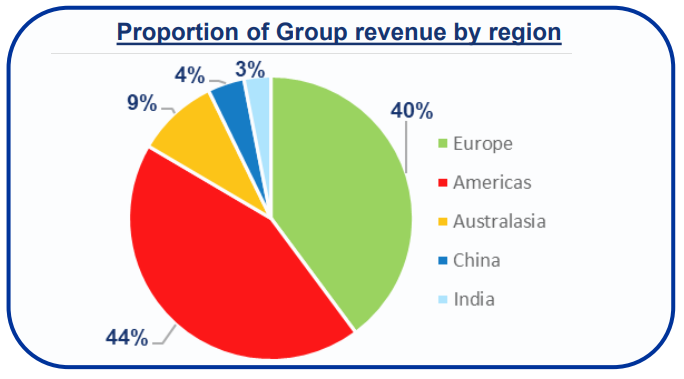

The acquisition of MAC Chain for $31.4 million continues Renold’s track record of strategic, value-add purchases. This acquisition enhances Renold’s presence in North America and Canada, complementing previous acquisitions in Australia and Spain. As Renold integrates these businesses, it expects not only to expand market share but also to realise synergies that can improve profitability.

Unlocking profitability through operating leverage

What truly distinguishes Renold is its potential for operating leverage and margin expansion…

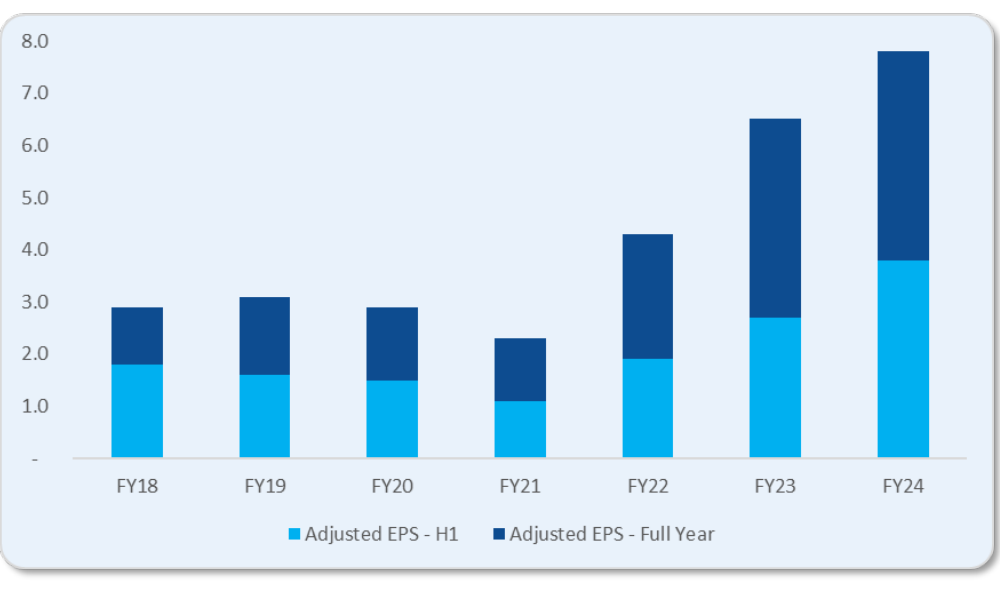

Over the past four years, the company has grown revenues at a compound annual growth rate of 6.25%, while operating margins have expanded from 7.1% to 12.3%. As Renold scales, it benefits from efficiencies in fixed costs, allowing a higher proportion of revenue to convert directly into profit.

The company’s central overheads remain relatively fixed, creating greater operating leverage, especially as acquired businesses are integrated. These synergies, along with cross-selling opportunities and the ability to eliminate duplicate costs, pave the way for mid-teen operating margins in the future.

Renold’s balance sheet is robust, with net debt of £24.5 million, equating to just 0.6x earnings (EBITDA). This ensures the company maintains the flexibility to pursue its acquisition-led growth strategy without overleveraging.

An undervalued gem: Growth, quality, and value

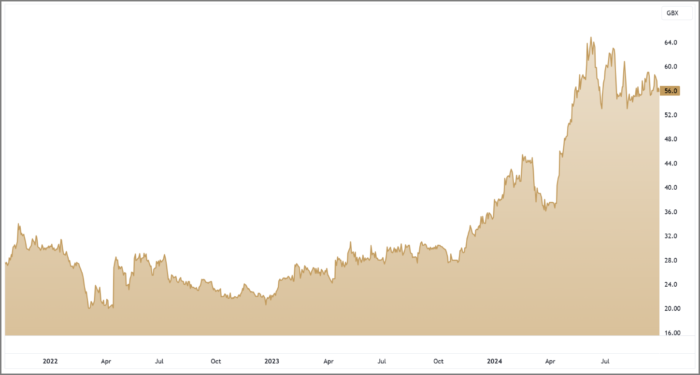

From a technical perspective, Renold’s share price has been locked in a strong uptrend this year. The 200-day moving average is sloping upward, reflecting bullish momentum.

Recent price action has led to consolidation around the 50-day moving average, forming a symmetrical triangle pattern. Such consolidation is often a precursor to a breakout, and given Renold’s dominant uptrend, the odds favour a breakout in-line with the trend.

At just 7x forward earnings, Renold’s stock appears undervalued relative to its growth potential. The company has proven it can expand through acquisitions, generate healthy margins, and capitalise on the automation wave in industrial markets.

With operating margins on the rise and consistent cash flow generation allowing for a resumed dividend, Renold offers a rare combination of growth, quality, and value. Now may be the perfect time to consider an investment in this promising small-cap stock.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.