Regency View:

BUY Renold (RNO)

Renold: A Great British Brand

The value of a time-tested brand should not be underestimated.

Legendary investor Warren Buffett put the protective power of a world-wide brand at the centre of his “economic moat” theory. And today’s stock, Renold (RNO) has a brand that has certainly stood the test of time…

Renold produces precision engineered power transmission products.

With its routes as an innovative chain making company dating as far back as the 1800’s, Renold has significantly more history attached to its brand than your average AIM listing…

Founder Hans Renold patented the first solid bush chain back in 1880 – the origin of the bush roller chain, the design of which is still used today throughout the world.

Alongside it’s Chain division (transmission, conveyor and lifting chain), Renold also has a Torque Transmission division which manufactures and develops industrial couplings and gearbox solutions.

Renold’s products tend to be relatively low cost when compared to their customers final project costs, and they also tend to be critical to the performance of the project – giving Renold high levels of customer retention, resilient margins and long-terms ‘sticky’ contracts.

The stock has one of the most attractive valuations in its peer group, and whilst the company has been hit hard by the disruption of the pandemic, a recent trading update revealed a very healthy order book.

Diversified in both geography and sector

From cement making to chocolate manufacturing, subway trains to power stations, escalators to quarries Renold’s products are used across a vast array of sectors.

With such high levels of sector diversity, its no surprise that Renold have a truly global footprint…

Around 40% of Group revenue is generated in Europe and Americas respectively. The remaining 20% is spread across high growth regions in Australasia, China and India.

Renold has a global manufacturing base which enables the business to control product specification and quality. It also has rapid response customer service and sales hubs in both traditional geographic territories and within emerging markets.

Existing facilities in India and China have recently been upgraded to build higher specification products, and Renold’s North American exposure has seen the company benefit from Joe Biden’s stimulus packages.

Four-month order intake surges

Whilst the global nature of Renold’s business provides a high degree of revenue diversification, it has also presented significant challenges during the pandemic.

Lockdowns and the rapid spread of the Delta variant have put supply chains are under pressure, leading to material price inflation. And Renold’s Full-Year 2021 revenue took a hit, contracting 12% year-on year to £130m.

However, recent trading updates indicate that demand is bouncing back faster than previously expected…

Last week, Renold reported that the “strong momentum experienced in the fourth quarter of the last financial year has been maintained in the new financial year, resulting in the continued recovery of both revenues and order intake”.

Order intake had surged more than 60% to £79.7m in the four months to end July, and sales revenue had jumped 13.6% to £62.5m during the same period.

“The Board now expects adjusted operating profit for both the first half and full year of FY22 to be higher than both market expectations and the equivalent prior year period” read the upbeat trading statement which prompted a very bullish response from the market…

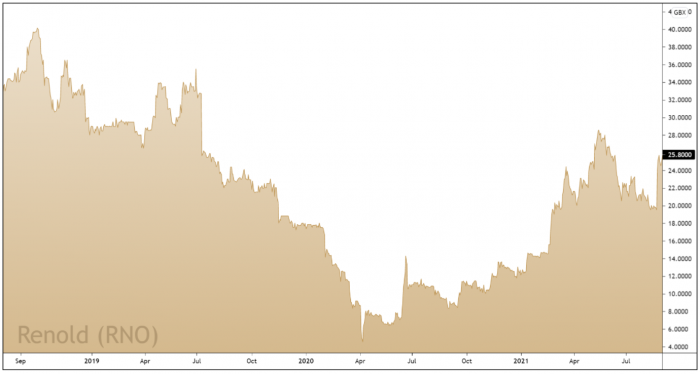

Renold’s share price gapped higher, snapping a descending trendline which had been in place since the summer.

The nature of this bullish price gap indicates that Renold’s share price is ready to resume the recovery uptrend which formed from April 2020 – May 2021.

Eye-catching valuation

There’s no getting away from it, Renold’s balance sheet isn’t nearly as shiny as the majority of stocks in our AIM Investor portfolio, but leverage is dropping fast…

Net debt has almost halved from £36.6m (2020) to 18.4m (2021) and cash generation has remained strong at £18.2m (2021).

And this has reduced leverage (net debt to adjusted earnings) from 1.7 times (2020) to 0.9 times (2021).

What’s far more attractive though is Renold’s current valuation…

The shares trade on a forward price/earnings (PE) multiple of just 8.4 – giving Renold one the most competitive valuations in the Machinery, Equipment & Components sector.

The forward PE ratio also looks attractive relative to forecast earnings growth of 37.8%. And Renold have the best Price to Free Cashflow (2.3) and best Price to Sales (0.33) in its sector.

Hence with the security of a strong order book behind them, we believe Renold’s eye-catching valuation should not be ignored.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.