5th Nov 2020. 8.58am

Regency View:

BUY Pan-African Resources (PAF)

Regency View:

BUY Pan-African Resources (PAF)

Click here for printer friendly version

Panning for gold

The Alternative Investment Market (AIM) is home to arguably the most exciting and diversified selection of small mining companies in the world.

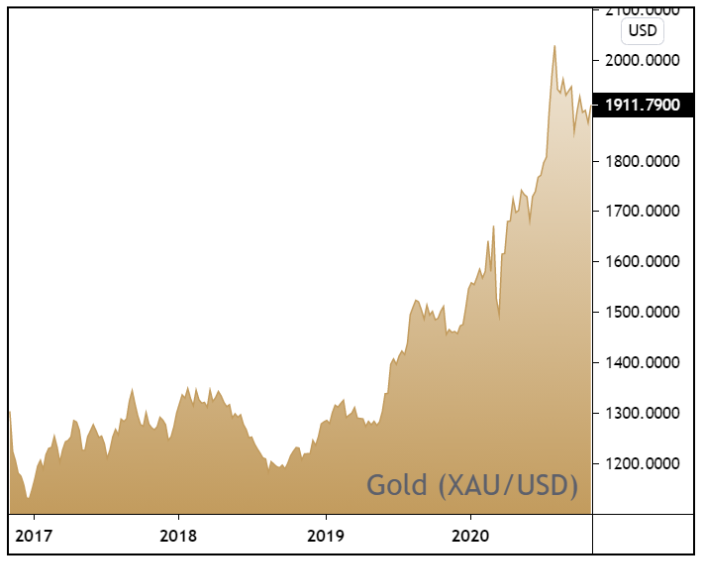

London’s time-zone advantage, its metals exchange and its resource-focused large-cap FTSE 100 index all make it the ideal location to list smaller mining companies. And with gold in the throws of a two-year bull run, we have been somewhat spoiled for choice.

As gold surged to highs of $2074 during August, we spent much of the summer crystalising some of those gold-related gains within our AIM Investor portfolio.

With our metals & mining exposure now reduced to just Anglo-Asian Mining, and with gold having undergone a pullback from those summer highs, we feel the timing is right to ramp up our natural-resource exposure again…

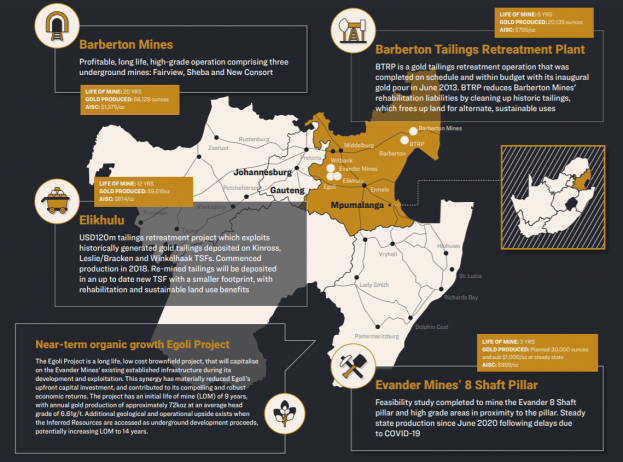

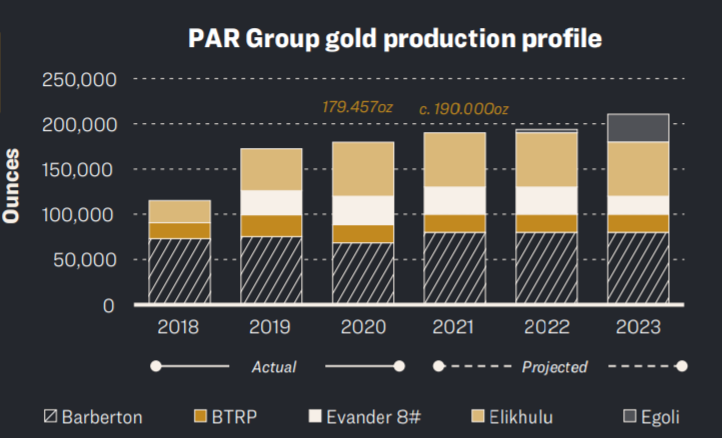

Pan-African Resources (PAF) own and operate a portfolio of high-quality, high-margin South African gold mines with a production capacity of approximately 200,000oz per annum.

PAF’s four gold-producing operations are:

Barberton Mines – A low-cost, high-grade operation comprising three underground mines: Fairview, Sheba, and New Consort. These flagship mines are long-life and high-grade – producing some 80,000oz of gold per year. Barberton Mines has a life of mine estimated at 20 years and a low all-in sustaining cost of US$1.375/oz.

Barberton Tailings Retreatment Plant – Located at Barberton Mines, this retreatment plant adds high margin and low risk ounces to PAF’s production profile – delivering 20,000oz of gold per year. The current life of the operation is estimated at 6 years and has the added benefit of turning PAF’s Barberton environmental rehabilitation liabilities into profits.

Elikhulu Tailings Retreatment Plant – ‘The Big One’ in Zulu, Elikhulu processes 1.2Mt of historic tailings per month and takes advantage of pre-existing gold tailings at three tailings storage facilities (TSFs).

Evander Mines’ 8 Shaft Pillar Mining – The 8 Shaft Pillar reached steady state production in June following delays due to the pandemic. This is the smallest of PAF’s operations and is expected to contribute 20,000oz to 30,000oz per annum for three years.

Transformational two-year period

Gold’s recent bull run came at the perfect time for PAF…

In 2018, the completion of the Elikhulu Tailings Retreatment Plant, in budget and ahead of schedule, enabled PAF to increase production whilst simultaneously lowering all-in sustaining costs, at a time when gold was just starting its bull run.

2019 was a breakout financial year for PAF, with its results from the 12 months to 30 June a major improvement on the 2018 financial year. Production jumped 54% while all-in sustaining costs fell 27%, and this momentum has followed through into 2020 with production levels surpassing their 176,000oz target levels.

In fact, PAF’s production profile looks very healthy. Guidance for 2021 stands at 190,000oz and the 200,000oz marker is forecast to be achieved by 2023.

PAF is also better positioned to cope with the impact of the pandemic than many of its peers due to most of its production coming from surface activities which are less labour-intensive.

During the South-African lockdown, PAF’s surface mining operated at 70% of normal capacity and has since returned back to 100% capacity.

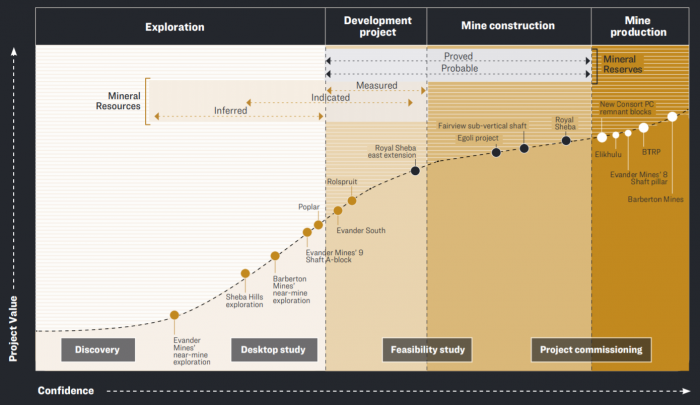

Regarding exploration and development, PAF have a robust project pipeline with five projects in early stage exploration, three in a more advanced development stage and a further three mines under construction.

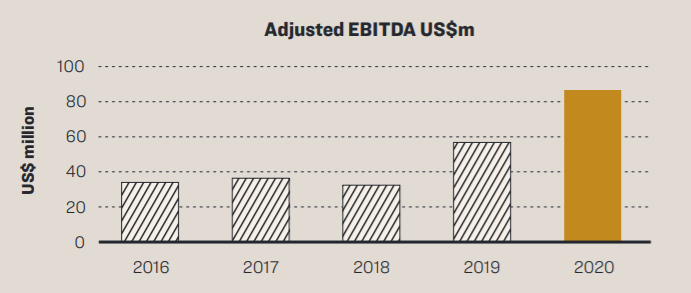

Rising earnings and falling debt, quite a combination

With a strong gold price, it is no real surprise to see PAF’s earnings growing at a decent pace. Adjusted earnings increased by 52.3% this year to $86.5m, up from $56.8m the year prior.

What’s more pleasing is PAF’s debt levels have been dropping as fast as earnings have been rising. This year, net debt has halved to $62m and PAF expect to be debt free by 2022.

This improving financial foundation puts PAF on a far better footing to deal with the economic uncertainty surrounding South Africa in the wake of the pandemic.

In terms of valuation, PAF currently trade on a mid-tier forward price/earnings multiple of 8. This looks attractive when compared to PAF’s 27.5% forecast EPS growth – giving PAF a price/earnings growth ratio (PEG) of 0.4 (where anything below 0.9 is generally worth paying attention).

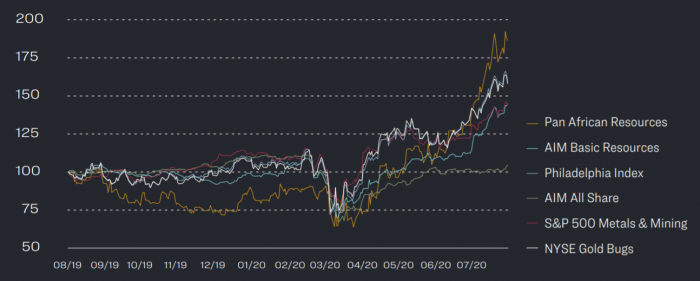

Relative strength

Make no mistake, PAF’s fortunes are intrinsically linked to the spot price of gold, albeit with a small but helpful hedge created by the weak rand against the dollar.

PAF’s share price has started to out-perform the AIM Basic Resources Index and the NYSE Gold Bugs Index since the summer months – reflecting PAF’s improving financials.

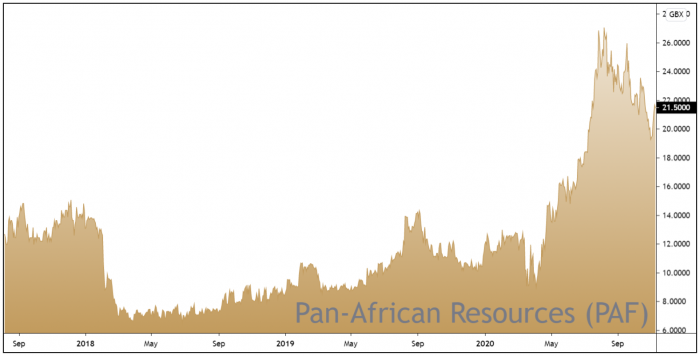

After hitting highs of £28 during the summer, PAF has undergone a 50% retracement of the Apr-Jul near exponential rally – reflecting the retracement in the underlying price of gold.

Interestingly, PAF’s retracement phase has taken the form of a well-defined descending channel and this indicates that what we’re currently seeing is merely a pullback within a long-term uptrend.

Hence, allowing for gold price volatility around the US election, we still expect PAF’s retracement phase to resolve itself in higher prices.

Overall, we feel PAF’s strong production outlook, combined with its robust exploration programme and improving debt levels, make PAF the perfect choice for increasing our gold exposure.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.