30th Jul 2020. 8.59am

Regency View:

BUY Oxford Metrics (OMG)

Regency View:

BUY Oxford Metrics (OMG)

The motion capture company with a vision for success

From Hollywood to hospitals, 3D motion capture is a highly diversified, fast growing market.

It’s a market that is expected to see a compound annual growth rate (CAGR) of 12% over the next five years, reaching $250m (£190m).

Today’s stock, Oxford Metrics (OMG) is a global leader in high-precision motion measurement and analysis.

Through its Vicon business, Oxford Metrics supply around 50% of the world market.

A diversified client base includes the likes of NASSA, MIT and Disney. Its proprietary motion measurement analytics is used in an ever-expanding range of applications including sport science, engineering, scientific research, medical equipment, movie making and game development.

Vicon’s product list combines state of the art hardware, such as 3D imaging cameras and inertial sensors, with patented software packages specifically designed for tasks such as biomechanics analysis, robot tracking and computer-generated imagery (CGI).

Gaining traction in high growth markets

Whilst Vicon did experience some order shipment issues due to lockdowns in the UK and US, the business has been making significant progress in key growth markets of game development and elite sports. Contract wins in the NBA basketball, NFL football and MLB baseball have been followed by deals with Asian gaming giants Konami in Japan and Tencent in China.

Vicon have also recently enhanced their product base with the launch of their Capture.U app which allows users to see human skeletal movement and inertial measurements overlaid on live video in real-time.

The app is completely unique in the market place and offers a low-cost entry point for sports scientists to use Vicon’s highly sophisticated technology. The software is designed to work with Vicon’s Blue Trident sensor hardware and features include an Augmented Reality (AR) mode that overlays an avatar or skeleton on real-time video, opening up a new way to review movement.

Yotta provides revenue stability and diversification

Alongside motion measurement, Oxford Metrics has a second business, Yotta which provides cloud-based infrastructure asset management software to central and local government agencies.

The software enables its users to optimize the management of assets such as street lights, drainage channels and road surfaces. And whilst Yotta contributes considerably less to group revenues than Vicon, the profile of these revenues tend to be very sticky and recurring in nature, hence Yotta add a great deal to group cash flow and revenue visibility.

Yotta delivered a strong performance in the first half with new contract wins from Somerset, South-Gloucestershire and Warwickshire county councils. Yotta also secured three new partnerships; with Panasonic to run waste collection vehicles, with Telensa, the UK’s largest provider of smart IOT street lighting and with B-bits to aid in the running of their Love Clean Streets initiative.

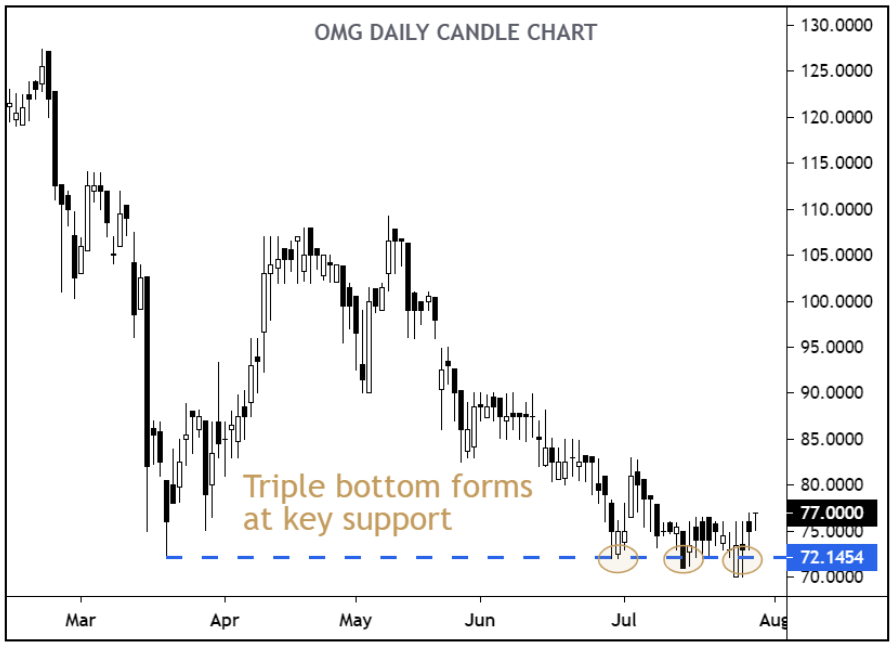

Tripple-bottom reversal forms at key support

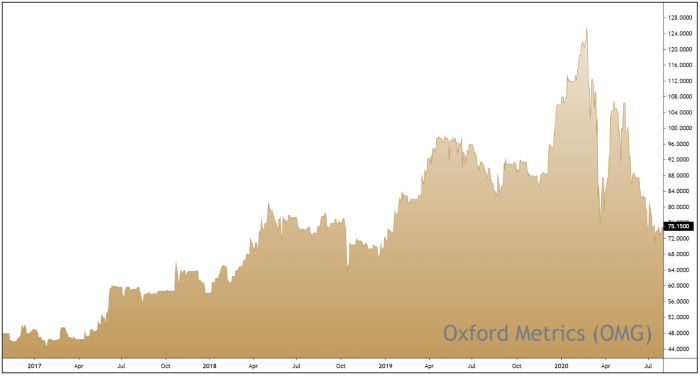

After surging more than 40% from December to January, Oxford Metrics’ shares are now changing hands at a very attractive level from both a technical and valuation standpoint.

Recent price action looks to be hammering out a bottom around a key level of support created by the March spike lows at 72p.

This month, the shares have bounced three times from 72p, forming a bullish ‘triple-bottom’ reversal pattern – indicating that the bad news is now fully priced in and that the shares are being accumulated.

From a valuation standpoint, Oxford Metrics now trade on a forward PE ratio of 14.1, which puts them in the top quartile of the Software & IT Services sector.

They have a strong, debt-free balance sheet and a £14.2m cash pile which leaves them well placed to enhance organic growth through acquisitions.

Overall, the firms improving level of revenue visibility combined with key contract wins in the fast-growing gaming market, make Oxford Metrics an attractive long-term addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.