4th Jan 2024. 9.07am

Regency View:

BUY Nexteq (NXQ)

Regency View:

BUY Nexteq (NXQ)

Nexteq: Powering tomorrow’s tech innovations

January is a time for bargain hunting, be it on the clothes rack, kitchen showroom, or stock market.

When it comes to long-term investing, finding a bargain means uncovering a high-quality company trading at a discounted valuation, akin to discovering a designer label at a fraction of its original price.

Nexteq (NXQ) isn’t just a sale find; it’s a debt-free, high-return on equity business that is trading well below its fair value.

Tailored tech solutions

Formerly known as Quixant, Nexteq specialises in creating technology solutions for various industries.

They craft innovative products like gaming platforms, advanced displays, and control systems used in things like video slot machines, broadcast equipment, and other industrial devices. Essentially, they design and make specialised tech that other companies use to build their own cool gadgets and machines.

Their primary brands consist of two key divisions:

1. Quixant division: This segment focuses on gaming technology solutions. Nexteq’s Quixant division offers a range of computer platforms, including entry- and mid-level products, catering to the gaming industry. These platforms power a variety of gaming machines and terminals, enabling customers to outsource the computer platform and concentrate on developing engaging gaming content. The division also extends its services to the provision of turnkey gaming cabinet solutions.

2. Densitron division: This division is divided into two main components:

- Broadcast technology: Densitron supplies advanced human-machine interface solutions to the broadcast industry. It specializes in providing display components and touch-screen technology, enabling seamless integration into production control rooms. Their solutions address the challenges of touch-screen technology adoption in broadcast, offering tactile feedback and precision in graphical interfaces.

- Industrial display components: Besides broadcast, Densitron supplies display components to various industrial sectors. These components cater to different markets, although recent trends have shown a slowdown in demand due to macroeconomic conditions.

In terms of revenue split, the Gaming Technology division contributed around 60-65% of total revenue (H1 23), while Densitron accounted for the remaining 35-40%.

Strategic avenues for Nexteq’s expansion and sustained growth

Nexteq has various growth opportunities they’re actively pursuing:

Expansion in gaming tech: This involves catering to the expanding global gaming market, especially in regions like Asia. Their focus is not only on providing hardware but also on offering complete turnkey solutions. They aim to capitalize on the demand for gaming equipment in casinos, arcades, and other entertainment venues by providing innovative products and services.

Diversification in broadcast tech: Leveraging their Densitron division’s capabilities in providing display components and emerging broadcast technology, they’re targeting the broadcast sector. The aim is to provide solutions for professional broadcast equipment, specifically focusing on enhancing the human-machine interface in production control rooms.

Penetration into new verticals: Nexteq is exploring opportunities in other industries beyond gaming and broadcast sectors where their expertise in technology solutions can be valuable. This includes identifying and investing in sectors undergoing technological changes where they can offer optimized, specialized solutions.

Product development and innovation: Their strategy involves continuous R&D investment, developing new products, and enhancing existing ones. This allows them to stay ahead in the market by offering cutting-edge technology solutions that cater to the evolving needs of their customers.

Strategic acquisitions: Nexteq may complement its organic growth strategy through targeted acquisitions. They aim to acquire companies that enhance their technical capabilities, provide access to new markets, or offer innovative technologies that align with their business model.

Resilient growth amidst market turbulence

Despite significant market hurdles which included global component shortages, Nexteq’s first-half results reflected resilient growth. The company delivered 6% top line growth, driven by a 9% jump in gaming sales to $34.3 million.

The gaming sector’s robust growth, despite lingering supply disruptions, signifies Nexteq’s adept handling of increased demand, shipping 13% more boards than the previous year. Moreover, Nexteq’s strategic foray into turnkey gaming cabinets and partnerships with prospective customers set the stage for continued expansion within the post-COVID recovery gaming market, especially in Asia.

Densitron faced some headwinds due to softer demand in some sectors, as customers adjusted their inventory levels amidst worsening economic conditions. However, the division’s strategic focus on high-quality revenue enhanced gross margins. And the burgeoning broadcast tech sector registered a 10% sales increase – reflecting a significant investment made by Densitron in touch-screen technology, positioning itself as a leader in this evolving market.

Despite the challenges, Nexteq’s commitment to innovation, fortified by 20 patents and a robust cash reserve, currently standing at $18.5 million, enabled the company to bolster its foothold in higher-margin sectors, ensuring sustained growth amidst a tough market landscape.

Trend shifts and compelling valuation

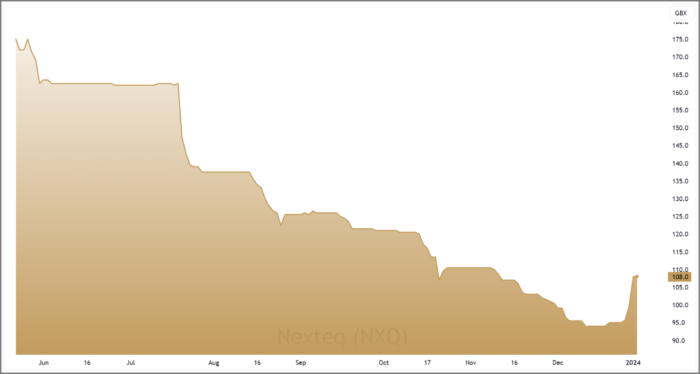

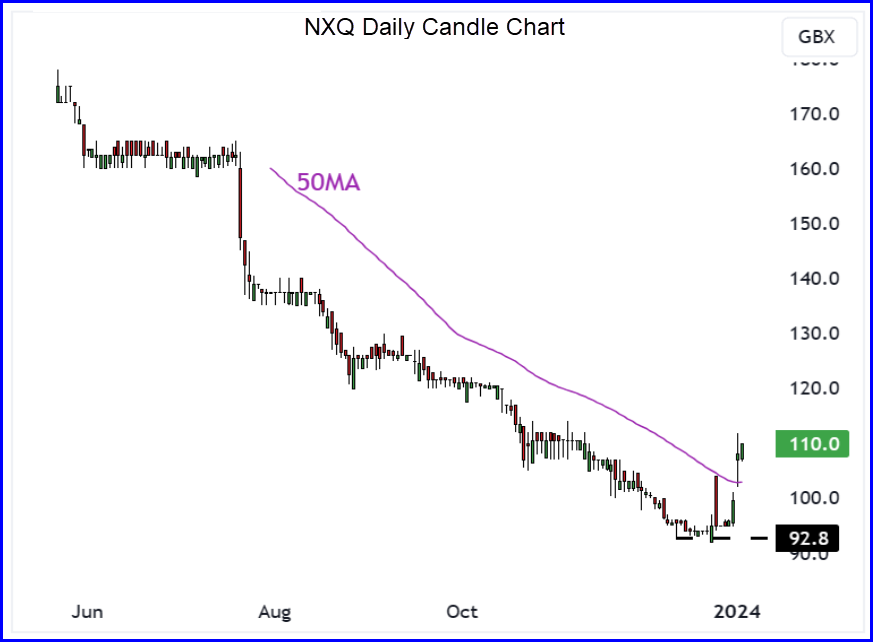

Over the past six months, Nexteq’s share price has trended downwards. However, recent sessions have seen a shift in momentum, breaking above the 50-day moving average for the first time since May, indicating a potential change in sentiment.

Nexteq currently trades at a forward Price-to-Earnings (PE) ratio of 7.7, a favourable position compared to its peers. The single-digit PE also compares well to forecasted double-digit EPS growth of 11.5%. Moreover, the stock is trading at an appealing 53% discount to its estimated fair value.

In summary, Nexteq holds promise as a high-quality small-cap, particularly due to its growth potential. The current valuation presents an attractive opportunity, especially if market conditions improve in 2024, aligning its valuation closer to its intrinsic value.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.