Regency View:

BUY Next Fifteen Communications (NFC)

Next Fifteen set to outperform with Saatchi saga behind them

“Everyone will be famous for 15 minutes, but we care about what happens next” – Next Fifteen CEO Tim Dyson.

Next Fifteen Communications (NFC) ‘make brands famous’ and we’ve been big fans of the digital marketing and communications group for several years.

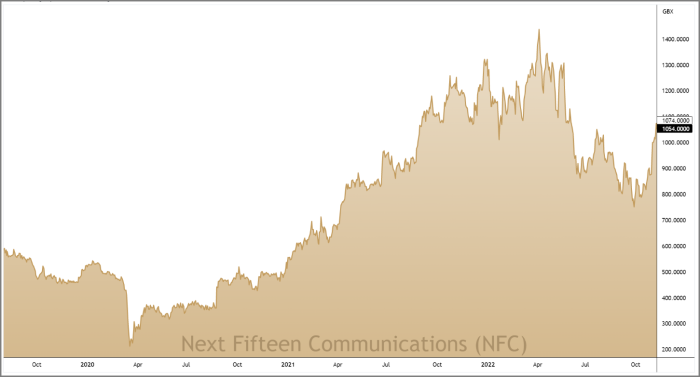

We highlighted the stock during the indiscriminate pandemic sell-off in 2020, banked a 140% gain in just over a year and have been patiently waiting for the right opportunity to jump back onboard.

And now with a protracted takeover saga behind them and fresh momentum on the price chart, we believe the timing is right to snap up this high-quality growth stock once again.

Deep-pocketed big-tech client base

Next Fifteen’s client base reads like a who’s who list of the giants of global tech…

Alphabet and Amazon, Meta and Microsoft, Next Fifteen has 57 of the world’s top 100 brands on its client list. And 13 of its top 20 clients have been with the group for more than three years.

This skew towards deep-pocketed big-tech and away from the hard-hit travel and leisure sectors helped to insulate Next Fifteen from the worst of the pandemic and has created a high degree of earnings visibility.

Next Fifteen’s half-year 2023 results saw revenue growth hit 65% year-on-year with organic growth of 31%, acquisitive growth of 27% and an 8% forex tailwind which comes from having 60% of your customer base billed in US dollars.

Profit before tax (PBT) jumped 73% in the half-year and recent contract wins added Morrisons, VMware and Verizon to Next Fifteen’s big name client base.

At the group level, Next Fifteen’s four divisions are yet to see any signs that a global economic slowdown is impacting advertising spend:

Customer Insight – is the most B2C exposed of the group divisions. Next Fifteen’s half-year numbers indicated that this division is trading well with no evidence of any customer slowdown.

Engage – has the broadest spread of clients with a high proportion being US big tech. So far, reduced spend by some clients is being offset and net client spend in this division remains positive.

Activate – this division saw very strong growth in FY21 and FY22 following the pandemic rebound. This growth has continued, albeit at lower levels.

Business Transformation – this division is dominated by a large Mach49 contract win worth $500m over five years which creates a high degree of fixed certainty around revenue and margin.

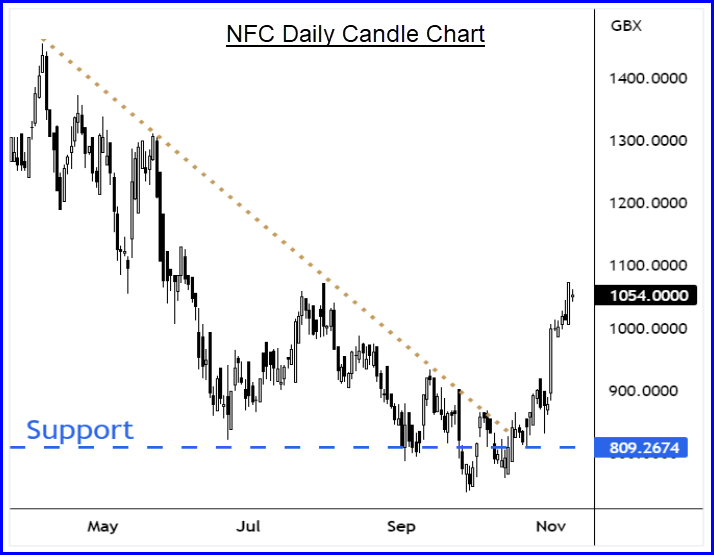

Shares rally from support as Next Fifteen end M&C Saatchi takeover saga

Markets hate uncertainty and when Next Fifteen became embroiled in a bidding war for M&C Saatchi the shares started to underperform.

In June, Next Fifteen had tabled a bid which represented a 40% premium to M&C Saatchi’s market valuation, a bid that did not impress investors.

Next Fifteen’s share price had pulled all the way back from £14 in April to £8 as the takeover saga rumbled on.

However, last week news broke that M&C Saatchi shareholders had voted down a resolution to approve the Next Fifteen bid, ending the speculation and providing some much-needed clarity for Next Fifteen’s investors.

Alongside the failed bid news, Next Fifteen issued a brief but bullish trading statement which said its strong first half momentum had continued into Q3 and that full-year numbers are “expected to be at least in line with management expectations”.

Since the news broke, the shares have undergone a strong rally from £8 support and short-term momentum has realigned with Next Fifteen’s long-term uptrend.

Attractive valuation backed by strong cashflows

When it comes to assessing the merits of an AIM stock, we place a great deal of emphasis on cashflow.

High levels of cash generation make it much easier for smaller businesses to grow without diluting shareholders, and Next Fifteen’s cashflows have more than doubled in the last three years.

In full-year 2022, Next Fifteen generated £85.2m operating cashflow of which £79m flowed through into free cashflow, creating a strong balance sheet which Next Fifteen have successfully leveraged to generate acquisitive growth.

Next Fifteen’s revenues have grown at a compound annual rate (CAGR/Avg) north of 20% over the last five years and they have a market-beating Return on Capital of 16.1%.

In terms of forward valuation, Next Fifteen trade on a forward price to earnings (PE) multiple of 12.3. This looks attractive relative to forecast EPS growth of 80.3%, giving the stock an eye-catching price to earnings growth (PEG) ratio of just 0.3.

With fresh momentum on the price chart, and the M&C Saatchi saga behind them, we expect Next Fifteen to have a strong finish to the year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.