8th Feb 2023. 4.41pm

Regency View:

BUY Netcall (NET)

Regency View:

BUY Netcall (NET)

Netcall bring AI-powered insights to everyday business

‘Customer engagement’ – a dry corporate buzzword that’s so overused it could mean anything.

But keeping people interested and interacting with your brand is the life blood of any business. It’s also very difficult to do successfully.

Websites, social media, blogs, and email marketing are just some of the many touchpoints that the average business must manage.

Delivering a consistent message, keeping your brand at the top of the customer’s mind, and capturing data across these touchpoints is something that Netcall (NET) help businesses with.

Netcall’s AI-powered customer engagement platform has amassed a host of big-name clients from all sectors.

Revenue growth is very consistent, and profits have more than doubled in the last year. And with the shares pulling back to key support, we believe the time is right to snap up this high quality tech stock.

Making advanced AI simple and easy to use

Netcall’s Liberty platform is a suite of AI-powered automation and customer engagement tools.

These tools are designed to integrate a businesses communications and data systems to improve the efficiency and effectiveness of digital customer journeys.

Yes, we’ve fallen back into corporate buzzword territory, but these are products that allow everyday businesses to utilise the benefits of advanced AI and machine learning technology:

Liberty Create – a low-code development platform that enables business to quickly produce apps that automate customer experience.

Liberty RPA – an AI-powered robotic process automation that allows business to boost productivity. The RPA Studio software allows businesses to reduce manual tasks, increase consistency and scale up.

Liberty Converse – a cloud contact centre solution which blends practical AI and automation with agent-assisted technology to boost productivity, reduce costs and improve customer experience.

Liberty Connect – an AI-powered chatbot which builds simple chat flows to answer routine questions, while freeing up contact centre agents for more complex enquiries.

Whilst Netcall’s product suite can be applied to any business, Netcall have a “core focus” on the Healthcare, Government and Financial Services sectors – representing 88% of total revenue.

Netcall’s customer base includes big blue chip names like Legal and General, Lloyds Banking Group, ITV, Nationwide Building Society, Santander and Aon.

And the value-add nature of Netcall’s products mean that contracts are sticky, creating a group revenue profile which has more than two-thirds recurring revenue.

Cloud offering drives growth

Netcall’s “engine of growth” is its Cloud offering which represents its largest revenue stream, growing 30% to £10.7m (FY22).

In terms of Annual Contract Value (ACV), Netcall’s leading indicator of future performance. Total AVC increased 31% to £24m last year (FY22) while Cloud AVC surged 60% to £15m with Cloud deployments accounting for 90% of all new product bookings.

Riding the theme of ‘transition to the Cloud’ is nothing new to AIM Investor and Netcall are very well positioned to benefit.

Netcall’s Cloud offering has a much lower cost base which is causing margins to widen which in turn means profitability is rising without needing to deliver huge levels of top line growth.

“We continued to see solid demand for our Intelligent Automation and Customer Engagement offerings, in particular for cloud-based solutions, including an increase in new customer wins” commented Henrik Bang, Chief Executive who joined Netcall in 2004.

“This has resulted in accelerated double-digit revenue and profitability growth underpinned by a significant increase in recurring revenue” he added.

Fast earnings growth justifies premium valuation

Netcall has an impressive track record of delivering year-on-year profitable growth.

Revenue has grown at a compound annual rate of 13.5% averaged over five years and profits are growing even quicker.

Net profit more than doubled in FY22 from 0.97m to 2.40m and net profit is forecast to £4.6m in FY23 and £5.6m in FY24.

Operating cashflow is modest at £6.34m (FY22), but with minimal levels of capital expenditure more than 80% flows through into free cashflow.

This steady profitable growth has created a rock-solid debt free balance sheet which has a cash position of £17.6m (FY22).

Of course, when investing on AIM you tend to get what you pay for and Netcall’s high quality financials are reflected in a high forward PE ratio of 28.8.

Whilst this is one of the highest valuations in the Software & IT Services sector, it looks reasonable given Netcall’s impressive growth in earnings per share (EPS) which has a 3yr compound annual growth rate (CAGR) of 177.95%.

Prices retest broken resistance

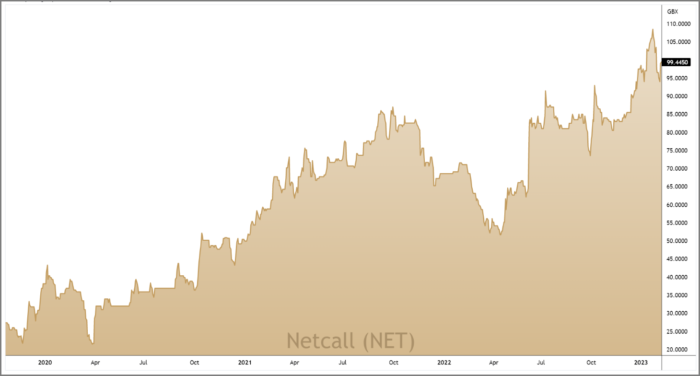

Netcall’s share price is locked in a multi-year uptrend fuelled by a series of strong trading updates and broker upgrades.

A key characteristic of long-term uptrends is that broken resistance tends to become support as prices ‘staircase’ higher and we’re seeing this in Netcall’s recent price action…

Having gapped higher in June following a significant contract win with an S&P 500 financial services firm worth $19m, Netcall’s share price broke through a key area of resistance in January (see chart right).

This break higher has been followed by a steady retracement, taking prices back down into the broken resistance zone.

This week we have seen the shares rally from the broken resistance zone, indicating that Netcall’s long-term uptrend has resumed.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.