Regency View:

Buy Mulberry (MUL)

Mulberry back in fashion with the shares looking cheap

Those of you who have had the sobering experience of glancing at a price tag on a Mulberry (MUL) handbag will certainly not associate the word ‘cheap’ with the UK luxury fashion house.

Mulberry’s share price, on the other hand is more bargain basement than Paris fashion week…

The shares are trading at a 50% discount to Fair Value on a backdrop of improving sales and a strong earnings outlook.

‘Made in England’ paying dividends in global supply crisis

Mulberry is the largest manufacturer of luxury leather goods in the UK with two Somerset-based factories producing 60% of its bags.

This local production base has come in very handy given the global supply chain crisis caused by Asian factory lockdowns and widespread container shipping disruption.

Mulberry avoided the kind of shortages that have forced some fashion companies, including Germany’s Hugo Boss and Italy’s Benetton, to bring production closer to their home countries.

And Mulberry is planning to enhance this strategic advantage, adding one extra production line and another if sales continued to grow at a similar pace to that seen in their recent Half Year results…

Indeed, Mulberry’s sales increased 34% to £66m in the six months to 25th September, compared with £49m in the same period in 2020 as it bounced back from the impact of the pandemic.

The sales recovery took Mulberry back into the black with pre-tax profits of £10.2m in the Half Year, compared with a £2.4m loss in 2020.

China’s insatiable demand for luxury fashion

Another key highlight from Mulberry’s upbeat Half-Year numbers was a 38% jump in China retail sales, of which 43% were online, and the demographics of the Chinese market look very healthy…

According to consultancy Oliver Wyman, 50% of Chinese luxury accessories and fashion shoppers just entered the market in the past 12 months, and they are expected to drive more than 80% of market growth this year.

“Unable to travel overseas and having money to spend, many Chinese are attracted to the idea of starting their luxury journey this year. These new customers have become the driving force of China’s luxury goods market growth in 2021,” said Imke Wouters, a Retail and Consumer Goods Partner at Oliver Wyman.

Asian expansion is a key strategic objective for Mulberry who added four new stores in the Asia Pacific region during the six-months to end September, taking their total number of stores in the region to 38.

In July, Mulberry launched a We Chat programme in China, which coincided with the launch of its Alexa Chung collaboration which was part of the brand’s 50th anniversary celebrations.

The We Chat initiative is a long-term marketing package designed to build brand awareness in the region and attract the younger Chinese demographic which is driving growth. It allows Mulberry to regularly update content and target campaigns and products.

Discount sale

Whilst Mulberry’s balance sheet isn’t debt free, its cash position has improved considerably in recent months, from £11.8m (FY21) to £30.3m on a trailing twelve-month basis (TTM).

The business generates plenty of cash, with Operating Cashflow of £38.2m (TTM) and Free Cashflow of £29.8m.

And the shares currently trade on a Price to Free Cashflow ratio of 10.8, one of the most attractive in the Textiles & Apparel sector.

In terms of traditional valuation metrics, Mulberry trade on a forward PE multiple of 23, which looks reasonable given forecast earnings per share (EPS) growth of 206%.

The shares are also trading at a significant discount to Fair Value – an estimate of what a stock price is worth based on the cash flows the company is expected to generate in the future.

Mulberry’s approx. Fair Value is £8.10 per share, hence the shares are currently trading at a deep discount which leaves scope for a re-rating should sales continue to recover.

Bullish newsflow backed by buying

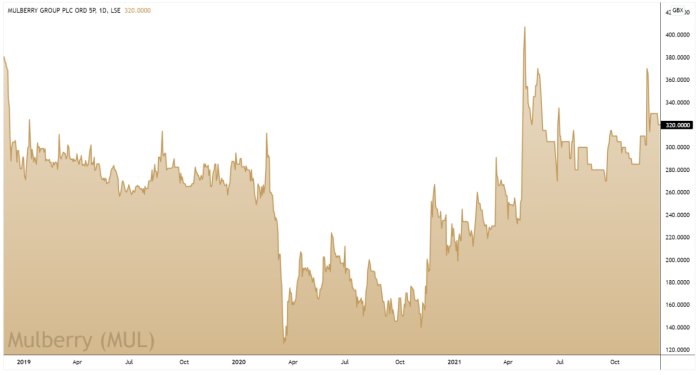

Mulberry’s share price has been trending broadly higher since the vaccine news in November 2020.

Of significance is the market’s reaction to this year’s trading updates…

The shares burst higher in April after Mulberry said it would outperform expectations, and we saw a similar reaction to Mulberry’s November update as sales returned to pre-pandemic levels.

When bullish newsflow is backed by buying in the market, this adds weight to Mulberry’s technical backdrop.

And with recent price action undergoing a small pullback from the November spike highs, we believe the technical timing looks accommodative.