28th Nov 2019. 9.06am

Regency View:

BUY Midwich (MIDW)

Regency View:

BUY Midwich (MIDW)

Amplifying our AIM Portfolio

Worldwide, the market for professional audio-visual (AV) is forecast to hit $230bn by 2023.

The industry uses rapidly advancing technology to transform the way businesses communicate, schools educate, and entertainers entertain.

According to the Audio-visual and Integrated Experience Association, key advancements in voice recognition, artificial intelligence and cloud computing are likely to propel the AV industry to even greater heights. One company with a strong foothold in this fast-growing market is AIM-listed Midwich (MIDW).

Midwich is a specialist AV distributor catering to the trade market.

Whilst Midwich is a relative newcomer to AIM, it has over 40 years’ experience in the AV market and started out selling overhead projectors to businesses back in the 1970’s. Now Midwich is the UK’s largest trade-only tech distributor – delivering double digit revenue growth for the last five years.

The sticky middleman

Midwich essentially sits in the middle of supply chains to help manufacturers maximise their reach.

From innovative large format digital displays manufactured by Phillips to pixel free 4K laser projectors from Panasonic, Midwich have a carefully crafted product portfolio which covers all major audio-visual technologies. The Group, which includes over 17 sub-companies, distribute to more than 17,000 customers globally, most of whom are professional AV integrators or IT resellers.

During the last three years the Midwich have chosen to position their product mix more towards specialist products that require a higher level of technical support. This ongoing support is sold as an ‘add on’ at point of purchase and has the dual benefit of boosting profit margins and strengthening the ‘stickiness’ of both vendor and customer relationships.

Demand for AV is booming

Despite fears over slowing economic growth in the UK and Europe, demand for new AV technology is booming…

Midwich has reported a 90% spike in demand for large format digital displays from the education sector as more emphasis is placed on interactive learning.

The firm have also seen a 66% rise in the number of laser projectors sold during the first half of the year, with museums and auditoriums as well as theme park rides and interactive experiences seeking to utilise 3D projection technology.

Demand for rentable LED display panels jumped 65% in the first half of 2019 so too did demand of OLED TV’s.

European expansion gathers momentum

Through as steady series of small acquisitions, Midwich has started to reduce its reliance on the UK market.

UK sales now account for just under half of total sales, compared with 58% at the same time last year. This has been largely due to the growth of its European business which saw a 48% jump in first half revenue – driven by acquisitions and strong performances in France, Germany and the Netherlands.

The recent acquisitions of MobilePro (Switzerland), Prase (Italy) and AV Partner (Norway), represent Midwich’s strategy of adding higher margin specialist tech to their product mix and they also expand their European footprint into new territories.

While, first-half acquisitions led to an increase in net debt and costs, management expect the group’s typically higher cash generation in the second half of the year to reduce leverage for the full year.

Full-year adjusted pre-tax profits are forecast to hit £34m, giving earnings per share (EPS) of 31.1p, a 14% increase on 2018. And although Midwich’s forecast earnings multiple (PE ratio) of 17.3 is by no means bargain basement, the firms tight capital management means it produces a very attractive returns on capital employed of 20.3%.

Technical timing looks right

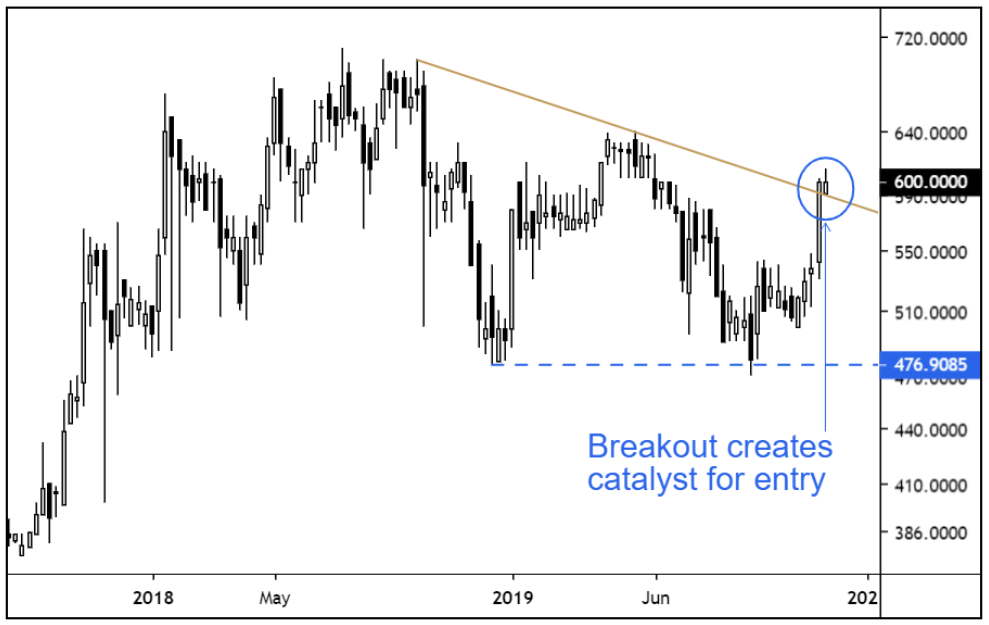

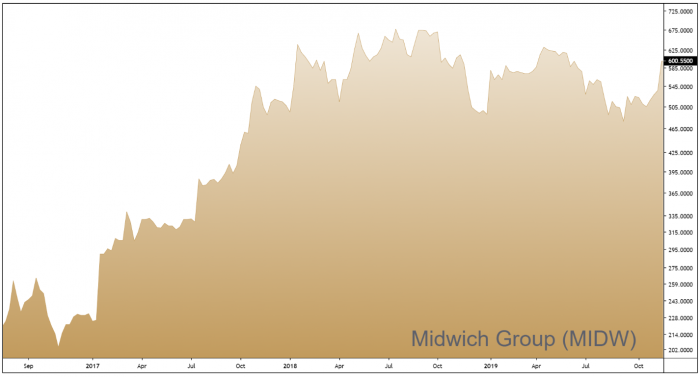

After a blockbuster 2017 which saw the shares more than double in value, price action during the last eighteen months has been much less eye catching. The shares have undergone a prolonged period of sideways consolidation, taking them out of the headlines and into a far more attractive valuation zone. These periods out of the limelight are very healthy and whilst the shares haven’t been surging to new highs, they have been holding their ground and building up stored potential.

Having hammered out a key area of support at 476p, the shares have started to regain momentum and last week’s price action saw prices break and close above a descending retracement line which had formed on the weekly candle chart. Last week’s decieive break higher signals that short-term momentum has realigned with longer term uptrend and we believe the technical timing is right to add Midwich to our AIM Investor portfolio.