Regency View:

BUY Marlowe (MRL)

A beautifully executed ‘Buy and Build’ strategy

“The whole is greater than the sum of its parts”…

This timeless observation from Aristotle is the bedrock of a ‘Buy and Build’ strategy.

A strategy which involves accelerating organic growth through a series of strategic acquisitions, enabling the acquired company to immediately benefit from increased scale, harnessing the concept that the whole is greater than the sum of its parts.

And just as a building is only as strong as its foundations, the ‘platform’ company must have stable management and well-developed infrastructure, capable of supporting and driving the rapid growth.

Today’s stock, Marlowe (MRL) is a well-oiled buy and build machine which has a proven track record of delivering shareholder value.

They operate a Software as a Service (SaaS) model in the business-critical and compliance services space, generating high levels of recurring revenue and increasingly impressive amounts of operating cashflow.

Marlowe’s corporate structure consists of two Operating Divisions:

Testing, Inspection and Certification (TIC) – Marlowe’s largest division, generating revenues of £157.4m (FY21), with adjusted earnings (EBITDA) of £19.9m on margins of 12.6%.End markets include Fire Safety & Security, Water Treatment & Air Hygiene, Contractor Compliance.

Governance, Risk and Compliance (GRC) – GRC is smaller but higher margin, generating revenues of £34.6m (FY21) with adjusted earnings (EBITDA) of £11.3m on margins of 32.7%.End markets include Health & Safety, Employment Law/HR, Occupational Health, Compliance Software.

Decentralised, divisional structure

All of Marlowe’s end markets are complimentary and this has created enhanced economies of scale – making them more attractive to clients who require a single outsourced, nationwide, provider of a comprehensive range of regulated health, safety and compliance solutions.

Marlowe’s decentralised, divisional structure is designed to undertake several acquisitions concurrently…

In full-year 2021, Marlowe completed 15 acquisitions, costing a total of £113m. And within the first year alone, these acquisitions have delivered revenues north of £60m.

Marlowe has an average pre-synergy EBITDA Multiple of 7x (since April 2020) – underlying their excellent execution of a buy and build strategy.

Boring businesses, exciting investments

Compliance Software, Health & Safety, Employment Law…hardly the juiciest market segments, but boring businesses can make for exciting investments…

Our current positions in the seemingly boring business-critical and compliance services space include Ideagen (IDEA), Restore (RST), Kape Technologies (KAPE) and Sureserve (SUR), all positions are in very healthy profits for us.

Marlowe have all the quality hallmarks of the above stocks, strong revenue track record and the visibility that comes with ‘sticky’ long-term contracts for essential services.

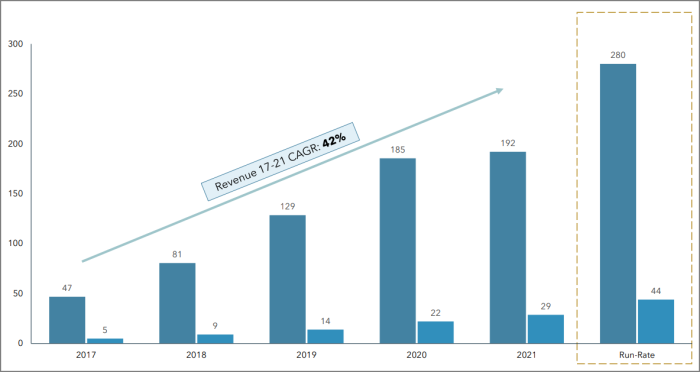

Cumulative average revenue growth (CAGR) over the last five years is 42%, and at their current run-rate, revenues are set to hit £280m in full-year 2022 with a recurring revenue rate north of 80%.

Marlowe also have the financial flexibility that comes with a strong, debt free balance sheet and a high proportion of earnings converting into free cashflow…

In Full-Year 2021, net cash generated from operating activities surged 153% to £28.3m (FY20: £11.2m) along with a significantly improved underlying cash conversion of 110% (FY20: 83%).

Ambitious growth plans

The business-critical and compliance service space is such rich breeding ground for high-quality investments because it has multiple long-term growth drivers which have been unaffected, if not enhanced by the pandemic…

Increased public awareness around safety & compliance standards has increased through social media and review websites and forums. This has created a cycle of tightening regulation and heightened sensitivity to corporate reputational risk.

There is more and more onus on organisations to ensure the safety & compliance of their properties and people, and Marlowe is perfectly positioned to take full advantage…

Marlowe believe its target addressable market in the UK alone is worth £6.8bn, led by the Fire & Safety sector which has an estimated size of £1.7 billion but a low-growth rate.

Higher growth sectors include Employment Law, HR and Occupational Health, which are worth a combined £1.8bn and are growing at around 6% per year.

Marlowe expect to more than double its FY21 revenues of £192m to £500m within the next three years. They also have a three-year target of £100m adjusted EBITDA and 20%+ EBITDA margin.

The trend is your friend

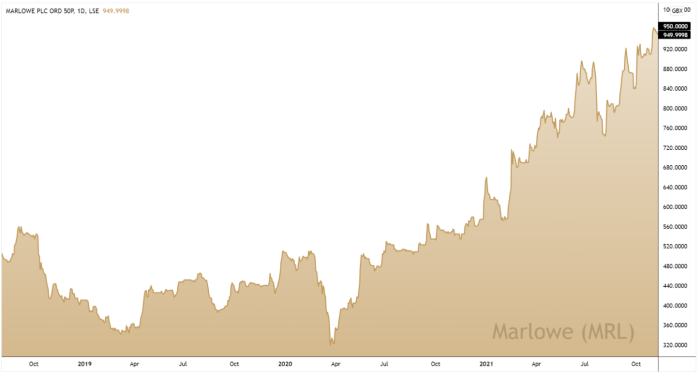

Marlowe’s share price has plenty of momentum…

The shares have formed a powerful uptrend during the last two years, and this trend has showed no signs of slowing.

Recent price action has seen Marlowe break and hold above a major area of resistance created by the summer highs at 907p.

With the resistance area cleared, we expect Marlowe’s long-term uptrend to accelerate through a series of steepening trendlines.

And a strong share price doesn’t necessarily equate to an expensive valuation….

We view Marlowe’s forward earnings multiple (PE) of 23.6 as more than reasonable given it’s forecast earnings per share (EPS) growth of 69.2% and its rapid improvement in operating cashflow.