24th Aug 2023. 8.53am

Regency View:

BUY M P Evans (MPE)

Regency View:

BUY M P Evans (MPE)

Cultivating growth and harvesting yield: M P Evans’ journey in sustainable palm oil

Palm oil plays a pivotal role in our daily lives, appearing in about half of packaged products on grocery store shelves.

The hardy African oil palm, has an impressively high yield, requiring less energy and land than comparable oil crops.

However, the shadow of deforestation casts a challenging light on palm oil, raising significant controversies due to its environmental impact.

Amidst this complex landscape, M P Evans (MPE) has emerged as a key player committed to producing palm oil that adheres to environmentally responsible practices.

MPE grow palm trees in smart ways that don’t harm the planet. Instead of cutting down forests, they use land in Indonesia that’s already been used for farming. MPE is a member of The Roundtable on Sustainable Palm Oil (“RSPO”) and is well placed to meet the growing demand for sustainable palm oil from Europe.

Much like the palms on its plantations, MPE’s financials are strong, sustainable, and high yielding. The business has a proven track record for delivering profitable growth, generates plenty of cash and has a debt-free balance sheet.

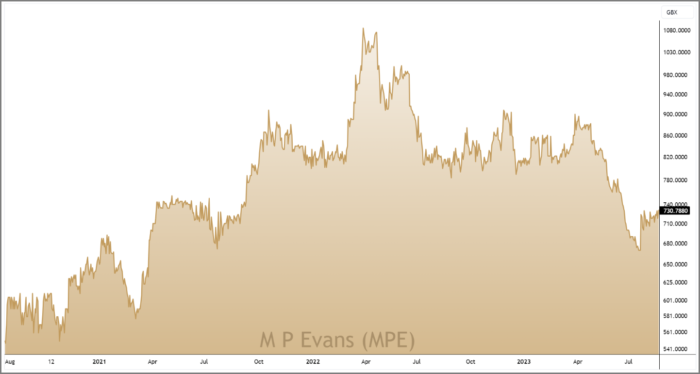

And with the shares currently trading at a deep discount, we believe the time is right to lock in MPE’s market-beating dividend.

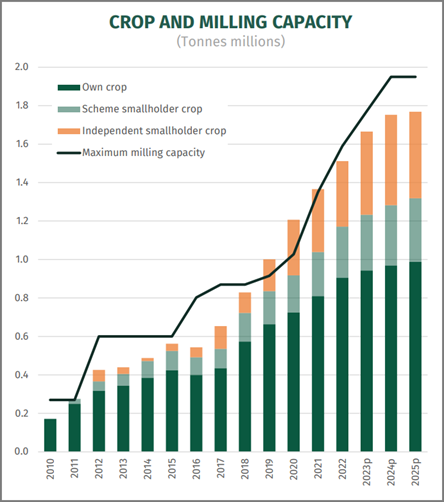

MPE plantations poised for substantial boost in crop output

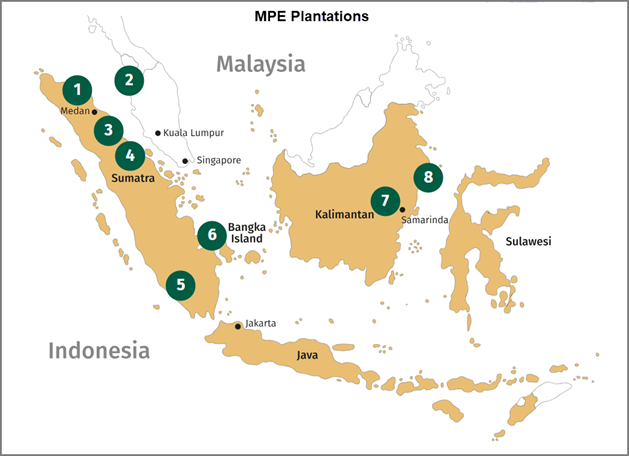

MPE’s plantations are strategically spread across five Indonesian provinces, including North Sumatra, South Sumatra, Aceh, Bangka-Belitung, and East Kalimantan.

One distinctive aspect of MPE’s plantations is the youthful average age of its palm trees, standing at just 10 years. This attribute holds significant importance due to the growth pattern of palm trees…

Young palms experience a steep increase in yield during their initial years, peaking around a decade of age. This means that MPE’s plantations are poised for a substantial boost in crop output in the coming years, as its palms enter their prime yielding phase.

This growth potential aligns with MPE’s forward-looking planting strategy, where new land is continuously cultivated to ensure a dynamic and high-yielding production base. This strategic approach not only supports MPE’s financial performance but also underscores its commitment to sustainable practices by optimising crop production on existing land and minimizing the need for further deforestation.

In 2022, MPE achieved a crude palm oil production of 341,700 tonnes, up from 312,900 tonnes in the previous year.

Despite inflationary pressures, their five Group mills operated consistently throughout 2022, and the sixth mill in Musi Rawas started production in February 2023, boosting margins by increasing in-house milling.

Global palm oil market: long-term drivers and short-term surges

The vast global palm oil market is worth $67.3bn and forecast to grow at a rate of 5.1% (CAGR) over the next five years.

The drivers for sustained demand span both the long-term and short-term contexts:

Long-term drivers:

- Population growth: As the global population is expected to reach 9.7 billion by 2050, the demand for food and consumer goods, including palm oil, is set to surge.

- Changing diets and urbanisation: The trend towards processed and convenient foods, coupled with increasing urbanization, fuels the demand for palm oil-based products, driving market expansion.

- Economic development: The burgeoning middle-class populations in emerging economies contribute to heightened consumption of goods containing palm oil.

- Biofuel demand: The quest for renewable energy sources positions palm oil as a potential biofuel option, aligning with governmental efforts to promote cleaner energy alternatives.

- Diverse industrial applications: The multifaceted properties of palm oil render it valuable not only in the food industry but also in cosmetics, soaps, and even biofuels.

Short-term surge:

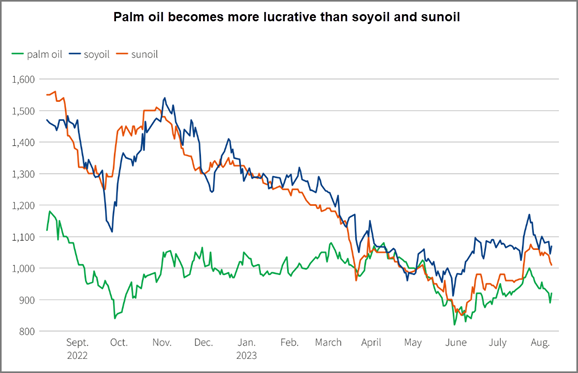

In the near term, the demand for palm oil is surging due to its price competitiveness compared to soyoil and sunflower oil. Concerns surrounding U.S. production and supply disruptions in the Black Sea region have further fuelled this demand.

The world’s largest edible oil buyer, India, experienced a 60% increase in palm oil imports in July compared to June. China’s palm oil imports also saw a significant rise of 48% in July, echoing a trend observed across other Asian countries.

This pattern has aided Indonesia and Malaysia in reducing their inventories while boosting Malaysian palm oil futures.

As soyoil prices escalated due to U.S. production apprehensions and reduced Argentine supplies, and sunflower oil prices increased following Russia’s withdrawal from a Black Sea grains deal, price-sensitive countries such as India, China, Bangladesh, and Pakistan are increasingly turning to palm oil due to its affordability and swift shipping.

Solid financial foundation

Valuation metrics are only as useful as the stability of the financials you are comparing them against.

For instance, a stock may be trading on a bargain basement price to earnings ratio, but if the companies track record for delivering those earnings is wildly inconsistent then your valuation metric isn’t very reliable.

This is the big appeal with MPE, it a business with a revenue growth rate of 22.9% (CAGR) over the last five years. During the same time period earnings per share (EPS) have grown at a similar rate of 26.2% (CAGR).

MPE’s operating margin is north of 30% and this means they generate serious levels of cash. In full year 2022, MPE’s operating cashflow was $187m of which $125m flowed through into free cashflow. And MPE’s balance sheet has swung to a debt-free, net cash position of $82.5m (FY22).

73% discount to Fair Value

In the context of MPE’s impressive financial foundation, the stocks market valuation metrics start to shine.

MPE trade of forward Price to Earnings ratio of just 8.5 which compares favourably to its peer group and the wider market.

A price to free cashflow ratio of 7.2 also looks good value relative to its peer group and the market, and the same applies to MPE’s enterprise value to adjusted earnings ratio of 3.76.

For a more advanced assessment of MPE’s value we can run a discounted cashflow (DCF) simulation and this generates a Fair Price of MPE when looking at its future cash flows. MPE’s estimated Fair Value comes in at whopping £27.25p – some 73% above current prices.

Based on these valuation metrics, we can rest assured that we’re not overpaying for MPE.

Market-beating income

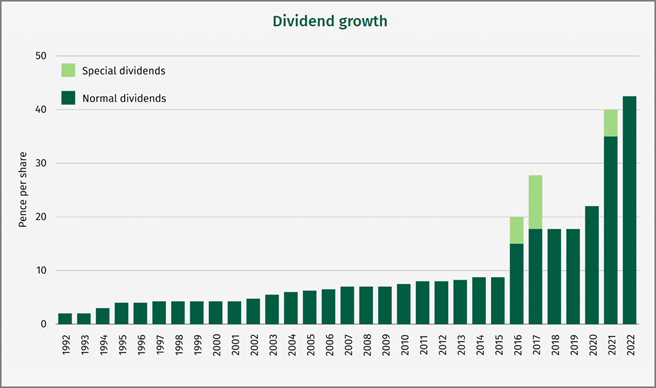

MPE also offers a market-beating dividend which is comfortably covered by earnings.

Last years payout topped 40p per share (FY22) – a historic yield of 5.59%. This substantial payout was covered more than twice over by earnings.

MPE have a 30-year track record of steadily increasing its normal dividend and this means the stock is well respected among income investors.

The stock trades on a forward dividend yield of 5.79% which is top quartile in both the Food & Tobacco sector and the overall market.

MPE’s solid financial performance, coupled with the steady and increasing demand for palm oil, adds to the appeal of its market-beating dividend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.