29th Feb 2024. 9.01am

Regency View:

BUY Litigation Capital Management (LIT)

Regency View:

BUY Litigation Capital Management (LIT)

LIT Illuminates legal finance down under: An Aussie star with global shine

At first glance, this week’s AIM stock, Australia-based litigation finance specialist, Litigation Capital Management (LIT) may seem a little left field, but its high-quality global revenue streams have caught our attention.

Beyond dominating the Australian legal landscape, LIT strategically operates as a global litigation finance specialist with a presence in the UK and Singapore. We believe the stocks modest forward valuation looks cheap relative to its impressive financials.

Scalable and efficient business model

LIT specializes in litigation finance, redefining how legal battles are funded. Their unique model involves providing financial support to litigants, ranging from single-case financing to portfolio funding for class actions and commercial claims. Here’s a simplified breakdown of how LIT makes money:

- Investing in legal cases: LIT supports individuals, companies, or law firms involved in legal disputes, covering costs associated with legal proceedings.

- Return on Investment (ROI): LIT’s revenue is tied to the outcomes of funded cases. Successful outcomes result in a share of financial settlements or court-awarded judgments, calculated as a multiple of the initial capital invested (ROIC).

- Performance fees: In addition to invested capital, LIT earns performance fees based on case success, receiving a percentage of financial benefits obtained by the litigant.

- Asset management model: LIT manages third-party funds for litigation financing, earning fees for its asset management services.

In essence, LIT’s success is tied to case outcomes, prompting strategic diversification across jurisdictions, sectors, and legal claim types for risk spreading and maximum returns.

Combining catalysts: Rising insolvencies and contracting competition

An economic landscape marked by uncertainties and disruptions has created a catalyst for a surge in litigation funding applications in the insolvency space.

There has also been a contraction competition within the litigation finance sector – creating a strategic opportunity for LIT to strengthen its market position and expand its footprint.

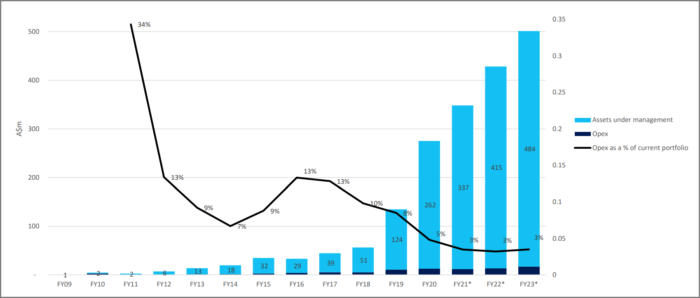

LIT’s successful resolutions and robust performance in its existing funds pave the way for future fund raises. With a solid track record and a 12-year return on invested capital (ROIC) of 1.78x, LIT is well-positioned to attract investor confidence for subsequent fund raises.

The successful launch of Fund II in March 2023, coupled with strong commitments and a positive outlook for the existing portfolios, sets the stage for the launch of Fund III.

Strong financials and undemanding valuation

The key driver behind our recommendation of LIT is its high-quality financials relative to its valuation.

Investors are being asked to pay less than 7x forward earnings (PE 6.7), which for a company with an impressive track record for delivering profitable growth looks very reasonable.

Revenue has grown at a compound annual rate of 19.6% averaged over the last five years and net profit has grown at 29.6% (CAGR/Avg) over the same period. The high levels of profitability are generated from impressive operating margins north of 50%.

Cashflow is strong but can be variable, and LIT’s balance sheet is rock solid and debt free with AU$83m net cash (FY23).

Coiled and consolidating ahead of earnings

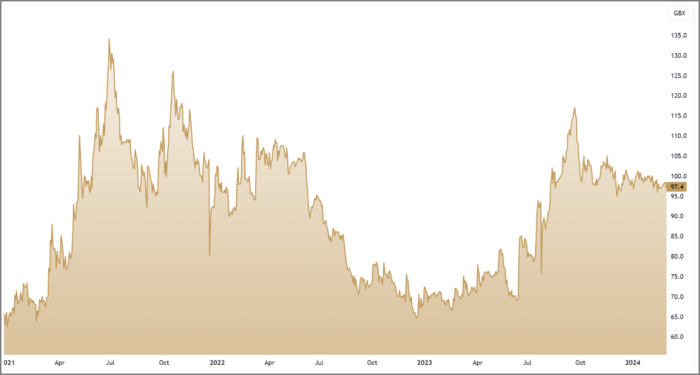

LIT’s share price looks tantalisingly poised heading into the release of their half year earnings on Thursday March 14th.

Having surged higher during the summer months of last year, the shares have spent the last six months consolidating. This period of mean reversion has tracked the 50-day moving average (MA) and prices have just touched the closely watched 200-day MA.

During this prolonged period of consolidation, we’ve seen prices carve out a series of lower swing highs and hammer out a clear area of horizontal support at 94p. This price action has funnelled the shares into a ‘wedge’ – patterns of this nature tend to culminate in an explosive directional move.

Given LIT’s quality, the strength of last year’s trending move higher, and the nature of its recent price action, we expect the upcoming earnings release to provide the catalyst required for the shares to breakout higher from the wedge pattern.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.