3rd Feb 2022. 9.00am

Regency View:

BUY Learning Technologies (LTG) – Second Tranche

Regency View:

BUY Learning Technologies (LTG) – Second Tranche

Learning Tech gaining global scale

To the long-term investor, short-term market pullbacks create opportunity…

In recent months we’ve seen some of 2020’s ‘hot air’ come out of AIM, and the world’s most successful growth market has under-performed its large-cap peers.

The rotation out of small-caps has created some great opportunities to pick up high-quality companies at a reduced valuation, and we believe Learning Technologies (LTG) is a prime example…

We first added Learning Tech to our AIM Investor portfolio back in January 2020.

During this time, the e-Learning specialist has executed its ‘buy and build’ strategy to perfection, gaining global scale and making it better placed than ever to take a sizeable chunk out of its “£100bn addressable market”.

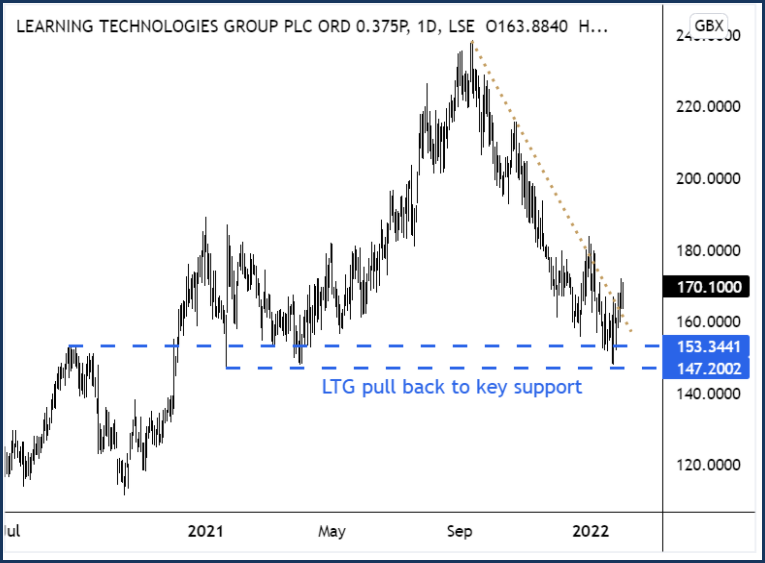

And after Learning Tech’s share price hit highs of 238p in Sep 2021, the shares have undergone a steady 30% pullback to long-term support.

During the pullback, Learning Tech has delivered a market-beating Full-Year trading update, and we believe the stocks forward valuation looks increasingly attractive. With this in mind, we’re going to snap up a second tranche…

Why GP Strategies acquisition is a game-changer

Learning Tech is focused on the outsourced segment of the e-Learning market, a market segment which is highly fragmented, comprising a multitude of small operators with each offering a limited range of services.

And long-term CEO, Jonathan Satchell has used a buy and build strategy to great effect, creating a group with global scale without sacrificing profitability.

Last year, Learning Tech completed four acquisitions in total…

In January 2021, Learning Tech snapped up Reflective, a San Francisco-based performance management software provider for $14.2m (£10.4m) in cash.

The Reflective deal was swiftly followed by the acquisitions of PDT Global, a UK-based provider online of diversity & inclusion (D&I) training solutions for £13.2m, and Bridge, a performance and skills development platform for £37m.

In October, Learning Tech announced their most “audacious” acquisition to date, a merger with US-listed GP Strategies…

To put the magnitude of this deal into context, GP Strategies were twice the size of Learning Tech at the time of purchase!

The combined business will generate pro-forma revenue in the region of £500m, that’s a near four-fold increase on Learning Tech’s FY 2020’s £132m.

Many acquisitions are branded ‘transformational’ by CEO’s, but this deal is truly worthy of that tag line. It gives Learning Tech an enhanced global footprint with over 5,000 employees in more than 80 countries.

In an interview earlier this month, Mr Satchell explained his thinking behind the deal he dubbed “the big one”…

“GP Strategies has always suffered from relatively low margins…we believed we could assist it with its operating efficiency without in any way diminishing or damaging the front-end operations of the business”.

He then went on to explain that these operational efficiencies were happening at a “much quicker pace than anticipated”, also adding “there are more opportunities than we realised from that business, and we’re really really excited because it has exceptional relationships with its customers”.

Learning Tech borrowed $300m to do the GP Strategies deal, but the Group’s enhanced cash generation should see the balance sheet de-lever quickly, and in January’s trading update, net debt came in £20m less than consensus estimates at £141.5m.

Pre-merger business in rude health

When assessing buy and build companies like Learning Tech, it’s challenging to accurately gauge the health of the underlying business…

The sheer volume of accounting shenanigans required to complete multiple acquisitions makes it very difficult to see the wood from the trees.

However, according to Learning Tech’s latest trading update, the core (pre-merger) business performed very well last year…

Their Content & Service division, which was hit hard when the pandemic first hit, has bounced back to 2019 levels – “we’re seeing a continuation of the sales pace (in this division) that we have seen from the last five quarters” commented Jonathan Satchell.

Learning Tech’s Software & Platforms division performed “in the same stable way that it had through the pandemic, with modest single digit growth” added Mr Satchell.

For the Group, Learning Tech expect organic revenue growth on a constant currency basis to be “not less than 7%”.

Growth at a reasonable price

The health of Learning Tech’s pre-merger business, along with the anticipated margin growth at GP Strategies should see a significant pick-up in earnings…

Learning Tech are forecasting earnings per share (EPS) growth of 57.5%, putting the stock on a Price to Earnings Growth (PEG) ratio of 0.6, which is one of the most attractive in the Professional & Commercial Services sector.

And with the shares having recently undergone a steady 30% pullback from their September highs, Learning Tech look well position to out-perform as the market continues to digest their bullish January trading update.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.